Recommended Items

-

LA Woman

Estevan Oriol is hailed as the eye of the new wave Latino aesthetic. Coming up from the streets and the Hip Hop scene, his rough and ready images of his neighborhood homies caught the attention of major media and music players. Oriol has since been commissioned by Nike and Cadillac, as well as directing music videos for Eminem, Linkin Park, D12 and Xzibit. He began taking pictures of his neighborhood and low-rider culture and soon discovered his incredible talent for capturing raw street life. He is now one of the most sought after photographers in the urban community.Read more

£543.90LA Woman

£543.90 -

Nancy Drew Complete Set 1-56 (Nancy Drew Mystery Stories)

Nancy Drew Hardcover Set 1-56 HardcoverRead more

£539.81 -

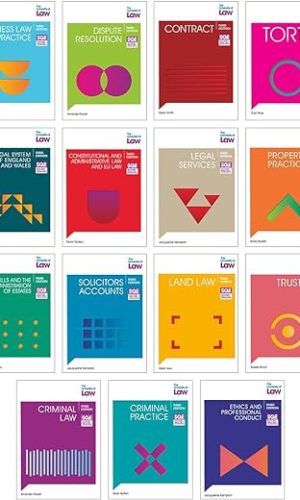

SQE Bundle FLK 1 & 2: 3e (SQE1)

The Law & Professional Practice (FLK1 & FLK2) bundle contains all 15 study manuals that have been specially collated to focus on the Law area of the Solicitors Regulation Authority (SRA) syllabus for the Solicitors Qualifying Examination (SQE1) in a concise and tightly focused manner.

Published and updated regularly, these user-friendly study manuals are designed to help you successfully prepare for the SQE1 exams. They provide solid knowledge and understanding of fundamental legal principles and rules, while bringing the law and practice to life with example scenarios based on realistic client problems.

Each title is complemented by worked examples and sample assessment questions that enable you to test your knowledge and understanding through single best answer questions that have been modelled on the SRA’s sample assessment questions.

For students at The University of Law, the study manuals are used alongside other learning resources and the University’s assessment bank to prepare students not only for the SQE1 exams, but also for a future life in professional legal practice.

The legal principles and rules contained within this study manual are stated as at 1 April 2023 (titles with tax elements to 30 April 2023)

Titles included in this bundle:

- Business Law and Practice

- Dispute Resolution

- Contract

- Tort

- Legal System of England and Wales

- Constitutional and Administrative Law and EU Law

- Legal Services

- Property Practice

- Wills and the Administration of Estates

- Solicitors Accounts

- Land Law

- Trusts

- Criminal Law

- Criminal Practice

- Ethics and Professional Conduct

Read more

£407.80£455.90SQE Bundle FLK 1 & 2: 3e (SQE1)

£407.80£455.90 -

Personal Injury Pleadings

Personal Injury Pleadings is the authoritative stand-alone source to assist the professional draftsman settling claimants and defendants statements of case. The sixth edition deals with contemporary challenges in litigation as diverse and demanding as the requirements for pleadings in fundamentally dishonest QOCS cases; relief from sanctions applications; cases involving foreign travel; the consequences of BREXIT in Personal Injury litigation; post-ERRA pleadings requirements as to breach of statutory duty; and much more. It provides informed, accurate, in-depth model pleadings, covering the whole gamut of personal injury work, drawn from many years practical experience of real cases. Comprehensive subject coverage is combined with up-to-date informed analysis of recent case law, legislation and subordinate legislation, changes in the Civil Procedure Rules, costs issues, and the minutiae of troublesome practical problems such as the special difficulties involved in fatal accident and late-onset terminal disease claims.Read more

£248.00Personal Injury Pleadings

£248.00 -

Tolley’s Health & Safety at Work Handbook 2022

This essential title provides an authoritative reference source covering key aspects of health and safety law and practice. Adopting a user-friendly A-Z format, the handbook presents clear narrative on the latest legislative changes, how to comply with current law and practice, and how they affect the role of the health and safety manager. Leading experts in health and safety offer insight and guidance on a range of subjects, from accident reporting, welfare facilities, mental ill-health, an aging workforce, absenteeism, travel safety and personal safety. This essential handbook also provides an authoritative reference source covering key aspects of health and safety law and practice, as well as related environmental and employment information. Updated annually, this title fully equips busy practitioners with everything to deal with day-to-day issues quickly.Read more

£237.50 -

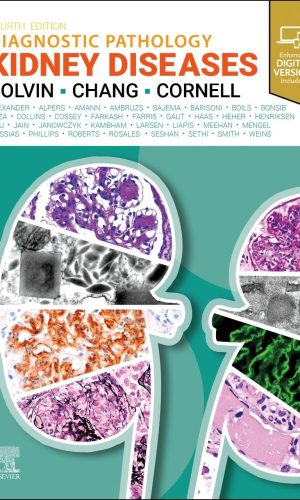

Diagnostic Pathology: Kidney Diseases

This expert volume in the Diagnostic Pathology series is an excellent point-of-care resource for practitioners at all levels of experience and training. Covering the full range of common and rare nonneoplastic renal diseases, it incorporates the most recent scientific and technical knowledge in the field to provide a comprehensive overview of all key issues relevant to today’s practice. Richly illustrated and easy to use, Diagnostic Pathology: Kidney Diseases, fourth edition, is a visually stunning, one-stop resource for every practicing pathologist, nephrologist, resident, student, or fellow as an ideal day-to-day reference or as a reliable training resource.-

Provides a comprehensive source for key pathologies and clinical features of more than 265 kidney diseases

-

Features two dozen new chapters on a variety of timely topics, including COVID-19 nephropathies, xenografts, artificial intelligence (AI), digital pathology analysis, harmonized nephropathology terminology, newly identified types of amyloidosis, common artifacts and pitfalls on kidney biopsy, vaccination-associated renal disease, crystal nephropathies, and much more

-

Includes updates from the International Kidney and Monoclonal Gammopathy (IKMG) research group, the American College of Rheumatology/European League Against Rheumatism (ACR/EULAR) classification criteria for IgG4-related disease, Banff Foundation for Allograft Pathology, and others

-

Details updated genetic causes of nephrotic syndromes and antinephrin antibodies in podocytopathies-by the investigator who discovered it

-

Discusses the newly identified variant IgG nephropathy and novel membranous autoantigens

-

Contains chapters on techniques, including immunofluorescence on paraffin sections, C4d staining, and polyomavirus detection in tissue

-

Contains more than 4,300 print and online images, including high-resolution photographs and histologic images, full-color medical illustrations, radiologic images, and more

-

Employs consistently templated chapters, bulleted content, key facts, a variety of tables, annotated images, pertinent references, and an extensive index for quick, expert reference at the point of care

-

Shares the expertise of internationally recognized authors who provide fresh perspectives on multiple topics, with a particular emphasis on practical information that directly assists in making and supporting a diagnosis

