Recommended Items

-

Plant Powered Plus: Activate the Power of Your Gut to Tame Inflammation and Reclaim Your Health from the Bestselling Author of Fibre Fuelled

The New York Times bestselling author of Fibre Fuelled offers a powerful programme to fight inflammation and boost your immune system by healing your gut

Dr. Will Bulsiewicz’s patients seek him out first and foremost because he’s a gastroenterologist. But more and more, he hears that in addition to their constipation or IBS, patients are also suffering from allergies, depression, thyroid problems, and more. What many don’t realize is that the gut is the gateway for both health and illness. So, if you have issues with your gut, chances are you may have issues with chronic illness.

In Plant Powered Plus Dr Bulsiewicz offers a powerful programme for addressing inflammation due to an imbalance in the gut with a combination of plant-forward diets. This book is a solutions-based approach to reclaiming a healthful, protective immune system that defends us rather than attacks us. Dr. Bulsiewicz draws the connections between gut issues and a variety of additional diagnoses and symptoms, including autoimmune disease, cardio-metabolic disease, hormonal conditions and more.

His nutrition plan will resolve inflammation and reorient your immune system by healing your gut microbiome and gut barrier. Including guidance on creating your ideal immune-balancing diet, Plant Powered Plus will help you harness the power of the gut-immune connection and live a life of boundless health.

Read more

From £7.47 -

Megalomaniacs: The Invasion Begins! (a Phoenix Comic Book, from the multi-million-selling Jamie Smart, Illustrator of the Year)

Are you ready for MEGALOMANIACS!? It’s the eagerly awaited BRAND-NEW series from Bunny vs Monkey creator Jamie Smart.

‘But what are Megalomaniacs?’ we hear you cry. Well . . .

There are three things you need to know about Megalomaniacs:

– They are TERRORS from outer space!

– There are LOADS of them!

– They are TINY!Bobbletown is under attack – from the cutest, silliest and zaniest alien invasion EVER! The super-powered Megalomaniacs have crash-landed, and they’re going to do their very best to take over planet Earth! That is, if they don’t get in each other’s way first . . .

Brought to you by Phoenix Comic Books and jam-packed with Jamie Smart’s unique exuberant humour and artwork, Megalomaniacs is the latest extravaganza in children’s comics! You’ve never read ANYTHING like this before!

‘One of the best children’s comics of all time’ Starburst Magazine

‘Smart’s comic timing is absolute perfection’ Comic.con

Do you love to draw? Want to create awesome characters just like the Megalomaniacs? At the back of this book are how-to-draw tutorials from Jamie Smart PLUS links to The Phoenix comic club website where you can find draw-along videos, free printable material AND top tips from tons of creators!

Read more

From £9.19£9.99 -

Bunny Girl Evolution 3: A Monster Evolution LitRPG

With the Gray family safe and sound, and no civilizations facing impending doom, Elise finally has time to take things slow and focus on her next evolution. In order to get the best possible evolution options, Oberon, the king of the fey offers to train her, and she accepts, not realizing what exactly she is signing up for.Forced outside her comfort zone, Elise has to get creative in order to keep moving forward and improving. She takes on new identities, meets new people, makes new friends (and enemies), and overall has a rather chaotic time trying to become the best fey she can be.

Meanwhile, she keeps her eyes ahead, preparing to attend Jelor University for the fall semester.

Read more

From -

Trust No One: A Thriller – A Treacherous Hunt Across Europe to Unlock the Secret to Immortality

From the #1 New York Times bestselling master of international intrigue comes a shocking new stand-alone thriller that thrusts a group of university students, falsely accused of murder, into a treacherous hunt across Europe, all to unlock the secrets buried within a centuries-old book that could change humankind forever.

Knowledge can be magic—until it falls into the wrong hands.

The ritualistic murder of a British professor at the University of Exeter points to a startling cast of suspects: his own students. All are enrolled in a postgraduate program covering the history of witchcraft, folklore, and spiritualism.

All evidence points to Sharyn Karr—an American student. Prior to the professor’s death, he had thrust a centuries-old book upon her. It appears to be the handwritten and encrypted diary of an eighteenth-century mystic and occultist, the Comte de Saint-Germain. The professor begged her to keep the text safe, ending with a warning: Trust no one.

