Recommended Items

-

A History of War Surgery

Since antiquity, war surgery has been a profession demanding a special kind of human: one able to face seemingly insurmountable problems; one able to keep a lucid mind and steady hands in extraordinary circumstances; one able to shoulder tremendous burdens; and one able to harden himself or herself, time and again, to failure and self-doubt. It is, and always has been, a harrowing business, and only for the brave. Dr John Wright charts the evolution of war surgery from ancient times to the present day, investigating its breakthroughs, its pitfalls, and the people and conflicts that have shaped it. But above all, this is a personal history, calling on the first-hand accounts of the surgeons, soldiers, medics, nurses, stretcher-bearers, and many others who have served in battle and come face-to-face with its most appalling horrors. This is not a book for the faint-hearted. It is one that searches for and delivers the truth about those who, with unerring skill, courage and determination, endeavour to undo the terrible damage we habitually inflict upon ourselves.Read more

£7.30A History of War Surgery

£7.30 -

First Words Age 3-5 Wipe Clean Activity Book: Ideal for home learning (Collins Easy Learning Preschool)

Level: EYFS

Subject: EnglishLearn first words at home with this motivating wipe-clean book!

- Lots of practice opportunities to help children learn how to write first words.

- Wipe-clean pages and pen so that children can try the activities again and again.

- Colourful, motivating activities to help boost confidence.

Read more

£4.70 -

Vision Board Clip Art Book For Teen Girls: Vision Board Supplies For Teens With Pictures, Quotes and Words For Teen Girls To Manifest Their Perfect Year Ever ( Vision Board Kit…

Vision Board Kit For Teen Girls To Manifest Their Best Life.

The Book Includes Pictures, Quotes and Words For:- Health

- Money, Business and Manifestation Checks

- Family

- Friends

- Beauty

- Travel

- Graduation

- Prom

- Study

- Positive Affirmations and Quotes

and more

Read more

£9.30 -

Knock Knock 52 Farts Playing Cards Deck, Adult-Humor Playing Cards (AKA Not Kiddo Friendly!): Playing Card Set

A deck of playing cards that also defines 50 types of farts? That’s right. This deck is beautifully designed, meticulously researched, and laugh-out-loud funny (and a totally legit card deck!). In other words, it’s the perfect gag gift for men or weird gift for your favorite weirdos. Kinda gives new meaning to the term “royal flush,” no? • Know when to hold ’em&emdash;and when to let ’em rip! • Because cards are fun and farts are funny. (Duh.) • 2.5 x 3.5 inches; 52 playing cards Knock Knock is an independent maker of clever gifts, books, and whatever else they can think up. Their mission is to bring humor, creativity, and smarts to everyday life. Put the fun in functional with #knockknockstuff.Read more

£6.00 -

Nicolas de Staël: Catalogue exposition MUSÉE ART MODERNE DE PARIS 2023

Présentant plus de deux cents tableaux, dessins, gravures et carnets issus de collections publiques et privées, cette rétrospective, organisée de manière chronologique, porte un nouveau regard sur le travail de Staël, en tâchant de rester au plus près de ses recherches graphiques et picturales. Loin du mythe, il s’agit de montrer l’artiste au travail, fasciné par le spectacle du monde – qu’il se confronte à un paysage, un match de football, un ballet ou un fruit posé sur une table. Menant de front plusieurs toiles, Staël travaille de longs mois, avant de condenser ses recherches dans un ou plusieurs tableaux-manifestes. Dans cette démarche expérimentale, le dessin joue un rôle prépondérant, tout comme la volonté d’explorer de nouveaux formats, médiums et outils. Depuis ses toiles sombres et matiérées des années 1940 jusqu’à ses tableaux lumineux peints avant sa mort prématurée en 1955, l’oeuvre de Staël bouleverse délibérément la distinction entre abstraction et figuration, dans la poursuite passionnée d’un art toujours plus dense et plus concis. Grâce une sélection d’oeuvres célèbres ou méconnues, cet ouvrage permet de prendre la mesure d’une quête picturale d’une rare intensité.Read more

£38.40 -

We’re All Neurodiverse: How to Build a Neurodiversity-Affirming Future and Challenge Neuronormativity

“Neurodiversity has helped me understand myself and provided a sense of relief that I’m a whole neurodivergent person functioning as my brain intends.”

“It’s provided me with the language to advocate for myself.”

“I no longer hated myself. I no longer felt broken. I found a sense of community. A sense of belonging”

This affirming and thoughtful guide outlines how and why we need to fundamentally shift our thinking about neurodivergent people. We need to accept differences rather than framing them as a problem, abnormality or disorder. Welcome to the neurodiversity paradigm.

At times challenging and radical, Sonny Jane Wise explores the intersections of neurodivergence with disability, gender, sexuality and race. Through interviews, narratives, and the lens of their own raw experiences, they consider how current systems and structures that impact neurodivergent people are rooted in outdated capitalist and racist frameworks, and how these need to change and adapt to be neurodiversity affirming. Sonny Jane’s words are a rallying cry to challenge the pathology paradigm. They offer nine principles for facilitating change, reflected in deeply personal stories from the neurodivergent community.

Powerful and persuasive, this book is a clarion call for a kinder and more neurodiversity affirming society.