-

Includes an eBook version that enables you to access all text, figures, and references, with the ability to search, customize your content, make notes and highlights, and have content read aloud

Read more

£220.70£237.50Diagnostic Pathology: Kidney Diseases

£220.70£237.50 -

-

Handbook of Conspiracy Theory and Contemporary Religion: 17 (Brill Handbooks on Contemporary Religion)

The Handbook of Conspiracy Theories and Contemporary Religion is the first collection to offer a comprehensive overview of conspiracy theories and their relationship with religion(s), taking a global and interdisciplinary perspective.Read more

£195.40

-

The Future of Money: How the Digital Revolution Is Transforming Currencies and Finance

An Economist Book of the Year

A Financial Times Book of the Year

A Foreign Affairs Book of the Year

A ProMarket Book of the Year

One of The Week’s Ten Best Business Books of the Year“A road map for money managers, market strategists, and others seeking to understand this new world.”―Barron’s

“Money shapes economies, economies shape nations, nations shape history. It follows that the future of money is profoundly important. Here is a definitive report on where we are and where we are going.”―Lawrence H. Summers, former Secretary of the Treasury

“Prasad manages to make the financial system intelligible and interesting without resorting to shortcuts and exaggeration…Previous overhauls mainly improved existing systems, he notes. The end of cash―likely within a decade or two―is revolutionary.”―The Economist

The world of finance is on the cusp of a major disruption that will affect corporations, bankers, states―indeed, all of us. As Eswar Prasad makes clear, the end of physical cash will fundamentally rewrite how we live. Bitcoin, Ethereum, and other cryptocurrencies are just the beginning: spurred by their emergence, central banks will increasingly develop their own, more stable digital currencies. Meanwhile, cryptocurrencies themselves will evolve dramatically as global corporations like Meta, Apple, and Amazon join the game.

Prasad shows how these innovations will redefine the very concept of money, unbundling its traditional functions. This transformation promises greater efficiency and flexibility, but also carries the risk of instability, lack of accountability, and erosion of privacy. A lucid, visionary work, The Future of Money shows how to maximize the best and guard against the worst of what is to come.

Read more

£16.10£19.00 -

Millionaire Mission: A 9-Step System to Level Up Your Finances and Build Wealth

There’s a better way to do money. Taking control of your financial freedom is simpler than you think. In fact, your money should work harder than you do.Brian Preston, host of The Money Guy Show and cofounder of Abound Wealth Management, lays out a nine-step system for building wealth with the money you already have.

Remember “PEMDAS” from grade school? It’s an acronym that helps break down complex math problems into simple steps. When it comes to managing your money, following a similar process–the Financial Order of Operations– will demystify your dollars and show you the way to build transformative wealth with the tools you already have available:

- Keep Your Financial Life Out of The Ditch (Cover Your Highest Deductible)

- Love That Free Money (Max-Out Your Employer Match)

- The Joneses Are Broke and Miserable (Pay Off High Interest Debt)

- Rainy Day Done Right (Build Emergency Reserves)

- Tax-Free Armageddon (Max-Out Tax-Free Growth with Roth and/or HSA Contributions)

- Max-Out Retirement Options

- Building That More Beautiful Tomorrow (Leverage Hyper Accumulation)

- Funding Abundance Goals (Prepay Future Expenses)

- Debt-Freedom (Prepay Low-Interest Debt)

Millionaire Mission helps you account for your blind spots, overcome the fear of making wrong decisions, and take the guesswork out of what to do with your next dollar.

You can own your time and own your life. Stop worrying so much about money and start focusing on what really matters to you. Millionaire Mission will do more than help you optimize your army of dollar bills–it will motivate you to be the best version of your financial self. What do you have to lose? Let’s discover what small decisions you can make today to move you closer to your more beautiful tomorrow.

Read more

£21.20 -

Personal Finance MOT: A guide to take control of your finances and achieve your goals.

Personal Finance MOT : A guide to take control of your finances and achieve your goals.Your tool kit to:

– Set out your financial dreams

– Balance your budget

– Make debt work for you

– Build a plan for retirement

– Invest and saveThis book will provide a toolkit to help you become financially literate, enabling you to understand and manage of your finances.

Read more

£3.80 -

How History Repeats Itself and Why It Matters for Today’s Investors

Discover the Secret Yet Predictable Patterns of History They Don’t Teach You In School You So You Can Safeguard Your Investments While Positioning Them for Future ReturnsUse this historical knowledge to gain an advantage as an investor while avoiding wasting valuable time and effort reading through hundreds of history books to gain the same insights!

This book will also uncover what the most successful investors throughout history have done in times of uncertainty, chaos, and crisis!

Here’s just a tiny fraction of what you’ll discover:

- Deadly investment mistakes made in history that help you avoid making the same ones and feeling like a fool because you didn’t know them beforehand;

- 15 tips every investor should follow during a depression so you can position yourself to thrive instead of merely surviving;

- Common formulas used by the most successful investors in history so you’re able to learn from those with proven track records instead of those that simply talk;

- What we can learn from the richest man who ever lived so you’re able to gain insight into his mindset and figure out how he may have chosen to build his wealth today;

- Lessons from the 1848 gold rush for today’s cryptocurrency investors, which lets you see who’s really making money in crypto (it’s not whom you think);

- And much, MUCH more!

And that’s not all! This book will also show you who made money during the 1929 Stock Market Crash and how you can follow their example today.

So scroll up and click the “add to cart” button to stop relying on faulty investment forecasts and instead begin to feel like a truly educated investor (with examples of history backing up your decisions)!

Read more

£2.50 -

The Intelligent Fund Investor: Practical Steps for Better Results in Active and Passive Funds

Investing in funds is not straightforward. We are faced with a countless range of options and constantly distracted by meaningless noise and turbulent markets. To make matters worse, our flawed beliefs and behavioural biases lead to repeated and costly mistakes, such as a damaging obsession with past performance and a dangerous attraction to thematic funds.There is a solution–a more intelligent way to invest in funds.

In The Intelligent Fund Investor, experienced portfolio manager and behavioural finance expert Joe Wiggins brings simplicity and clarity to fund investing. Each chapter of this fascinating and highly readable book focuses on a vital element of investing in funds–exploring how and why investors can get it badly wrong, and providing direct, actionable steps for better results.

Joe reveals: why we should avoid investing with star managers; how to decide between active and passive funds; why we should beware of smooth performance and captivating stories; why risk is far more than just volatility; the importance of a long time horizon; and much, much more. Using a combination of stories, empirical evidence and experience, Joe gives all fund investors–active and passive–what they need to reassess their beliefs, understand their biases, and make better investment decisions.