Such a responsibility forces her into cooperation with Duncan Maxwell, a fellow postgrad and the sixteenth in line to the British Crown. Already, Duncan has proven himself a savant with encryptions. Unfortunately, the pair clash at every level, but they both need one another. Especially when they discover the book’s opening words: Herein lies the secret to my immortality. Come find me, if you dare.

As dark forces close upon the pair, she and her friends are forced to flee, pursued by law enforcement and hunted by a powerful cabal. In an explosive chase across Europe—from the Tower of London to Parisian chateaus to a fortress in the Italian Alps—Sharyn must learn the true secret hidden in Saint-Germain’s text. It will send her and the others across history and deep into the heart of one of the world’s greatest mysteries, a secret buried at the roots of Western Civilization, a discovery that could topple empires and change humanity forever.

For what lies at the end of Saint-Germain’s diary is as shocking as its opening words.

Read more

From £0.99 -

Dear Debbie

A brand new twisted thriller that will have you cheering “good for her!” from the #1 New York Times bestselling and global sensation Freida McFadden, author of The Housemaid!

Sometimes, enough is enough…

Debbie Mullen is losing it. For years, she has compiled all of her best advice into her column, Dear Debbie, where the wives of New England come for sympathy and neighborly advice. Through her work, Debbie has heard from countless women who are ignored, belittled, or even abused by their husbands. And Debbie does her best to guide them in the right direction.

Or at least, she did.

These days, Debbie’s life seems to be spiraling out of control. She just lost her job. Something strange is happening with her teenage daughters. And her husband is keeping secrets, according to the tracking app she installed on his phone. Now, Debbie’s done being the bigger person. She’s done being reasonable and practical. It’s time to take her own advice.

And now it’s time for payback against all the people in her life who deserve it the most.

From #1 New York Times and international bestselling author Freida McFadden comes a biting, subversive thriller about what happens when women finally choose to take justice into their own hands – with killer results.

Read more

From £3.58Dear Debbie

From £3.58 -

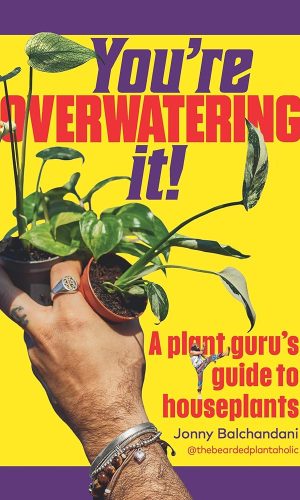

You’re Overwatering It!: A Plant Guru’s Guide to Houseplants

You don’t need a green thumb, you just need the right guide.

Jonny Balchandani (a.k.a thebeardedplantaholic) is the plant whisperer, showing thousands how to know, grow and style their space from the backdrop of his own indoor jungle.

This is the ultimate guide to levelling-up your house plant care, full of wild wisdom a few hard truths and lots of leafy love:

Watering hacks

Light mastery

Pest control

Soil sorcery

Repotting rules and moreDiscover the simple secrets to help your house plants thrive and become a jungle boss at home.

Read more

From £18.70£23.80You’re Overwatering It!: A Plant Guru’s Guide to Houseplants

From £18.70£23.80

-

The Castle (Audio Download): Jon Ronson, Jon Ronson, Penguin: Amazon.co.uk: Books

Brought to you by Penguin.

The million-copy bestselling author of The Psychopath Test, So You’ve Been Publicly Shamed and the award-winning BBC podcast Things Fell Apart moves to Penguin for his first book in eleven years, a darkly comic true crime mystery set within the masculinity crisis, The Castle.

I honestly have no clue what is going on.

This is very weird.

We left. Was completely fucked. All good now.When Jon Ronson received a series of disquieting texts after his son Joel had been lured to a mysterious castle in the forests of New England under false pretences late one evening, it set Ronson Sr. off on an extraordinary adventure into a world of unmoored men on a desperate search for purpose, whatever the cost.