Read more

£8.50 -

My Revision Notes: AQA A-level Accounting

Exam board: AQA

Level: A-level

Subject: Accounting

First teaching: September 2017

First exams: Summer 2018 (AS); Summer 2019 (A-level)Target success in business with this proven formula for effective, structured revision; key content coverage is combined with practical tips to create a revision guide that students can rely on. With My Revision Notes, every student can:

– Plan and manage a successful revision campaign using the topic-by-topic planner

– Consolidate subject knowledge by working through clear and focused content coverage

– Identify areas for improvement with regular ‘Now Test Yourself,’ tasks and answers

– Improve exam technique through practice questions and examples of typical mistakes to avoid

– Get exam ready with extra quick quizzes and answers to the practice questions available onlineRead more

£18.90

-

Accounting for Value (Columbia Business School Publishing)

Accounting for Value teaches investors and analysts how to handle accounting in evaluating equity investments. The book’s novel approach shows that valuation and accounting are much the same: valuation is actually a matter of accounting for value. Laying aside many of the tools of modern finance–the cost-of-capital, the CAPM, and discounted cash flow analysis–Stephen Penman returns to the common-sense principles that have long guided fundamental investing: price is what you pay but value is what you get; the risk in investing is the risk of paying too much; anchor on what you know rather than speculation; and beware of paying too much for speculative growth. Penman puts these ideas in touch with the quantification supplied by accounting, producing practical tools for the intelligent investor. Accounting for value provides protection from paying too much for a stock and clues the investor in to the likely return from buying growth. Strikingly, the analysis finesses the need to calculate a “cost-of-capital,” which often frustrates the application of modern valuation techniques. Accounting for value recasts “value” versus “growth” investing and explains such curiosities as why earnings-to-price and book-to-price ratios predict stock returns. By the end of the book, Penman has the intelligent investor thinking like an intelligent accountant, better equipped to handle the bubbles and crashes of our time. For accounting regulators, Penman also prescribes a formula for intelligent accounting reform, engaging with such controversial issues as fair value accounting.Read more

£30.80£36.10 -

Accounting Fundamentals: A Non-Finance Manager’s Guide to Finance and Accounting

The only guide required for Non-Finance Managers and Professionals, Entrepreneurs, Business Owners and Students!Are you frustrated by the complexities of Finance and Accounting?

Do you find reading financial statements overwhelming and intimidating?

As a business owner or manager, you know that finance and accounting are critical aspects of running any successful enterprise. But unfortunately, for many people, it is a complicated topic full of jargon that can be confusing and daunting. The lack of financial literacy can lead to costly mistakes, missed opportunities, and unnecessary stress.

Imagine if you had a clear and concise guide that could help you easily master the basics of finance and accounting. Well, there is. This book was written to empower you with strong financial acumen so that you can make better, informed decisions in your career and business.

Here are some topics you will learn about:

- The Principles of Finance and Accounting: Easy to grasp Accounting Principles and Financial practices to equip you with the knowledge you need to manage financial matters without frustration or confusion.

- Basic Financial Terms: 23 Financial terms explained in a way that anyone can understand, so you can confidently engage in conversations with any finance professional.

- Financial Analysis: Learn how to read a financial statement like a pro, this will enable you to analyze and gauge the financial performance of any business.

- Business Budgeting and Forecasting: Gain the tools and strategies needed to navigate the intricacies of business planning, create realistic budgets, and make accurate business forecasts.

Don’t let your lack of financial knowledge hinder your ability to grow a profitable business or build a successful career. With this book as your trusted resource, you too can build financial confidence … in as little as 7 days!

It’s time to make the decision today to invest in your Financial Empowerment. Are you ready to embark on a journey toward Financial Mastery?

Read more

£15.20 -

Accounting Guide For Complete Beginners: Grasping Essential Concepts with Ease | Navigating the World of-Accounting-and Adjusting Entries

“Accounting Guide For Complete Beginners” is your key to unraveling the mysteries of accounting with simplicity and clarity. Whether you’re a small business owner, a student, or simply someone curious about the world of finance, this book provides a straightforward path to understanding fundamental accounting concepts.

Your Accounting Journey Begins Here: This comprehensive guide starts from scratch, ensuring that even those with no prior knowledge of accounting can grasp its principles quickly and effortlessly.

Demystifying Financial Statements: Financial statements don’t have to be intimidating. “Accounting Guide For Complete Beginners” breaks them down into digestible pieces, making it easy for you to understand and interpret them with confidence.

Mastering Adjusting Entries: Adjusting entries are a crucial part of the accounting process, and this book makes them crystal clear. You’ll learn how to ensure your financial records accurately reflect the financial health of your small business.

A Valuable Resource for Small Business Owners: Running a small business comes with its own set of financial challenges. “Accounting Guide For Complete Beginners” equips you with the knowledge and skills needed to manage your finances effectively, enabling your business to thrive.

Practical Examples and Exercises: Reinforce your learning with practical examples and exercises that allow you to apply what you’ve learned. These hands-on activities make accounting principles come to life.

Clarity and Confidence: By the time you finish “Accounting Guide For Complete Beginners,” you’ll have the clarity and confidence to tackle accounting tasks and make informed financial decisions.

Your Journey to Financial Literacy Starts Now: Are you ready to demystify accounting, master financial statements, and become proficient in adjusting entries? “Accounting Guide For Complete Beginners” is your guide to achieving these goals. Take action now and add this invaluable resource to your collection.

Empower yourself with financial knowledge and make informed decisions for your small business or academic pursuits. Buy your copy of “Accounting Guide For Complete Beginners” today and embark on a journey to accounting mastery. Don’t wait—grab your book now and transform your understanding of basic accounting principles.

Read more

£10.10 -

Accounting in a Nutshell: Accounting for the non-specialist (CIMA Professional Handbook)

Designed primarily for middle and junior management who deal with financial information without really understanding the content; students who are studying accounting as a non-specialist subject, for example on a business studies or engineering course. The book serves as a basic reference to be used throughout the course. It will also be particularly helpful in providing the basic grounding that is required before moving on to the more technical and in-depth study of the subject that may be required on some courses. Students who are embarking on a course of study to become a professional accountant will also find this book of major benefit. In addition to revisions through out, a new new chapter ‘Making long-term investment decisions’ covering capital investment decisions, extends and rounds out the final part of the book: using Financial Information to Manage a Business. The chapter deals with the investment appraisal process and covers the main investment appraisal techniques from the point of view of a non-specialist: payback periods, accounting rate of return and discounted cash flow methods are just some of the new topics covered. The focus will be on the level of understanding that a non-specialist requires in the work place as such, in keeping with the rest of the book, the chapter includes practical examples and exercises to enhance the reader’s understanding.Read more

£29.40 -

Accounting Information Systems, Global Edition

For one-semester undergraduate or graduate courses in accounting information systems.