Read more

£20.00£23.70 -

HBR Guide to Finance Basics for Managers (HBR Guide Series)

DON’T LET YOUR FEAR OF FINANCE GET IN THE WAY OF YOUR SUCCESS

Can you prepare a breakeven analysis? Do you know the difference between an income statement and a balance sheet? Or understand why a business that’s profitable can still go belly-up? Has your grasp of your company’s numbers helped―or hurt―your career?

Whether you’re new to finance or you just need a refresher, this go-to guide will give you the tools and confidence you need to master the fundamentals, as all good managers must.

The HBR Guide to Finance Basics for Managers will help you:

- Learn the language of finance

- Compare your firm’s financials with rivals’

- Shift your team’s focus from revenues to profits

- Assess your vulnerability to industry downturns

- Use financial data to defend budget requests

- Invest smartly through cost/benefit analysis

Read more

£12.20 -

Accounting and Finance: An Introduction

For undergraduate and MBA courses in Accounting and Finance.

Gain a complete grounding in Accounting and Finance and develop skills to work with financial information

Accounting and Finance: An Introduction 10th Edition by Eddie McLaney and Peter Atrill contains all the information on Accounting and Finance you need to start your career in business. With an emphasis on introducing topics in a step-by-step and accessible way, you will be taught how to understand and use financial information and reports, and will gain an appreciation of the key roles that both accounting and finance have to play in business decision-making. This bestselling text continues to be popular in universities and business schools, and makes the experience of learning about accounting and finance relevant and practical through its use of real numerical accounting techniques, the inclusion of important international financial standards, an increased number of activities to encourage learning in an active way, and through a range of relevant, real-world examples, many of which are new to this edition. Covering financial accounting, management accounting and financial management in a single text, this book is focused on providing you with the tools you need to make informed, successful business decisions.

Also available with MyLab Accounting

MyLab™ is the teaching and learning platform that empowers you to reach every student. By combining trusted author content with digital tools and a flexible platform, MyLab personalizes the learning experience and improves results for each student. MyLab Accounting for this textbook includes over 1700 questions, now including a larger number of algorithmic questions (more than 300) that require different numerical responses from different students. Learn more about MyLab Accounting.

Note: MyLab Accounting is not included. Students, if MyLab Accounting is a recommended/mandatory component of the course, please ask your instructor for the correct ISBN and course ID. MyLab Accounting should only be purchased when required by an instructor. Instructors, contact your Pearson representative for more information.

Pearson, the world’s learning company.

Read more

£52.20 -

Quantitative Finance For Dummies

An accessible, thorough introduction to quantitative financeDoes the complex world of quantitative finance make you quiver? You’re not alone! It’s a tough subject for even high-level financial gurus to grasp, but Quantitative Finance For Dummies offers plain-English guidance on making sense of applying mathematics to investing decisions. With this complete guide, you’ll gain a solid understanding of futures, options and risk, and get up-to-speed on the most popular equations, methods, formulas and models (such as the Black-Scholes model) that are applied in quantitative finance.

Also known as mathematical finance, quantitative finance is the field of mathematics applied to financial markets. It’s a highly technical discipline—but almost all investment companies and hedge funds use quantitative methods. This fun and friendly guide breaks the subject of quantitative finance down to easily digestible parts, making it approachable for personal investors and finance students alike. With the help of Quantitative Finance For Dummies, you’ll learn the mathematical skills necessary for success with quantitative finance, the most up-to-date portfolio and risk management applications and everything you need to know about basic derivatives pricing.

• Covers the core models, formulas and methods used in quantitative finance

• Includes examples and brief exercises to help augment your understanding of QF

• Provides an easy-to-follow introduction to the complex world of quantitative finance

• Explains how QF methods are used to define the current market value of a derivative securityWhether you’re an aspiring quant or a top-tier personal investor, Quantitative Finance For Dummies is your go-to guide for coming to grips with QF/risk management.

Read more

£18.20£21.80Quantitative Finance For Dummies

£18.20£21.80 -

Finance 102 for Kids: Practical Money Lessons Children Cannot Afford to Miss

How can we help our kids develop the right habits and money management skills that will allow them to thrive financially in the real world?

Parents know the importance of making their children financially literate at a young age. Yet, for most parents, providing financial training to their children remains a mystery.

Following the wild success of Finance 101 for Kids, author Walter Andal’s vision of guiding young minds to personal financial empowerment continues in this second installment. This latest inception takes everything we learned in the original book and applies it to real-life situations. Kids will have fun while learning practical financial lessons that they can bring forth into their adult lives.

In Finance 102 for Kids, children and parents will learn:

• How to spend wisely and live within your means

• How to determine the real cost of a purchase and make informed decisions

• Different ways to stretch your money’s worth

• How to resist unhealthy media and social influence

• How to make credit cards work for you

• The power of saving, investing, and compound interest

• How to protect your money, property, and reputation

• Things beyond money that can make you rich

And so much more!

This book is essential for parents who want their kids to flourish financially. Give your children the tools they need today, and set them up for financial success!

Read more

£8.70 -

Money Skills for Teens: These Are The Things About Money Management and Personal Finance You Must Know But They Didn’t Teach You in School (Life Skill Handbooks for Teens)

This is how to Make More, Keep More and Eventually… Spend More! Keep reading to learn how your teen could benefit from this every teen’s favorite guide!

🎁 The Perfect Gift for Teen Boys and Girls From Ages 12-19 Years Old 🎁

Bank accounts. Bills. Credit. Taxes. Save. Invest…

Have you become worried about your teen’s personal finances and financial future?

Does it feel like there are too many things your teen should learn about money but find it hard to teach everything to them?

Do you feel like no one has ever taught them ALL the important lessons about money, not even school?

Or maybe you are looking for a way to teach your teen essential money skills in a simple but effective way?

If your answer to any of those was yes, this book is for you.

You see, becoming financially savvy at an early age doesn’t have to be complicated.

Even if you’ve already tried to do some research on the net but became overwhelmed by the amount of information and didn’t know where to start or who to trust anymore…

The truth is, teaching your teen to be financially savvy is much easier than you think.

With over 10 years of experience in the education and parenting fields, the author of The Big Book of Adulting Life Skills for Teens, Emily Carter provides you now with the teen’s all-around guide to personal finance and money management. The guide will teach them all the important stuff about personal finance without having to do hours and hours of research to find nothing life-changing.

Here’s just a fraction of the things you’ll discover in the Money Skills for Teens:

- The 3 different ways to start making money NOW (Yes, even as a teen) – Page 13

- Mindset first: How to develop a healthy money mindset and set up your financial goals… the right way – Page 6

- Handling money has never been this easy, learn all the secrets of it – Page 31

- The right way of building a budget so that all your teen’s money problems will be gone for good – Page 55

- BIG things need BIG thinking, learn how to buy a house or pay for college the right way – Page 115

- The secrets of building a top-tier credit score – Page 90

- The “magic” behind growing your wealth (Your teen must learn this!) – Page 104

- The forgotten truth about retirement planning (the earlier they learn this, the better) – Page 121

- And much, much more…

And as a COMPLEMENTARY BONUS, you will receive THREE EBOOKS:

- ”Unleashing Your Potential”: A Teenager’s Guide to Developing a Growth Mindset and Opening Your Path to Success

- ”The Essential Summer Job Handbook”: The Teen’s Guide to a Fun and Profitable Summer

- ”Raising Teens With Confidence”: 10 Exclusive Blog Posts on Parenting Teens

Just imagine how you’ll feel once you know that your teenager can handle their finances responsibly and how stress-free your and their life could become.