Why did the wealthy scion of a gilded age tycoon entice Jon’s son to his castle on the pretext of a party, when the reality was something else entirely? Could Jon uncover what was really going on inside that strange castle? Why was a popular online lawncare influencer wrongly implicated in a bizarre plot to traumatize millions of unsuspecting children? And, more pressingly, why are two recently paroled murderers on their way to pay Jon an ominous visit?

Against the backdrop of the sometimes moving, often disturbing masculinity crisis, Jon follows the trail of those men who are acting out, checked out or just plain out of time. Drawing on his trademark brand of humour, psychological insight and unrivalled prescience, and told in the riveting style of a true crime thriller, The Castle marks Jon Ronson’s triumphant return to the written page in his darkest and most wildly enjoyable journey yet – deep into the recesses of the Castle and the secret lives of men.

PRAISE FOR JON RONSON:

‘Simultaneously frightening and hilarious’ The Times

‘Funny and compulsively readable’ Louis Theroux

‘His scalpel-sharp journalistic mind comes wrapped in disarming, diffident warmth’ Miranda Sawyer, Guardian

‘Ronson is one of our most important modern-day thinkers’ US News & World Report

‘Funny and thought-provoking . . . original, inspired journalism’ Financial Times

‘Gutsy and smart’ New York Times

‘Simmering with humour, weirdness and pathos’ Sunday Times

‘A diligent investigator and a wry, funny writer, Ronson manages to be at once academic and entertaining’ Boston Globe

‘The belly laughs come thick and fast – my God, he is funny’Observer

Jon Ronson 2026 (P) Penguin Audio 2026

Read more

From -

The Elements of Power: A New Yorker writer uncovers the darker side of the green revolution

‘A tale of rapacious colonialism, Cold War spy games, dazzling technical innovation, big business rivalry, big power geopolitics […] Niarchos has produced an unflinching, landmark work on the nature of extractive capitalism.’ Patrick Radden Keefe, bestselling author of Empire of Pain and Say Nothing

How we became addicted to a supply chain that wreaks havoc across the globe.

Epic, shocking, and deeply reported, The Elements of Power tells the story of the war for the global supply of battery metals – essential for the decarbonization of our economies – and the terrible, bloody human cost of this badly misunderstood industry.

Congo is rich. Swaths of the war-torn African country lack basic infrastructure, and, after many decades of colonial occupation, its people are officially among the poorest in the world. But hidden beneath the soil are vast quantities of cobalt, lithium, copper, tin, tantalum, tungsten, and other treasures. Recently, this veritable periodic table of resources has become extremely valuable because these metals are essential for the global “energy transition”―the plan for wealthy nations to wean themselves off fossil fuels by shifting to sustainable forms of energy, such as solar and wind. The race to electrify the world’s economy has begun, and China has a considerable head start. From Indonesia to South America to Central Africa, Beijing has invested in mines and infrastructure for decades. But the U.S. has begun fighting back with massive investments of its own, as well as sanctions and disruptive tariffs.

In this rush for green energy, the world has become utterly reliant on resources unearthed far away and willfully blind to the terrible political, environmental, and social consequences of their extraction. If the Democratic Republic of the Congo possesses such riches, why are its children routinely descending deep into treacherous mines to dig with the most rudimentary of tools, or in some cases their bare hands? Why are Indonesia’s seas and skies being polluted in a rush for battery metals? Why is the Western Sahara, a source for phosphates, still being treated like a colony? Who must pay the price for progress?

With unparalleled, original reporting, Nicolas Niarchos reveals how the scramble to control these metals and their production is overturning the world order, just as the global race to drill for oil shaped the twentieth century. Exploring the advent of the lithium-ion battery and tracing the supply chain for its production, Niarchos tells the story both of the people driving these tectonic changes and those whose lives are being upended. He reveals the true, devastating consequences of our best intentions and helps us prepare for an uncertain future. If you have ever used a smartphone or driven an electric vehicle, you are implicated.