Accounting Information Systems delivers the most unprecedented coverage of each major approach to teaching AIS, giving instructors the opportunity to reorder chapters and focus the material to suit their individual course needs. The 15th Edition, Global Edition covers all of the most recent updates in AIS, including how developments in IT affect business processes and controls, the effect of recent regulatory developments on the design and operation of accounting systems, and how accountants can use AIS to add value to an organisation. Not only will students see how AIS has changed the role of an accountant, but they’ll also be prepared for a successful accounting career in public practice, industry, or government.Samples

Download the detailed table of contents

Read more

£61.20£75.00Accounting Information Systems, Global Edition

£61.20£75.00 -

Accounting Ledger book – 8 Column: Simple Leather Cover | Ledger Paper Pad, Columnar Notebook | For bookeeping, money management, accountant to record … (100 pages)…

Get this ledger, the perfect financial planning tool to help you manage your expenses and budget.

8 column ledger will help you work more efficiently, smarter and better at the office, home or school.

A simple tool to keep accurate, permanent bookkeeping records.Book Details:

– Size 8.5×11 inches

– 100 pages contain

– Premium Matte Soft Cover

– White pagesThanks for looking for this accounting ledger book.

Read more

£4.70 -

accounting ledger book | 8.5 ” x 11 ” | 100 Pages

You can use the accounting ledger book for your business in the best way possible. thank you for choosing usRead more

£2.80 -

Accounting Ledger Book 3 column: Simple Accounting Ledger for Bookkeeping and Small Business | Large Print Income Expense Account Recorder and Tracker Logbook

Accounting ledger bookThis Ledger is perfect for tracking and recording finances and transactions, very simple and easy to use for personal, small business or for home-based businesses.

Features:

- 110 pages Perfectly Sized at 8.5″ x 11″.

- Premuim matte cover design.

- Light weight. Easy to carry around.

- Printed on quality paper.

Read more

£4.70 -

Accounting Ledger Book for Small Business, Home Income and Expense, Bookkeeping, Personal Use & Finance – Large – Black

Are you Looking for a Simple and Effective Way to Keep Records of Your Transactions? Do you want to feel in touch or connected to your money rather than storing information on a computer that you have to log in to or stare at on a cold screen?

We Have the Perfect Log Book For You :

- SIMPLE & EASY TO USE TOOL: Most individuals struggle with tracking their transactions and keeping their books organized. We designed this accounting ledger book to help you record your income, and expenses and become better at bookkeeping. This ledger logbook is a simple and helpful way to methodically keep a log of your transactions and is helpful for tax purposes. Keep up with every cent in your trusty accounts ledger!

- TAKE CONTROL OF YOUR FINANCES – Accounting and bookkeeping don’t have to be disorganized and overcomplicated. This income log book and the expense log book an efficient tools to easily track payments, deposits, and balances in each of your accounts. With this ledger logbook, you’ll finally have a clear and detailed record of your transactions and be able to take full control of your finances.

- IDEAL FOR PERSONAL USE FINANCES OR SMALL BUSINESS ACCOUNTING – This accounting ledger book is perfect for a small business or tracking personal finances. For each transaction, you will log its number, date, description (memo), account, income (deposit/credit), expense (payment/debit) and total (balance). This ledger book for bookkeeping is an effective way to keep an eye on your financial activity, and mistakes and spot any unexpected transactions or fraudulent charges that might occur. This check and debit card register helps you take control of your money, balance your finances and prepare accurate financial statements whenever required.

- RECORD & MANAGE YOUR MONEY IN MULTIPLE ACCOUNTS – Keep track of your deposits, withdrawals, and activity in multiple accounts when using the dedicated column to add the bank account number every time you make a record. Using this ledger book for small businesses, you will be able to analyze your financial activity easily and prepare accurate financial statements quickly. Use your accounting journal records to assess your spending and income regularly in multiple accounts. Improve your financial performance with this accounting log book by discovering any unnecessary expenses you can cut.

- PREMIUM DESIGN FOR DAILY USE: This columnar book has a soft glossy cover, printed on double-sided non-perforated premium paper. This book will easily stand wavy everyday use to last a long time. This ledger book for home expenses’ simple design and layout allows you to keep track of multiple accounts at once (checking, savings, credit card, etc.).

- PLENTY OF WRITING ROOM & 2,860 ENTRY LINES – Each accounting notebook measures 8 x 10 inches and has 110 pages with 2860 entries (26 lines per page & 108 pages per register). This large format gives you plenty of room to write your transactions, track bills, budget and general cash flow. This is perfect for any money planner who doesn’t want to have to write too small in their accounting journal. This accounting book is perfectly sized to fit into your backpack, laptop bag or home office because it’s not big or bulky; a large accounting ledger book. The best columnar journal for tracking transactions, daily finance logs, balance & and money.

Accounting Ledger Book Details:

- Glossy Cover

- 108 pages

- 2780 entry lines

- 8 x 10 inches

Read more

£4.60 -

Accounting Ledger Book: For Bookkeeping | 6 Column

This Accounting Ledger Book is perfect for recording and tracking finances and transactions.This book features:

– 110 Pages;

– Information to fill in: Date, Account, Description, Debit, Credit, Balance;

– Size: 8.5 x 11 inches.Easy to use and suitable for both Personal and Business use.

Read more

£6.60 -

Accounting Ledger Book: Income and Expense Log Book – Simple Record Tracker for Bookkeeping

Keep your finances under controlAre you looking for an easy way to recordyour income and expenses?

Our Accounting Ledger Book is designed to make bookkeeping simple, stay organized and on top of your finances.