Imagine how amazing it would be for them to know how to invest and make their money grow already as a teenager.

Imagine the advantage your teen will get financially when they have the power of knowledge on your side.

So even if you’re coming from disadvantageous circumstances where money has always been the root of all evil, you can change the direction of your teen’s personal finances for the better with Money Skills for Teens.

If you want to secure your teen’s financial future, then scroll up and click “add to cart” NOW!

Read more

£10.60 -

Corporate Finance, 4e

The fourth edition of Corporate Finance takes an applied approach to cover all the latest research and topic areas important to students taking Finance courses. The new edition provides an international perspective on all areas of corporate finance and has been updated to include discussion on current trends such as the rise of populism and trade barriers on international finance, the advent of Financial Technology, and key regulatory changes impacting the sector.Understanding and Application

•Clear, user-friendly style

•Example boxes in every chapter provide hypothetical examples to illustrate theoretical concepts such as cash flow timing, dividend smoothing and differential growth.

•Real World Insight boxes use real companies like Siemens, Avast and Adidas to show how they have applied corporate finance theories and concepts to their businesses and business decisions.

•Chapter links in the margin provide quick cross-referencing to show students the connections between topics.Practice and Proficiency

•Mini and Practical cases present scenarios and questions to practice applying what you have learnt.

•Rigorous testing: between 30 and 40 Questions and Problems per chapter are categorised by topic and level of difficulty.

•Numbered maths equations and key notation boxes listing the variables and acronyms that will be encountered in each chapter, designed to encourage mastery of Maths.

•Exam Questions designed to take 45 minutes and test you on material learned in a more formal exam style.

•Connect® resources include algorithmic questions designed to ensure equations and calculations are not learned by rote but by thorough understanding and practiceNew to This Edition

•Updated discussions on peer-to-peer trading, cash flow forecasting methods, import/export partners and additional investment appraisal methods

•Updated chapters on corporate governance to reflect global changes, efficient markets and mergers and acquisition to reflect new research, financial distress to reflect new data with discussion on trends and insolvencies and fully updated chapter on Leasing to reflect new IFRS standards

•New section on Modified Internal Rate of Return and Margin of Safety in Investment Appraisal, Net Asset Value, Islamic Financing, and alternatives to CAPM to reflect research developments• NEW: This edition has now been updated with 8 new videos that covers a worked example from the text and each video has associated concept check questions. The videos are now available on Connect® and cover:

• Chapter 1 & 2: Introduction to Finance and Corporate Governance

• Chapter 5: Long-Term Financing

• Chapter 6: Investment Appraisal

• Chapter 9 & 10: Risk and Return

• Chapter 15 and 16: Equity and Debt Valuation

• Chapter 20: Advanced Capital Budgeting

• Chapter 21: Dividends

• Chapter 22: OptionsDavid Hillier is Associate Principal and Executive Dean of the University of Strathclyde Business School. A Professor of Finance, David was recognized as being in the top 3 per cent of the most prolific finance researchers in the world over the past 50 years (Heck and Cooley, 2009) and appears regularly in the media as a business commentator.

Read more

£56.90£58.90Corporate Finance, 4e

£56.90£58.90 -

The Black Girl’s Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your Dreams

“Paris’s relatable guide will teach you how to build wealth and live life on your own terms.”—Kristy Shen, co-author of Quit Like A Millionaire“A great roadmap to mastering your money – and learning a lot about yourself in the process.—Lynnette Khalfani-Cox, The Money Coach(R), author of the New York Times bestseller, Zero Debt: The Ultimate Guide to Financial Freedom

Are you tired of spinning your wheels following financial advice that leaves you feeling broker than before? Are you pulling your hair out trying to follow the complicated instructions offered by the gurus? In The Black Girl’s Guide to Financial Freedom, Paris Woods takes the guesswork out of wealth-building and presents a plan that anyone can follow.

Paris spent years working in education and wanted to find a way to build wealth without changing careers or taking the traditional real estate or business routes. This book is the result of years of research and practice that helped her find a simpler path. Through real-life stories coupled with clear and actionable advice, you will learn to:

- Build generational wealth

- Avoid common financial traps

- Earn your next degree debt-free

- Achieve financial independence and retire early

- Design a dream life you can start living today

This book is perfect for Black women of any age, including young professionals just starting to set financial goals and mid-career women who are tired of following the same old rules and are ready to live life on their own terms. If freedom is your goal, then this is the book for you.

Pick up your copy today by clicking the BUY NOW button at the top of this page.

Read more

£11.80 -

Money Changes Everything: How Finance Made Civilization Possible

“[A] magnificent history of money and finance.”—New York Times Book Review

“Convincingly makes the case that finance is a change-maker of change-makers.”—Financial Times

In the aftermath of recent financial crises, it’s easy to see finance as a wrecking ball: something that destroys fortunes and jobs, and undermines governments and banks. In Money Changes Everything, leading financial historian William Goetzmann argues the exact opposite—that the development of finance has made the growth of civilizations possible. Goetzmann explains that finance is a time machine, a technology that allows us to move value forward and backward through time; and that this innovation has changed the very way we think about and plan for the future. He shows how finance was present at key moments in history: driving the invention of writing in ancient Mesopotamia, spurring the classical civilizations of Greece and Rome to become great empires, determining the rise and fall of dynasties in imperial China, and underwriting the trade expeditions that led Europeans to the New World. He also demonstrates how the apparatus we associate with a modern economy—stock markets, lines of credit, complex financial products, and international trade—were repeatedly developed, forgotten, and reinvented over the course of human history.

Exploring the critical role of finance over the millennia, and around the world, Goetzmann details how wondrous financial technologies and institutions—money, bonds, banks, corporations, and more—have helped urban centers to expand and cultures to flourish. And it’s not done reshaping our lives, as Goetzmann considers the challenges we face in the future, such as how to use the power of finance to care for an aging and expanding population.

Money Changes Everything presents a fascinating look into the way that finance has steered the course of history.

Read more

£11.10 -

Financial Jokes for Financial Folks: Accounting and Finance Jokes

This financial jokes book (full of all original accounting and finance jokes) is the perfect gift for anyone who works in an accounting/finance department who loves telling cheesy jokes, corny jokes, or jokes that make people roll their eyes! Here’s some examples:

—

Why was the accountant’s self esteem always so low? Because he never gave himself enough “credit”.