Read more

From £9.38 -

Made in America: The dark history that led to Donald Trump

Trump’s second term, even more than his first, is often called ‘unprecedented’. But history shows that Trump and his policies are as American as apple pie…

‘A well argued and elegant answer to the question, how did America get to this place? … The ideal antidote to the coarseness of the times.’ Justin Webb, presenter of Americast

‘Pithy, entertaining and informative . . . Stourton makes a persuasive case that Trump is a logical outcome of American history’ Guardian

Much of what Donald Trump does seems maverick and even mad. His actions and policy pronouncements are a stark rupture from the American style of leadership that we have lived with all our lives. But whether we like them or not, his trade tariffs, his determination to deport tens of thousands of people, and his apparent contempt for the rule of law are deeply rooted in American history.

Since Donald Trump took office plenty of people – on both sides of the Atlantic – have argued that he will destroy his country’s democracy. Made in America shows how the ideal of liberty has been tested in past generations, from the first intolerant Pilgrims to the brutal invasion of Mexico, revealing the dark side of the American Dream in order to offer urgent lessons to our turbulent present.

Read more

From £12.99 -

Formula One 2026: The World’s Bestselling Grand Prix Guide (Formula One Grand Prix Guide)

The world’s bestselling Grand Prix handbook is back for the new season.

This is the definitive guide to Formula 1 in 2026 – a complete examination of all the teams, drivers and tracks featured in the packed Grand Prix calendar. Also including a full review of the 2025 season and a breakdown of the new rules and regulations for 2026, this indispensable guidebook features a full breakdown of last season’s drivers’ and constructors’ world championship results – as well as a fill-in chart for 2026, so each book becomes your own personalised guide to the year’s action.

Written by bestselling F1 author Bruce Jones and containing dozens of breathtaking photographs and detailed circuit illustrations plus a statistics section highlighting the major records in F1 history, this is the only guide you’ll need for the racing action ahead.

Read more

From £3.31 -

The Science of Baking: Everything You Need to Know to Create Perfect Sweet and Savoury Bakes, Every Time (The Science of Food)

“An essential book for anyone looking to understand and improve their baking” Tom Kerridge

“Whether you’re a novice baker or a seasoned professional, Matt brings clarity and precision to the mysteries of baking” Helen Goh

Discover the secrets of professional bakers to achieve perfect bakes every time

Baking is essentially chemistry for the kitchen, and in order to perfect our home bakes, we first need to understand the processes and variables that go into creating the perfect bake. Join bestselling author, self-taught baker, and pastry chef, Matt Adlard, as he demystifies the science behind your favourite bakes, teaching you how to recreate them at home with show-stopping results.

The Science of Baking teaches you how baking actually works: what purpose each ingredient serves in a recipe, how they combine and interact together and, most importantly, how to use the correct temperature and oven settings for the best results.

With more than 50 step-by-step recipes for delicious breads, pastries, cookies, cakes, and desserts, plus detailed illustrations, expert tips, and troubleshooting for every subject – from sourdough starters to cake decorating, gluten-free, and vegan baking – as well as knockout recipes for chocolate chip cookies, desserts such as Vanilla Burnt Basque Cheesecake, Crème Caramel, and the ultimate Black Forest Swiss Roll, this is everything you need to understand and explore the world of baking.

Read more

From £27.93 -

Clean in 15: Create a Clean & Happy Home in Minutes

‘I’ve finally found the book that makes my house sparkle!’ – Louise Pentland

Make your home spotless in next to no time.

From quick fixes for spills and stains to swift spritzes and full spring cleans, TV’s favourite cleaning expert, Iwan Carrington, shows you how to make your home spick and span with minimal elbow grease.

Room by room and task by task, Clean in 15 makes maintaining a sparkling home a doddle with ingenious hacks and easy routines that promise more free time for you.

Make it easy: Follow routines that are fun, simple, and faff-free

Make time: Complete tasks in 5 to 50 minutes

Make it happen: Only take action when you need to, from daily hacks to monthly maintenance

Make it yourself: Follow budget-saving recipes for multipurpose cleaning productsRead more

From £3.07 -

The Intruder

Who knows what the storm will blow in…Casey’s cabin in the wilderness is not built for a hurricane. Her roof shakes, the lights flicker, and the tree outside her front door sways ominously in the wind. But she’s a lot more worried about the girl she discovers lurking outside her kitchen window.