Highlights

- Track activities in multiple accounts

- Easy and efficient recording of transactions

- Large format with plenty of writing space

- Premium design for comfortable daily use

Details

- Over 3’000 transactions

- 2 pages for notes

- Perfect Size:8.5 x 11 Inches

- Matte finish

Grab your copy today

Read more

£4.70 -

Accounting Ledger Book: Large Simple Accounting Ledger Book for Bookkeeping and Small Business Income and Expense Recorder Journal – 100 Pages – Income Expense Account Notebook

Simple Accounting Ledger – perfect for tracking income and expenses. Suitable for personal, small business or home-based businesses.You can annotate the Ledger number on the Cover of the book for easy future reference.

Each page has an area to note down the Starting Balance.

Transitions capture columns include:

- Entry #No

- Date

- Account

- Description

- Payment (Debit – )

- Deposit (Credit +)

- Balance

Plus there is additional space at the bottom of each page to capture further important notes.

Large size and clear layout make it easy to write down.

Maintain accurate business records, keep track of your finances and transactions.

Large 8.5” x 11” size format workbook. 100 pages , 30 Rows per page (50 double sided sheets)

Perfect size – Not too large or too small, this design will easily fit in a standard backpack or briefcase.

Printed on white paper

Matte finished coverRead more

£6.60 -

Accounting Ledger Book: Large Simple Accounting Ledger Tracker Logbook | Accounting Log Book for Bookkeeping and Small Business or Personal

This accounting ledger book is the perfect logbook for recording and tracking transactions and finances and is suitable for small and large business use, home-based business use, and personal use.

Book features:

109 pages for recording transactions

Size: 8.5 inches x 11 inches

Record date, description, account, debit, credit and balance

High quality matte finish coverRead more

£3.80 -

Accounting Ledger Book: Perfect for Bookkeeping, Recording Transactions, Balance Checkbook, Income and Expenses Tracker, Purple Cover

The accounting ledger book is a great tracker for finances and transactions.

It can be used for personal, small businesses, or home-based businesses.

Our Objectif is to cover all the important info you need to track with a load of space and a well-organized Template of up to 28 Transactions per Page

Details:

- Size: 8.5″x11″

- Print length: 110 Pages

- Cover Type: Premium Soft Matte

- Cover Color: Purple

- Cover Design: Simple, Minimalist, Trendy

- Paper Type: Premium White Paper

- Ink Color: Black and White

Features:

This Book Includes:

- Accounting information introduction page (Start Date, Book NO, Department Info, and more!)

- Simple Accounting Ledger pages: (Year, Month, and Sheet No Sections, Date, Account, Description, Debit, Credit, and Balance)

For more Sizes and Designs Check Our Author Page, or Contact us on knowledgesparkpublishing@gmail.com

Get Yours Now!!

We are waiting for your feedback

Read more

£2.90 -

Accounting Ledger Book: Simple Accounting Ledger Book for Small Business for Bookkeeping and Small Business Income & Expenses Account Tracker helps … Journal Book &…

Entrepreneurs have plenty on their to-do lists and keeping track of their finances may be difficult.

Daily small business expenses or maintenance costs on the facility, equipment, or building are sometimes overlooked for recording. Paying utility bills, rent, and invoices from vendors, as well as any other small business transactions, if not properly recorded, will reveal errors in your budgeting, cash flow statements, ledgers, and receivables.

Most people fail to keep record of minor financial transactions. Businesses must keep an accurate record of all financial transactions for an extended period of time. The financial information you record and store can be referred to in the future for legal, financial, organizational, or tax purposes.This Accounting Ledger Book is great for basic accounting and bookkeeping. It assists you in maintaining records of daily business and personal transactions which includes bank statements, invoices, receipts, tax forms, and other records.

This Accounting Ledger book saves time and stress.

Features

★120 Pages (60 Sheets helps to record 60 Account name)

★Note for Each Account Name helps to record other important information

★Contains No., Date, Description, Account, Amount Paid (Debit), Amount Receieved (Credit), Balance Column and Note

★Perfectly Size: 8.5 inches x 11 inches

★High-Quality Matte finish softcoverRead more

£4.70 -

Accounting Ledger Book: Simple Accounting Log Book for Bookkeeping, Recording Small Business Income and Expenses, Tracking Finances and Transactions

This accounting ledger book is the perfect log book for recording and tracking transactions and finances, and is suitable for small and large business use, home-based business use, and personal use. Simple and effective book for basic bookkeeping.

Book features:

- 110 pages for recording transactions

- Size: 8.5 inches x 11 inches

- Record date, description, account, debit, credit and balance

- Ample row space to record extra information

- An index page helps locate information quickly

- A notes page for recording related information

- Attractive high quality matte finish cover

Read more

£5.30 -

Accounting Ledger Book: Tropical Leaves Cover Simple Accounting Ledger for Bookkeeping, 6 Column Account Record Journal / Notebook, Financial Accounting for Women – Size 8.5″ x 11″

This Accounting ledger book is a great and versatile tool for tracking finances and transactions. It can be used for personal finance tracking to small or home based business tracking. This book includes Account No., Date, Description, Reference, Debit, Credit and Balance. There are 110 pages and the size of the book is 8.5″ x 11″. Premium Matte Finish.Read more

£5.20 -

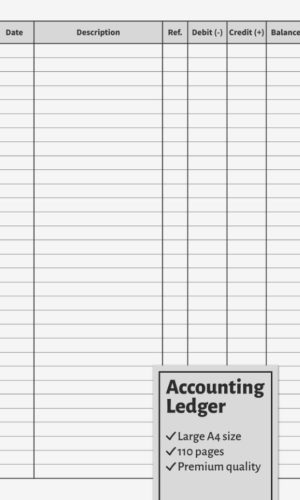

Accounting Ledger: A4 Income and Expenses Cash Book for Small Business

A4 Accounting Ledger

Stay on top of your business finances with this simple accounting ledger. Includes customized columns for tracking income (credit) and expenses (debit), and notes pages for writing down additional information and references.