Why couldn’t they sell the Tower of Pisa? There was a “lien” on it.

—

Each page has a joke and a funny picture to go along with it!

—

If you want to make your business friends and family laugh then you need to get them this book! If you want to make you accounts payable department smile then get them this book! If you know anybody that has a problem with telling too many bad jokes then give them this book and make it worse!

—

Everybody will be laughing for the rest of the day after you give them this joke book!—

- A fantastic novelty gift for an Office Party, Fathers day, & Christmas / Stocking Stuffer / White Elephant Gift.

- All the jokes in this book are clean family friendly jokes. No swear words or anything like that.

Read more

£5.60 -

Python for Finance Cookbook: Over 80 powerful recipes for effective financial data analysis, 2nd Edition

Use modern Python libraries such as pandas, NumPy, and scikit-learn and popular machine learning and deep learning methods to solve financial modeling problems

Purchase of the print or Kindle book includes a free eBook in the PDF format

Key Features

- Explore unique recipes for financial data processing and analysis with Python

- Apply classical and machine learning approaches to financial time series analysis

- Calculate various technical analysis indicators and backtest trading strategies

Book Description

Python is one of the most popular programming languages in the financial industry, with a huge collection of accompanying libraries. In this new edition of the Python for Finance Cookbook, you will explore classical quantitative finance approaches to data modeling, such as GARCH, CAPM, factor models, as well as modern machine learning and deep learning solutions.

You will use popular Python libraries that, in a few lines of code, provide the means to quickly process, analyze, and draw conclusions from financial data. In this new edition, more emphasis was put on exploratory data analysis to help you visualize and better understand financial data. While doing so, you will also learn how to use Streamlit to create elegant, interactive web applications to present the results of technical analyses.

Using the recipes in this book, you will become proficient in financial data analysis, be it for personal or professional projects. You will also understand which potential issues to expect with such analyses and, more importantly, how to overcome them.

What you will learn

- Preprocess, analyze, and visualize financial data

- Explore time series modeling with statistical (exponential smoothing, ARIMA) and machine learning models

- Uncover advanced time series forecasting algorithms such as Meta’s Prophet

- Use Monte Carlo simulations for derivatives valuation and risk assessment

- Explore volatility modeling using univariate and multivariate GARCH models

- Investigate various approaches to asset allocation

- Learn how to approach ML-projects using an example of default prediction

- Explore modern deep learning models such as Google’s TabNet, Amazon’s DeepAR and NeuralProphet

Who this book is for

This book is intended for financial analysts, data analysts and scientists, and Python developers with a familiarity with financial concepts. You’ll learn how to correctly use advanced approaches for analysis, avoid potential pitfalls and common mistakes, and reach correct conclusions for a broad range of finance problems.

Working knowledge of the Python programming language (particularly libraries such as pandas and NumPy) is necessary.

Table of Contents

- Acquiring Financial Data

- Data Preprocessing

- Visualizing Financial Time Series

- Exploring Financial Time Series Data

- Technical Analysis and Building Interactive Dashboards

- Time Series Analysis and Forecasting

- Machine Learning-Based Approaches to Time Series Forecasting

- Multi-Factor Models

- Modelling Volatility with GARCH Class Models

- Monte Carlo Simulations in Finance

- Asset Allocation

- Backtesting Trading Strategies

- Applied Machine Learning: Identifying Credit Default

- Advanced Concepts for Machine Learning Projects

- Deep Learning in Finance

Read more

£36.10 -

Clever Fox Budget Planner PRO – Financial Organizer + Cash Envelopes. Monthly Finance Journal, Expense Tracker & Personal Account Book, Undated, 18 x 25.5cm – Grey

- TAKE CONTROL OF YOUR FINANCES: Budget Planner PRO combines a spacious, large format, effective budgeting tools, and helpful extras to make personal finance management easy, effective, and stress-free.

- SET & ACHIEVE BIG FINANCIAL GOALS: This budget organizer is not just a tool; it’s a framework for achieving your financial goals. The finance planner helps you develop a strategy and break your ambitious goals into manageable monthly tasks.

- EASILY CONTROL YOUR SPENDING, DEBTS & SAVINGS: This money planner is undated and covers 12 months. Every month features a calendar, budget plan, and expense tracker. The budgeting planner also includes 8 saving and 12 debt trackers, and a holiday budget.

- CASH ENVELOPES, STICKERS & USER GUIDE: The budgeting planner measures 18x25cm and features 5 durable cash envelopes, stickers, user guide, eco-leather hardcover, thick 120gsm paper, lay-flat binding, pen loop, elastic band, and pocket for notes.

- 60-DAY GUARANTEE – We will exchange or refund your budget planner organizer if you aren’t satisfied with your budgeting workbook for any reason. Reach out to us via message to refund your financial planner.

£22.80 -

BTEC National Business Unit 3: Knowledge Book (Business Finance): structured knowledge retrieval activities on Business Finance to support revision for 2024 and 2025 exams…

The Unit 3 Knowledge Book for Business Finance provides a comprehensive series of structured, step by step activities designed to equip students with the essential knowledge for their BTEC National Business Unit 3 external assessment.Read more

£9.50£10.40 -

Budget Planner & Monthly Bill Organizer | Finance Budget Planner, Financial Savings, Debt, Income, Expenses, Spending & Bill Trackers – A5

- Annual Budget Planner

- Annual Finance Tracker

- Income & Expense Tracker

- Bill Tracker

- Savings Tracker

- Debt Snowball Trackers

- Tax Deduction Trackers

- Donations

- Monthly Budget Plans

£9.00 -

Islamic Capital Markets: The Structure, Formation and Management of Sukuk (Islamic Business and Finance Series)

This book offers a unique, in-depth, and up-to-date overview of Islamic banking and finance, capital markets, and sukuks at the grassroots level. It deals with one of the most potent and increasingly popular financial instruments. It defines and explores the differences between conventional and Sukuk bonds and also examines the integration of Sukuk in various country contexts and both Muslim and non-Muslim economies.

The book consists of five core topics. First, it describes the evolution of the Islamic finance industry and capital markets; second, it discusses the basic features and instruments of Islamic banking; and third, it illustrates the current state of capital markets and Islamic finance. The book then examines the development of Sukuk in Islamic capital markets and Shariah perspectives and, finally, briefly discusses the structure of Sukuks and its development in the context of Pakistan.

In a nutshell, this book provides a basic understanding of Islamic financial instruments, their implementation in different regions, and their points of differentiation from conventional modes of finance; therefore, it will be a useful addition to the literature for scholars, researchers, and students of Islamic banking and finance.