She’s young. She’s alone. And she’s covered in blood.

The girl won’t explain where she came from or loosen her grip on the knife in her right hand. And when Casey makes a disturbing discovery in the middle of the night, things take a turn for the worse.

The girl has a dark secret. One she’ll kill to keep. And if Casey gets too close to the truth, she may not live to see the morning.

In this taut, deadly tale of survival and desperation, #1 New York Times bestselling author Freida McFadden explores how far one girl will go to save herself.

Read more

From £0.99The Intruder

From £0.99 -

Broken Country: AMAZON’S BOOK OF THE YEAR – THE MILLION-COPY BESTSELLER

*****AMAZON’S BOOK OF THE YEAR*****

INSTANT SUNDAY TIMES AND NEW YORK TIMES BESTSELLER

REESE WITHERSPOON’S BOOK CLUB PICK

FEARNE COTTON’S HAPPY PLACE BOOK CLUB PICK

AMANDA LAMB BOOK CLUB PICK‘An unforgettable story of love, loss, and the choices that shape our lives . . . but it’s also a masterfully crafted mystery that will keep you guessing until the very last page. Seriously, that ending?! I did not see it coming’

REESE WITHERSPOON‘This story of a love affair is so addictive it could be at home with the thrillers . . . A simmering book of secrets, scandal and devastating consequences’ The i

‘Excellent . . . a vivid, forceful love story which plays out at the pace of a thriller’ Irish Times

‘In this surprising romantic novel, there are decisions to be made that are heartbreaking and real, yet amid the gentle pastoral setting . . . it has all the pace of a literary thriller. A dazzling debut’ Woman and Home

‘Beautiful . . .So moving on the subject of how a tiny decision can have cataclysmic consequences’ Good Housekeeping

‘Wistful love meets murder . . . a tear-jerker’ Grazia

Everyone in the village said nothing good would come of Gabriel’s return. And as Beth looks at the man she loves on trial for murder, she can’t help thinking they were right.

Beth was seventeen when she first met Gabriel. Over that heady, intense summer, he made her think and feel and see differently. She thought it was the start of her great love story. When Gabriel left to become the person his mother expected him to be, she was broken.

It was Frank who picked up the pieces and together they built a home very different from the one she’d imagined with Gabriel. Watching her husband and son, she remembered feeling so sure that, after everything, this was the life she was supposed to be leading.

But when Gabriel comes back, all Beth’s certainty about who she is and what she wants crumbles. Even after ten years, their connection is instant. She knows it’s wrong and she knows people could get hurt. But how can she resist a second chance at first love?

A love story with the pulse of a thriller, Broken Country is a heart-pounding novel of impossible choices and devastating consequences.

‘Lyrical, brutal and passionate. I devoured it’

MIRANDA COWLEY HELLER, author of The Paper Palace‘Evocative, sensitive and compelling . . . Fires directly at the heart and hits the mark’

DELIA OWENS, author of Where the Crawdads Sing‘Broke my heart then mended it again. An epic, tortured love story. Bring tissues’

JENNIE GODFREY, author of The List of Suspicious Things‘I stayed up until 4am to finish it, something I haven’t done in years. It’s a page-turner, but also beautifully written’

FLORENCE KNAPP, author of The Names‘Had me hooked from start to finish . . . a really great book’ DAWN O’PORTER, author of Cat Lady

‘A love story like no other’

CHRIS WHITAKER, author of All the Colours of the DarkREADERS LOVE BROKEN COUNTRY ⭐⭐⭐⭐⭐

‘This book is everything. Love, heartbreak and hope’

‘Will break you into pieces and then put you back together again’

‘I was absolutely gripped and didn’t want it to end’

‘If I could give more than five stars, I would. Perfect’Read more

From £11.80 -

The Names: ‘The best debut novel in years’ Sunday Times

A once-in-a-generation debut from a major new talent, The Names is the story of three names, three versions of a life, and the infinite possibilities that a single decision can spark.