Features:

- Ledger pages – 100 ledger pages with columns for tracking business transactions. Columns include: date, description, reference, debit, credit, and balance

- Notes pages – 10 lined pages at the back for important information and references

- Book details – A4 size. 110 pages. Premium quality cover and paper

Grab your accounting ledger today!

Read more

£5.70 -

Accounting Ledger: Bookkeeping For Small Businesses, Income And Expenses Log Book a4, Simple Accounts Book Self Employed, Sole Trader Accounts Book.

Accounting Ledger is the perfect tool to keep track of your income and expenses, easy to use and ideal for home-based businesses, personal and small business.Columns:

– No.

– Date

– Details

– Income

– Expenses

– TotalFeatures:

– 8.5”x11” large size

– 110 pages

– Premium qualityGrab your accounting ledger today!

Read more

£4.70 -

Accounting Ledger: Simple 6 column General Ledger, Debit & Credit Record Book, Basic Ledger For Small/Medium Businesses

Accounting Ledger

Stay on top of your business finances with this simple accounting ledger. Includes customized columns for tracking debit and credit transactions, and notes pages for writing additional information and references.

Columns:

- Date

- Description

- Reference

- Debit

- Credit

- Balance

Features:

- 9.7”x7.4” medium size

- 110 pages

- Premium quality

Grab your accounting ledger today!

Read more

£5.70 -

Accounting Ledger: Simple Black Cover Aesthetic Bookkeeping record book | Cash Book Accounts Bookkeeping Journal for Small Business | 100 pages … | Compliant with accounting…

Accounting Ledger/Account Journal

Control your finances with this simplistic cash accounting record. Ideal for businesses to keep records of debits and credits during the year.

This simple & basic bookkeeping layout helps you to write & keep track of all of your income expenses. Large 8.5″x11″ sheets provide an abundance of room to log under the titles of Date, Description, Debit, Credit, Balance. Simply record transactions as they occur before entering them into your accounting software.

Book features:

- 100 pages bookkeeping log

- Size: 8.5 inches x 11 inches

- Date, Description, Debit, Credit, Balance fields

- Premium matte cover design

- Printed on High-quality paper

- Made in USA / UK

Read more

£3.80 -

Accounting Ledger: Simple Bookkeeping Record Book| Cash Book|Accounts Bookkeeping Journal for Small Business | Income and expense|100 pages Financial … | Compliant with…

Accounting Ledger/Account Journal

Control your finances with this simplistic cash accounting record. Ideal for businesses to keep records of debits and credits during the year.

This simple & basic bookkeeping layout helps you to write & keep track of all of your income expenses. Large 8.5″x11″ sheets provide an abundance of room to log under the titles of Date, Description, Debit, Credit, Balance. Simply record transactions as they occur before entering them into your accounting software.

Book features:

- 100 pages bookkeeping log

- Size: 8.5 inches x 11 inches

- Date, Description, Debit, Credit, Balance fields

- Premium matte cover design

- Printed on High-quality paper

- Made in USA / UK

Read more

£2.80 -

Accounting Ledger: Simple Cash Book Accounts Bookkeeping Journal for Small Business | Log, Track, & Record Expenses & Income – Rose Gold & Baby Pink Money Pattern Cover

Stay in control of finances with this simple cash accounting ledger. Perfect for small businesses to keep track of income & expenses throughout the tax year. Spacious 8.5″x11″ pages allow plenty of room to record entries under the headings of Date, Description, Income, Expenses, and Total. Easily record incomings & outgoings as they happen so you always know where you stand financially at any point in the year. This versatile accounting book will suit most types of small business. Can be used alone or in conjunction with digital accounting systems for recording income & expenses to add to your digital system later.- Quick & easy to add entries.

- Versatile – adaptable to many types of small business.

- Large 8.5″x11″ size for plenty of writing space.

- Perfect bound.

- Durable soft cover.

- Thick 90 gsm white paper stock.

- Rose gold & baby pink money patterned cover.

Read more

£5.50 -

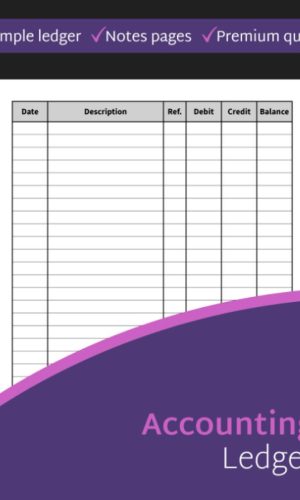

Accounting Ledger: Simple Ledger | Cash Book Accounts Bookkeeping Journal for Small Business | 120 pages, 8.5 x 11 | Log & Track & Record Debits & Credits

Accounting Ledger/Account Journal

Manage your finances with this simple cash accounting ledger. Perfect for small businesses to keep track of debits and credits throughout the year. Spacious 8.5″x11″ pages allow plenty of room to record entries under the headings of Date, Description, Ref, Debit, Credit, Balance. Easily record transactions as they happen before inputting them into your accounting software.

- 120 pages

- Size: 8.5 inches x 11 inches

- Date, Description, Ref, Debit, Credit, Balance fields

View our other accounting and bookkeeping themed books by clicking on the “Accountant Life Publishing” title above.

Read more

£5.70 -

Accounting Ledger: Simple Ledger Book For Small Businesses And Self Employed, income and expenses log book a4.

Accounting Ledger.

Keep track of your business income and expenses in one place with this logbook and keep an eye on your professional earnings.Include sections for:

– No.

– Date

– Description

– Income

– Expenses

– TotalBook details:

– 110 pages

– Durable matte paperback cover

– Size 8,5 x 11 inchesGET YOUR COPY TODAY!