Read more

£18.00 -

Budgeting For Dummies (For Dummies (Business & Personal Finance))

Build a budget that puts you on solid financial footing

Ask any financially successful person how they achieved their goals, and chances are they’ll tell you it all started with a budget. And that’s exactly where you should start. Budgeting For Dummies shows you how to create a plan that fits your lifestyle, manages everyday needs, and builds your savings. Author Athena Valentine, founder of the Money Smart Latina blog, offers step-by-step details for creating and following a budget without feeling like you’re depriving yourself and your family of all the things that make life worth living. This book shows you how to figure out where your money comes from and where it goes so you can live the life you want and work toward your financial goals. Find out how to establish an emergency fund, eliminate debt, improve your credit score, and stick to your budget through economic ups and downs.

- Discover budgeting methods that work so you can live within your means

- Create a budget for your unique situation to get a handle on your income and expenses

- Deal with common budgeting challenges without taking on more debt

- Increase your credit score and save toward a major purchase

You don’t need to make six figures to achieve your financial goals. Valentine, who also writes for Slate.com, knows the struggle of trying to make ends meet and is enthusiastic about sharing her knowledge with anyone who wants to improve their financial literacy. If you’re not sure where to start when it comes to managing your money, you can depend on Valentine’s tried-and-true advice in Budgeting For Dummies to set you on the right path.

Read more

£10.30£15.20 -

Wykeham’s Resourceful Journal – Personal Finance and Budgeting Planner (Brown, A5)

- Yearly Goals: Take control of your financial destiny by setting clear yearly objectives. Define income, expenses, savings, and debt goals, providing a tangible roadmap for your financial future.

- Monthly Planner: Seamlessly manage your finances with a 12-month planner. The double-page spreads simplify budgeting and expense tracking.

- Savings & Debt: Keep your savings and debt management in check. The 10 trackers for each category offer a clear view of your financial obligations and savings goals.

- Expense Tracking: Cultivate spending discipline with a comprehensive 12-month budgeting and expense tracking section. Each month offers six pages for meticulous recording.

- Yearly Insight: Gain profound insights into your financial journey with the yearly summary and review section. Thought-provoking prompts guide you in reflecting on your progress.

- Hardback Gift Box: Our Resourceful Journal isn’t just a personal essential; it’s also a thoughtful gift. Each journal comes elegantly packaged in a hardback gift box, making it an ideal choice for gifting occasions.

£9.50 -

Accounting and Finance: An Introduction

Gain a complete grounding in Accounting and Finance and develop the skills necessary to work with financial information in the business environment.

“A comprehensive, accessible and user-friendly text that employs contemporary, real-life examples, promotes critical thinking and reflects the latest international rules and regulations. A most valuable resource.”

Dr Christos Begkos, Associate Professor

Alliance Manchester Business School, University of Manchester“The textbook is a useful tool for students who are new to accounting. The exercises at the end of each chapter make it easy for the students to grasp the concepts”

Matthias Nnadi

Cranfield UniversityAccounting and Finance: An Introduction, 11th edition by Eddie McLaney and Peter Atrill, is the ideal introduction to the subject, providing you with the knowledge you need to make informed, successful business decisions.

This book is ideal for students who study Finance or Accounting- related modules in Undergraduate and MBA courses, covering Financial Accounting, Management Accounting, and Financial Management in a single text.

With its approachable style and language that is easy to understand, this edition will help you learn step-by-step how to use financial information and reports as you work through its chapters and expand your learning of accounting and finance from theory to practice.

Key features include:

- Updated content, creating a practical learning experience relevant to contemporary changes in the field.

- Real numerical accounting techniques, with consideration of up-to-date, important financial standards.

- A large number of exercises, encouraging active learning and practicing.

- Real-world examples, many of which are new to this edition, applying theory to practice.

Gain an appreciation of the key roles that Accounting and Finance have to play in successful decision-making and expand your knowledge with this must-have guide that will equip you with the tools to start your career in Business.

Personalise learning with MyLab® Accounting

By combining trusted author content with digital assessments, support at the point of need, and a flexible platform, MyLab® Accounting personalises the learning experience and improves results. MyLab for this textbook includes over 1750 questions and provides a range of help tools to support tackling accounting problems.

If you would like to purchase both the physical text and MyLab Accounting search for:

9781292435497 Accounting and Finance: An Introduction 11th edition with MyLab® Accounting

Package consists of:

- 9781292435527 Accounting and Finance: An Introduction 11th edition

- 9781292435503 Accounting and Finance: An Introduction 11th edition MyLab Accounting

- 9781292435510 Accounting and Finance: An Introduction 11th edition Pearson eText

NOTE: MyLab® Accounting is not included. Before purchasing, check with your instructor to confirm the correct ISBN. Several versions of the MyLab® platform exist for each title, and registrations are not transferable. To register for and use MyLab Accounting, you may also need a Course ID, which your instructor will provide.

Used books, rentals, and purchases made outside of Pearson: If purchasing or renting from companies other than Pearson, the access codes for the MyLab platform may not be included, may be incorrect, or may be previously redeemed. Check with the seller before completing your purchase.

Read more

£30.40 -

Budget Planner – Monthly Finance Organizer with Expense Tracker Notebook to Manage Your Money Effectively, Undated Finance Planner/Account Book, Start Anytime, 1 Year Use, A5, Teal

- MANAGE YOUR MONEY EFFECTIVELY – This budget planner contains financial goals, financial strategy, savings, debts, daily expense, monthly budget, monthly budget review, Christmas budget, summary of the year sections, which is a good finance books, it will help you to take control of your money effectively

- MONTHLY GOALS & BUDGET & REVIEW ORGANIZED – 12 month budget planner helps you to set monthly goals, budget, review, and develop monthly habits, monetary strategies & action plans well. Write down monthly financial goals, put reminders of bills & payments on the calendar. Monthly budget section to plan your monthly budget in each categories. Track daily expenses during the month. Review monthly budget at the end of month, reflect on your accomplishments and think about how to improve next month

- UNDATED & 1 YEAR USE – Undated finance books start with 1 page for financial goals, 1 page for financial strategy, 4 pages for saving tracker, 4 pages for debt tracker, followed by 12 months(10 pages per month, 1 unique color for each month). 2 pages for Christmas budgeting, 2 pages for yearly summary and 12 pages for notes(colleague ruled). It is undated, so you could start at any time, suitable for 1 year use

- PREMIUM QUALITY – A5 budget planner with 100gsm paper to reduce ink leakage, erase fraying and shade issues. Sturdy and flexible cover, elastic closure to protect the inner pages well. Strong metal and lay-flat twin-wire binding. Inner pocket to store loose items, like bills, receipts etc. User manual with filled examples for quick start. One colorful trapezoid on each edge of planner, 12 colorful trapezoid represent 12 months. Easy to track by colorful trapezoid on side view

- GURANTEED SATISFACTION – We gurantee this money planner could manage your financial effectively

£9.00 -

Problems and Solutions in Mathematical Finance, Volume 2: Equity Derivatives (The Wiley Finance Series)

Detailed guidance on the mathematics behind equity derivativesProblems and Solutions in Mathematical Finance Volume II is an innovative reference for quantitative practitioners and students, providing guidance through a range of mathematical problems encountered in the finance industry. This volume focuses solely on equity derivatives problems, beginning with basic problems in derivatives securities before moving on to more advanced applications, including the construction of volatility surfaces to price exotic options. By providing a methodology for solving theoretical and practical problems, whilst explaining the limitations of financial models, this book helps readers to develop the skills they need to advance their careers. The text covers a wide range of derivatives pricing, such as European, American, Asian, Barrier and other exotic options. Extensive appendices provide a summary of important formulae from calculus, theory of probability, and differential equations, for the convenience of readers.