‘I’ve just been blown away by the best debut novel in years . . . A genius idea for a book’

Sunday Times‘Wildly original and emotionally profound’

Observer‘An unadulterated success: moving, evocative and utterly convincing’

The TimesTHE INSTANT SUNDAY TIMES BESTSELLER

It is 1987, and in the aftermath of a great storm, Cora sets out with her nine-year-old daughter to register the birth of her son. Her husband intends for her to follow a long-standing family tradition and call the baby after him. But when faced with the decision, Cora hesitates. Going against his wishes is a risk that will have consequences, but is it right for her child to inherit his name from generations of domineering men? The choice she makes in this moment will shape the course of their lives.

Seven years later, her son is Bear, a name chosen by his sister, and one that will prove as cataclysmic as the storm from which it emerged. Or he is Julian, the name his mother set her heart on, believing it will enable him to become his own person. Or he is Gordon, named after his father and raised in his cruel image – but is there still a chance to break the mould?

Powerfully moving and full of hope, this is the story of three names, three versions of a life, and the infinite possibilities that a single decision can spark. It is the story of one family, and love’s endless capacity to endure, no matter what fate has in store.

CHOSEN AS A SUNDAY TIMES, DAILY MAIL, RED, PRIMA, STYLIST and EVENING STANDARD BOOK OF 2025 | A READ WITH JENNA BOOKCLUB PICK

‘The viral literary hit of the summer’

Grazia‘A beautiful, heartwrenching, utterly original novel’

Miranda Cowley Heller‘The 2025 book that will be everywhere . . . One of those rare books that makes you glad to be alive’

Stylist‘Magnificent . . . Read it. It’s very special’

Chris Whitaker‘Beautifully written, and wise and tender . . . An utter original’

Jojo Moyes‘Exceptional . . . will stay with me for a very long time’

Anita Rani, Woman’s Hour‘Heart-shattering . . . a sucker punch of a novel’

Pandora Sykes‘A modern classic’

Jenna Bush Hager‘Heartbreaking and yet brimful of hope . . . Exceptional’

Mail on Sunday‘Brilliant . . . one of those books that will make you irritable with anyone who interrupts you, but which you’ll finish wanting to press into the hands of a friend’

The Times‘Astonishing, unique and incredibly moving, The Names is a beautiful novel about the courage of a mother in the moment she names her child . . . I know it will stay with me for a long time’

Jeanine CumminsRead more

From £10.89 -

Flesh: WINNER OF THE BOOKER PRIZE 2025

**WINNER OF THE BOOKER PRIZE 2025**

‘A masterpiece, told with virtuosic economy… Pure brilliance from the first to the (devastating) last sentence’ India Knight

‘Brilliance on every page’ Samantha Harvey

‘Spare, visceral, urgent, compelling. This book doesn’t f**k around’ Gary Stevenson

‘So brilliant and wise on chance, love, sex, money’ David NichollsThrough chance, luck and choice, one man’s life takes him from a modest apartment in Hungary to the elite society of London – in this captivating new novel about the forces that make and break our lives

Fifteen-year-old István lives with his mother in a quiet apartment complex in Hungary. New to the town and shy, he is unfamiliar with the social rituals at school and soon becomes isolated, with his neighbour – a married woman close to his mother’s age – as his only companion. As these encounters shift into a clandestine relationship, István’s life spirals out of control.

Years later, rising through the ranks from the army to the elite circles of London’s super-rich, he navigates the twenty-first century’s tides of money and power. Torn between love, intimacy, status, and wealth, his newfound riches threaten to undo him completely.

‘How do I get out of a reading slump? This is the book to do that’ Rhianna Dhillon, BBC Radio 4

‘A revelatory novel’ Sunday Times

‘So much searing insight into the way we live now’ Observer

‘Refreshing, illuminating and true’ Financial Times

‘Compelling and elegant, merciless and poignant’ Tessa Hadley

‘One of the year’s best novels to date’ Daily Mail

‘Utterly engrossing and I read it all in a day’ 5* reader review

‘I was hooked and tried to read this book with any spare moment that I had’ 5* reader review

A ‘Best Book of 2025’ in the Guardian, Observer, Financial Times, Daily Telegraph and Daily Mail

Read more

From £9.49£18.99Flesh: WINNER OF THE BOOKER PRIZE 2025

From £9.49£18.99