Read more

£3.80 -

Accounting Made Simple: Accounting Explained in 100 Pages or Less (Financial Topics in 100 Pages or Less)

Find all of the following explained in Plain-English with no technical jargon:

The Accounting Equation and why it’s so significant

How to read and prepare financial statements

How to calculate and interpret several different financial ratios

The concepts and assumptions behind Generally Accepted Accounting Principles (GAAP)

Preparing journal entries with debits and credits

Cash method vs. accrual method

Inventory and Cost of Goods Sold

How to calculate depreciation and amortization expensesRead more

£10.10 -

Accounting QuickStart Guide: The Simplified Beginner’s Guide to Financial & Managerial Accounting For Students, Business Owners and Finance Professionals (QuickStart Guides™ -…

THE ULTIMATE GUIDE TO ACCOUNTING FOR STUDENTS, BUSINESS OWNERS, & FINANCE PROFESSIONALS!

UPDATED AND EXPANDED 3RD EDITION

The ONLY accounting book written by a CPA for both a small business owners and accounting students!

#1 AMAZON BEST SELLER!

->Are you a student that wants to master the fundamentals of financial and managerial accounting?

Then you NEED this book. Buy now and start reading today!->Are you a business owner who wants to operate a successful and financial sound operation?

Then you NEED this book. Buy now and start reading today!->Are you a finance professional who need to understand financial statements?

Then you NEED this book. Buy now and start reading today!Meet Josh Bauerle, reluctant accounting student turned super CPA and author of Accounting QuickStart Guide, 3rd Edition. This revolutionary book expertly simplifies accounting fundamentals and is an invaluable resource for accounting students, business owners, bookkeepers, and other finance and record keeping professionals everywhere! Whether you are a business owner looking to boost your bottom line or an accounting student looking to boost your grade, this book will prove indispensable on your journey.

Why do accounting students, business owners, and finance professionals love this book so much? Accounting QuickStart Guide smashes the myth that says accounting must be dry, dense, and difficult to learn. Josh Bauerle simplifies the core principles of accounting with entertaining stories and examples as well as clarifying illustrations and practice problems—all of which combine to provide learners a path to fast and effective mastery of the material.

FOR BUSINESS OWNERS

Learn how to control your cash flow, audit-proof your business, and increase your profits. Accounting QuickStart Guide will teach you the key insights to boost your bottom line in an easy-to-read, informative format.FOR ACCOUNTING STUDENTS:

Learn the fundamental principles of both financial and managerial accounting in an engaging and educating format that you simply will not find in any textbook. Understand core accounting concepts such as the fundamental accounting equation, financial statements, managerial accounting and more through practical, real-world examples. Utilize Accounting QuickStart Guide to supplement existing material for high school, undergraduate, or graduate courses.YOU WILL LEARN:

- The Logic and Methods of Classic Double-Entry Accounting!

- Business Entity Types; Their Pros, Cons and Their Financial Statements!

- The Principles of Financial Accounting, Managerial Accounting and Tax Accounting!

- GAAP Standards and Why They Matter to Accountants!

- How to Fraud-Proof Your Business Using Simple Accounting Tactics!

QuickStart Guides are books for beginners, written by experts.

*FREE ACCOUNTING DIGITAL RESOURCES:

Each book includes tons of online resources including workbooks, cheat sheets, calculators reference guides, chapter summaries and more! Follow the instructions in the book to receive your free digital resources.**GIVING BACK*

QuickStart Guides proudly supports One Tree Planted as a Reforestation partner. Working with One Tree Planted, we plant trees where they are needed most!Read more

£14.80£17.10 -

Accounting Workbook For Dummies (UK Edition)

Want to become an accountant? Own a small business but need help balancing your books? Worried about managing your finances under the cloud of the recession?This hands-on workbook gets you up to speed with the basics of business accounting, including reading financial reports, establishing budgets, controlling cash flow, and making wise financial decisions. The question and answer sections encourage you to find your own solutions to challenging accounting problems – and there’s plenty of space to scribble your workings out! Accounting Workbook For Dummies is the only book that makes truly light work of the financial fundamentals that many businesspeople try to bluff their way through every day.

Accounting Workbook For Dummies, UK Edition covers:

Part I: Business Accounting Basics

Chapter 1: Elements of Business Accounting

Chapter 2: Financial Effects of Transactions

Chapter 3: Getting Started in the Bookkeeping Cycle

Chapter 4: The Bookkeeping Cycle: Adjusting and Closing EntriesPart II: Preparing Financial Statements

Chapter 5: The Effects and Reporting of Profit

Chapter 6: Reporting Financial Condition in the Balance Sheet

Chapter 7: Coupling the Profit & Loss Statement and Balance Sheet

Chapter 8: Reporting Cash Flows and Changes in Owners’ Equity

Chapter 9: Choosing Accounting MethodsPart III: Managerial, Manufacturing, and Capital Accounting

Chapter 10: Analysing Profit Behavior

Chapter 11: Manufacturing Cost Accounting

Chapter 12: Figuring Out Interest and Return on InvestmentPart IV: The Part of Tens

Chapter 13: Ten Things You Should Know About Business Financial Statements

Chapter 14: A Ten-Point Checklist for Management AccountantsMain changes in the UK edition include:

- UK Accounting practice

- Currency

- UK institutions – Inland Revenue and Customs and Excise etc

- National Insurance, PAYE

- UK taxation and VAT

- Partnerships and Limited company information

- UK legal practice

- UK specific forms

- UK specific case studies

Read more

£12.70£15.20Accounting Workbook For Dummies (UK Edition)

£12.70£15.20 -

Accounting, 3rd Edition

We asked over 5000 accounting lecturers what would help them teach and students learn?

The results were:

Help with student engagement and varying levels of ability;

Real world examples to be used in class;

Content to break up lectures and engage students.Accounting 3e has been developed to incorporate these elements and much more!

Accounting 3e provides a very accessible and easy-to-follow introduction and is aimed at students studying accounting for the first time. The book introduces concepts in an engaging and easy-to-follow manner, and examples are tried and tested with many graded questions and answers.