As Volume II of the four-volume Problems and Solutions in Mathematical Finance series, this book provides clear explanation of the mathematics behind equity derivatives, in order to help readers gain a deeper understanding of their mechanics and a firmer grasp of the calculations.

- Review the fundamentals of equity derivatives

- Work through problems from basic securities to advanced exotics pricing

- Examine numerical methods and detailed derivations of closed-form solutions

- Utilise formulae for probability, differential equations, and more

Mathematical finance relies on mathematical models, numerical methods, computational algorithms and simulations to make trading, hedging, and investment decisions. For the practitioners and graduate students of quantitative finance, Problems and Solutions in Mathematical Finance Volume II provides essential guidance principally towards the subject of equity derivatives.

Read more

£56.50 -

Renewable Project Finance for Lenders: Step-by-Step Walkthrough

From the Back Cover

Are you looking for ways to get into infrastructure finance?

Are you interested to learn about renewable energy?

Are you curious about the lending processes at a bank and how a project financing transaction comes together?Project finance is a method for sponsors to raise the financing required to develop large infrastructure projects around the world. This could include power generation facilities, pipelines, mining projects, social infrastructure projects, etc.

This book lets you step into the shoes of a project finance lender to evaluate a wind farm financing from the initial receipt of due diligence materials from a sponsor right up to bank approval and closing of a transaction. This step-by-step walkthrough provides a practical guide on how to evaluate a transaction, which questions to ask, and key elements for success.

Are you ready to take a deep dive into what it’s like to go through a project financing transaction? Grab your copy now and be prepared for any opportunities in lending, infrastructure, and renewable energy finance.

About the Author

Jason Han is an experienced project finance lender who worked at a North American commercial bank for over a decade and has worked on financings across many industries, asset classes, and jurisdictions.Read more

£8.70 -

Real Estate Investment and Finance: Strategies, Structures, Decisions, 2nd Edition (Wiley Finance)

The fully revised and updated version of the leading textbook on real estate investment, emphasising real estate cycles and the availability and flow of global capital

Real Estate Investment remains the most influential textbook on the subject, used in top-tier colleges and universities worldwide. Its unique, practical perspective on international real estate investment focusses on real-world techniques which measure, benchmark, forecast and manage property investments as an asset class. The text examines global property markets and real estate cycles, outlines market fundamentals and explains asset pricing and portfolio theory in the context of real estate.

In the years since the text’s first publication, conditions in global real estate markets have changed considerably following the financial crisis of 2008-2009. Real estate asset prices have increased past pre-crisis levels, signalling a general market recovery. Previously scarce debt and equity capital is now abundant, while many institutions once averse to acquiring property are re-entering the markets. The latest edition – extensively revised and updated to address current market trends and practices as well as reflect feedback from instructors and students – features new content on real estate development, improved practical examples, expanded case studies and more. This seminal textbook:

- Emphasises practical solutions to real investing problems rather than complex theory

- Offers substantial new and revised content throughout the text

- Covers topics such as valuation, leasing, mortgages, real estate funds, underwriting and private and public equity real estate

- Features up-to-date sections on performance measurement, real estate debt markets and building and managing real estate portfolios

- Includes access to a re-designed companion website containing numerous problems and solutions, presentation slides and additional instructor and student resources

Written by internationally-recognised experts in capital management and institutional property investing strategies, Real Estate Investment, Second Edition: Strategies, Structures, Decisions is an indispensable textbook for instructors and students of real estate fund management, investment management and investment banking, as well as a valuable reference text for analysts, researchers, investment managers, investment bankers and asset managers.

Read more

£38.00£51.30 -

The Money Maze: Navigate Your Way Through Personal Finance in the UK – How to Manage Money, Pay Off Debt & Save Well

Are you fed up with personal finance books telling you what to do, but not how to do it? Then you’re in luck.

Time and time again we are told to reduce spending, pay off debts and save up an emergency fund.

And yet… Not once is how this can be done ever explained properly.

That’s without mentioning that pretty much all the personal finance content and information out there is all geared toward U.S audiences and financial systems.

Leaving us brits, in the dark when it comes to sorting out our financial lives.

Well, that is until now. In The Money Maze, you’ll discover:

- Where you can find thousands of pounds that you didn’t even know you had!

- How and where to record your entire financial position, on one easy-to-navigate spreadsheet, which will also be provided.

- What a payslip actually tells you and how you are taxed.

- How to cut out needless expenses and save on those you thought impossible.

- The secret to creating a one-time budget, that won’t involve recording each and every transaction that you make for the rest of your life.

- How to get started paying off your debts in the cheapest and most efficient way possible, saving you hundreds of pounds!

- And finally, not just how to save, but also where and what accounts you’ll need.

This book has been designed for even those of you who have failed before, to follow along easily and get the results that you deserve.

So, don’t get left behind because you’re too scared of failing, now is the time to kick-start you’re new life of financial literacy and prosper by clicking “Add to basket” now.

Read more

£14.20 -

Financial Accounting For Dummies (UK Edition)

Your plain–English guide to financial accounting for students and trainees.Financial Accounting For Dummies provides students who are studying finance, accounting and business with the basic concepts, terminology, and methods to interpret, analyse, prepare and evaluate financial statements. Covers concepts accountants and other business professionals use to prepare reports; mergers and acquisitions purchase and pooling; free cash flow; and financial statement analysis.

Whether you′re a student on your way to earning a degree, working towards your ACCA qualification, or a trainee just starting out in your accounts career, Financial Accounting For Dummies gives you a wealth of information to grasp the subject.

- This UK version is adapted to take in UK accounting practice and international reporting standards

- Provides a firm grounding in interpreting, analysing, preparing and evaluating corporate financial statements

- Includes easy–to–understand explanations and real-life examples to consolidate learning

Read more

£18.20£21.80Financial Accounting For Dummies (UK Edition)

£18.20£21.80 -

Structured Finance: Leveraged Buyouts, Project Finance, Asset Finance and Securitization

Comprehensive coverage of all major structured finance transactions

Structured Finance is a comprehensive introduction to non-recourse financing techniques and asset-based lending. It provides a detailed overview of leveraged buyouts, project finance, asset finance and securitisation.