The third edition is updated to reflect IFRS terminologies and format including the reorganisation of the UK standards committee in July 2012. Double entry bookkeeping is included, however, this can be bypassed for students not requiring this.

Read more

£50.00£51.30Accounting, 3rd Edition

£50.00£51.30 -

Accounting: A book for beginners to learn Financial Accounting Basics

Understanding the basics of financial accounting can be a tricky task to master. This practical guidebook provides an overview of the fundamental principles in a jargon-free and simple format.

”Accounting : A book for beginners to learn Financial Accounting Basics” provides concise overviews of the key financial accounting topics supplemented by practical examples and exercises to enable readers to test their knowledge and understanding in bite-sized chunks. In empowering students to learn at their own pace, the book enhances course learning to maximise chances of overall success.

Paperback: 73 pages.

Product Dimensions: 6 x 9 inches. 15.24 x 22.86 cm

Largeur : 31,80

Hauteur : 23,50Read more

£5.30 -

Accounting: A Comprehensive Guide for Beginners Who Want to Learn About Basic Accounting Principles, Small Business Taxes, and Bookkeeping Requirements (Start a Business)

Discover accounting made easy!Are you looking for an accounting book that can teach you how to run your small business?

Are you tired of having to continually visit an accountant or consultant for essential advice on how to manage your financial records?

Do you want a book that not only gives you the basic knowledge of accounting fundamentals but also provides valuable ways to manage your business and finances like a pro?

If you said yes to any of these questions, then this book is for you.

In this book, you will:

- Master the conceptual knowledge about accounting and bookkeeping

- Discover the differences between accounting and bookkeeping

- Discover which accounting methods suit your small business

- Get the top 10 tools for digital accounting

- Learn step-by-step instructions on setting up your Chart of Accounts

- Understand the differences in transactions, ledgers, and journal entries

- Learn how to process payroll

- Get an entire chapter on financial statements and how to analyze them

- Master how to close your books easily and quickly

- Get advice on small business budgeting

- Uncover the 3 small business accounting pitfalls you should avoid at all costs

- And so much more!

This easy-to-understand guide will provide you with clear concepts and methods to help you think like an accountant and teach you how to implement them into your small business.

So, what are you waiting for? Click the “add to cart” button now to get your copy of this book!

Read more

£2.00 -

Accounting: A Smart Approach

Engaging and lively, clear and practical, Accounting: a Smart Approach 2e brings accounting to life for both lecturers and students. Developed specifically with non-specialist students in mind, it addresses key questions that students might have:Why is accounting relevant to business?

How does accounting help managers to understand and develop their businesses?

How will studying accounting help me after my course?Following the global success of the first edition, Accounting: A Smart Approach 2e continues this fresh and effective approach to accounting for non-specialists, using a running case study to help students to understand the relevance of accounting alongside their wider studies:

Sam Smart is the budding entrepreneur who forms the basis of the case study at the heart of this book. We follow Sam as he goes from starting as a sole trader , printing sports kits for local teams, to managing a global sports business. Throughout the course of the book he assesses the success of his business, finances day to day activities, makes pricing decisions, opens new branches, looks at cash flow, and facilitates planning, control, and investment. Featuring at the start of every chapter, directing students to the implications and applications of the the topic they are about to study, Sam and his business provide consistency and connection.

As we follow the case study, all the topics central to accounting are covered with clarity, imagination and relevance, giving students confidence in approaching their course and exams. Through the wealth of additional examples and self-test exercises available alongside the case study, students will not only develop an appreciation of how accounting information allows a manager to make key business decisions, but they will also acquire the skills necessary to enable them to converse with accountants, and challenge their assumptions and methodologies.

Through the provision of integrated PowerPoint slides, a comprehensive test bank of questions and a detailed assessment guide, lecturers are provided with an invaluable package of support, which is vital when teaching large student cohorts.

An Online Resource Centre accompanies the text book and includes:

For Students:

Flashcard glossary

Multiple choice questions

Additional practice questions with answers

Tables from the text

Extra chapters on double-entry bookkeepingFor Lecturers:

Solutions to end-of-part case studies

Additional end-of-part case studies (with solutions)

Assessment guide

PowerPoint presentations

Test bankRead more

£4.40 -

Accounting: A smart approach

Engaging and lively, clear and practical, this is the most applied accounting book written specifically for business and management students.Sam Smart is the budding entrepreneur on whom the case study at the heart of this book is based. Featured at the start of each chapter, we follow Sam as he goes from starting a small business, printing sports kits for local teams, to managing a global sports business. Throughout the course of the book he assesses the success of his business, finances activities, makes pricing decisions, opens new branches, looks at cash flow, and facilitates planning, control, and investment.

As we follow the case study, the core topics central to accounting are covered with clarity, imagination, and relevance, giving students the support they need to complete their course and exams with confidence. The wealth of additional examples and self-test exercises available alongside the case study enable students not only to develop an appreciation of how accounting information allows a manager to make key business decisions, but also to acquire the skills necessary to enable them to converse with accountants, and challenge their assumptions and methodologies.

This book is accompanied by the following online resources:

For Students:

– Multiple choice questions

– Additional practice questions with answers

– Flashcard glossary

– Tables from the textFor Lecturers:

– Test bank

– PowerPoint presentations

– Solutions to end-of-part case studies

– Additional end-of-part case studies (with solutions)

– Assessment guide

– Double entry chaptersRead more

£50.30Accounting: A smart approach

£50.30 -

Accounting: A Very Short Introduction (Very Short Introductions)

If you read the ‘business pages’ of a newspaper or if you listen to the financial news on the television or radio, you will often hear terms such as ‘liability’, ‘balance sheet’ or ‘earnings’. These terms turn up in non-financial contexts as well: ‘he was more of a liability than an asset’. If you invest in shares, have a building society account, or sit on a committee of the property company which owns your apartment block, you will receive financial statements every year. If you are a manager in a company, a hospital or a school, you will see accounting information often.This Very Short Introduction provides a guide to understanding and using accounting information. Christopher Nobes explains the main areas of accounting work, from bookkeeping and financial reporting to auditing and management accounting.

ABOUT THE SERIES: The Very Short Introductions series from Oxford University Press contains hundreds of titles in almost every subject area. These pocket-sized books are the perfect way to get ahead in a new subject quickly. Our expert authors combine facts, analysis, perspective, new ideas, and enthusiasm to make interesting and challenging topics highly readable.

Read more

£7.10£8.50 -

Accounting: An Introduction

Accounting: An Introduction is renowned for its clear, accessible and uncluttered style. It provides a comprehensive introduction to the main principles of financial accounting, management accounting, and the core elements of financial management. With a clear and unequivocal focus on how accounting information can be used to improve the quality of decision making by managers, combined with a strong practical emphasis, this book provides the ideal grounding for a career in management.Read more

£1.40 -

Accounting: The Ultimate Guide to Accounting for Beginners – Learn the Basic Accounting Principles

Say goodbye to scratching your head in confusion

This accounting book could be the answer you’re looking for…

This book is intended for people who want to know something about the fundamentals of financial accounting without becoming an accountant. Many people are in this position; small business owners, employers, employees, business owners, stockholders, investors, and many, many more. Most of these folks do not need a deep understanding of accounting; they just need to learn what accounting is and how they should be using it. Just as important, they need to understand what accountants are talking about in their reports. They must learn the vocabulary and the most important terms. If you are one of those, you have found the right book for you.

We will examine this subject in some detail, discussing accounting fundamentals, the various areas where accounting professionals work and the information they produce. We will also examine the measures and ratios that accountants use to analyze an organization’s performance and the important relationship between time and money. The fact that information is the product of accounting will remain foremost in this book.

Here are just some of the topics that are discussed within this book:

- Accounting is Different From Bookkeeping

- Understanding the Vocabulary

- Accounting Reports: The Income Statement

- The Balance Sheet

- The Cash Flow Statement

- The Accounting Equation

- The CPA and Public Accounting

- Jobs in Accounting: Financial Accounting

- Tax Accounting

- Accounting Consultants

- Forensic Accounting

- Personal Accounting

- Measures and Ratios

- Accounting Software

- And Much, Much More

So, what are you waiting for? Start your learning now by downloading this magnificent book

Read more

£2.20 -

Accounting: The Ultimate Guide to Accounting Principles, Financial Accounting and Management Accounting

3 comprehensive manuscripts in 1 book

- Accounting Principles: The Ultimate Guide to Basic Accounting Principles, GAAP, Accrual Accounting, Financial Statements, Double Entry Bookkeeping and More

- Management Accounting: The Ultimate Guide to Managerial Accounting for Beginners Including Management Accounting Principles

- Financial Accounting: The Ultimate Guide to Financial Accounting for Beginners Including How to Create and Analyze Financial Statements

Accounting is a crucial part of any successful business as it records all profits, losses, credits, and debts and tells you the state of a business. In an economy where labor-driven jobs are disappearing faster than ever before, it is essential to know the concepts of accounting so you can succeed in your own business or in your career by increasing the profits in the company you work for.

Here are some of the topics that are discussed in the first part of this book:

- The Explosive Basics

- Accounting Methods

- Two Sides of The Accounting Coin

- Merchandising and Their Inventories

- Analyze Like A Pro

- Payroll Accounting

- Budgeting to Make It Big

- Balanced Scorecard

- Fraud and Internal Controls

- And Much, Much More

Here are some of the topics that are discussed in the second part of this book:

- Accrual Accounting

- Financial Accounting Basics

- Who May Use the Financial Statements?

- Recording Business Transactions

- Stockholders’ Equity

- Ratios and Other Tools for Analyzing

- Income Statement

- Balance Sheet

- Statement of Cash Flows

- Statement of Stockholders’ Equity

- And Much More

Here are some of the topics that are discussed in the third part of this book:

- Management Accounting and Its Importance

- Management Accounting Principles

- Responsibility Accounting

- Understanding and Managing Costs

- Budgeting Like a Pro

- Forecasting Tools for Business Trends

- Theory of Constraints

- Careers in Management Accounting

- And Much, Much More

So, what are you waiting for? Start your learning now by downloading this magnificent book!

Read more

£3.60 -

Accounting: Theory and Practice, 7th Ed.

Accounting Theory and Practice is a comprehensive and wide-ranging textbook on the theory and practice of modern financial and management accounting. It provides a theoretical framework for the understanding of accounting, and an appreciation of the purpose of various accounting practices. Accounting Theory and Practice is an essential text for first year and second year undergraduate degree courses in accounting, first year MBA courses, professional accountancy examinations and practising accountants who want a broader view of the accounting process.Read more

£4.00 -

Accounting: Understanding and Practice: Understanding and Practice

The fourth edition of Accounting: Understanding and Practice by Danny Leiwy and Robert Perks has been fully revised throughout and updated in accordance with the International Financial Reporting Standards. Ample practice illustrations and examples help present the subject in relation to a business world to which readers can easily relate.Read more

£56.90£58.90 -

Accounts book self employed: Accounting book | business bookkeeping record book – income and expense log book – financial ledger – Journal For Sole … with accounting…

✓ This accounting ledger is perfect for keeping your small business transactions under control.

This simple & basic bookkeeping layout helps you to write & keep track of all of your income expenses

Suitable for personal or small business accounting

• Perfect for small businesses to keep track of income & expenses throughout the tax year. Spacious 8.5″x11″ pages allow plenty of room to record entries under the headings of Date, Description, Income, Expenses, and Total. Easily record incomings & outgoings as they happen so you always know where you stand financially at any point in the year. This versatile accounting book will suit most types of small business

- 120 ledger pages

- Month and year at the top of each page

-

Plenty of writing space large size 8.5″x11″ 120 pages

◆ Complies with accounting obligations◆

Read more

£6.60