Through thirteen case studies and more than 500 examples of companies, the book offers an in-depth analysis of the topic. It also provides a historical perspective of these structures, revealing how and why they were initially created. Instruments within each type of transaction are examined in detail, including Credit Default Swaps and Credit Linked Notes. A presentation of the Basel Accords offers the necessary background to understand the regulatory context in which these financings operate.

With this book, readers will be able to:

- Delve into the main structured finance techniques to understand their components, mechanisms and how they compare

- Understand how structured finance came to be, and why it continues to be successful in the modern markets

- Learn the characteristics of financial instruments found in various structured transactions

- Explore the global context of structured finance, including the regulatory framework under which it operates

Structured Finance provides foundational knowledge and global perspective to facilitate a comprehensive understanding of this critical aspect of modern finance. It is a must-read for undergraduate and MBA students and finance professionals alike.

Read more

£39.90 -

The Normative Foundations of International Climate Adaptation Finance (Elements in Earth System Governance)

Billions of dollars are annually transferred to poor nations to help them adapt to the effects of climate change. This Element examines how the discourses on adaptation finance of many developing country negotiators, environmental groups, development charities, academics and international bureaucrats have renewed a specific vision of aid, that of an aid intended to respond to international injustices and to fuel a regular transfer of resources between rich and poor countries. By reviewing manifestations of this normative vision of aid in key contemporary debates on adaptation finance, the author shows how these discourses have contributed to the significant financial mobilisation of developed countries towards adaptation in the Global South. But there remains a stark contrast between the many expectations associated with these discourses and today’s adaptation finance landscape.Read more

£15.10 -

The New Finance: Overreaction, Complexity and Uniqueness: International Edition

A supplement for junior/senior and graduate level courses in Investments, Behavioral Finance Theory, and related courses.

This brief text makes the case for the inefficient market and the complexity and chaos on asset pricing, positioning the efficient market paradigm at the extreme end of a spectrum of possible states. It presents a comprehensive and organized collection of the evidence contradicting market efficiency.

Read more

£11.90 -

Real Life Money: An Honest Guide to Taking Control of Your Finances

‘Want to finally get a grip on your cash? This is the book for you’ Cosmopolitan

‘The book everyone should read’ Stylist

‘Packed with encouragement, support and wisdom’ Anna Mathur, author of Mind Over Mother

Real Life Money is a holistic approach to personal finance that addresses the deeper causes of debt and financial difficulties.

Part memoir, part guide, Real Life Money takes the reader on a journey that can be adapted to their own pace and circumstances. It covers everything from how to negotiate repayment terms with creditors and setting realistic budgets without punishing yourself, to dealing with money anxiety.

The goal is not to get rich overnight, or to pay off debt at the expense of all of life’s pleasures, but rather to gain an understanding of why we feel the way we do about money, and how we can use that to change our mindset and our finances for good.

Read more

£13.10£14.20 -

Finance Officers I’m Not Arguing I’m Just Explaining Why I’m Right: Funny Lined Journal Notebook Gifts for Finance Officers.

- Show your appreciation to the best Finance Officers. You can use this notebook journal for taking notes, organizing daily activities, creating stories, goal setting, your favorite memories etc. This is a perfect Gift Idea For Coworker, Boss , friends and loved one. Makes an excellent gift for, birthdays, Thanksgiving, Appreciation, anniversaries, Christmas and other special occasions.

Features:

- 100 blank lined pages

- Small, convenient travel size of 6 x 9 inches

- Cute, fun cover design

- Makes a great gift

- Matte Finish Cover

Read more

£5.00 -

Personal & Business Finance: A guide to achieving a DISTINCTION in the BTEC Level 3 Finance Exam

This book combines feedback from examiners reports, marks schemes, past papers and candidate exemplar responses to show you how to maximize your grade in this challenging exam. Using the sample assessment exam paper, the book includes exemplar responses highlighting the key learning points It covers the following: 1. The exam, examiner expectations & common errors to avoid2. How to write distinction grade answers to Section A Personal Finance written questions3. How to complete calculation questions4. How to write distinction grade answers to Section B Business Finance written questions5. A guide on what to revise next to further improve your score.6. A learning checklist of all key content for each of the 6 Learning Aims. 7. A complete glossary of key terminology.Read more

£6.60 -

How To Save Money: A Guide to Spending Less While Still Getting the Most Out of Life

With the recent cost of living crisis, we are all looking for ways to cut bills and save money. Ann Russell, who is best known as “TikTok’s Auntie”, has lived much of her life on a tight budget, and since energy bills first started rising, has been answering fan’s questions not just about cleaning but about all kinds of ways to economise.

Following on from her first book, How To Clean Everything, in How To Save Money Ann will share her advice on the best ways to save money and cut back in all sorts of areas, covering everything from budgeting to meal planning and reducing food waste, and from tips on spending less each month to the most energy efficient ways to heat your house, do your laundry etc.

Written with Ann’s trademark warmth, humour and understanding, this is a book that will help everyone who is looking to spend less while still getting the most out of life.

Read more

£11.40£12.30 -

Taxation Finance Act 2023

Gain a clear understanding of UK taxation rules and policies for 2023

Taxation, 29th edition by Alan Melville, updated with the Finance Acts 2023, is the definitive, market-leading text on UK taxation. Known for its comprehensive coverage of the changes introduced by the annual Budget, the text is clean and well-structured, with a wealth of updated examples and exercises. This popular guide serves as both a core textbook for those studying taxation for the first time, and as a reference text that clearly explains the UK tax system and taxation regulations.

This new edition brings the book completely up to date, covering major taxation changes including:

- Further delays to MTD for income tax

- Income tax higher rate limit reduced

- Dividend allowance reduced

- Basis period rules for 2023-24

- Spreading of transition profits

- AIA £1m limit made permanent

- Pensions tax relief reforms

- CGT annual exemption reduced

- Corporation tax full expensing

- R&D tax relief reforms

- Investment zones

- VAT aspects of Windsor Framework

This text will be of value to both undergraduate and graduate students of accounting and finance, and will be particularly useful for students preparing for the following examinations:

ICAEW Certificate Level, Principles of Taxation; ACCA Applied Skills Level, Taxation; ACCA Technician Scheme, Foundations in Taxation; CIPFA PQ, Taxation; CIPFA PAQ, Tax and Law; AAT Professional Diploma, Personal Tax and Business Tax; ATT Certificates, Personal Taxation and Business Taxation; AIA Professional Level 1, Taxation; IFA Personal Taxation, Business Taxation.

Additionally, a free-to-access Companion Website at go.pearson.com/uk/he/resources features opportunities for extra practice, chapter appendices and a range of useful links to explore UK taxation rules and the tax system further.

Read more

£41.90£45.60Taxation Finance Act 2023

£41.90£45.60 -

A Practical Guide to Personal Finance: Budget, Invest, Spend (Practical Guide Series)

MAKE YOUR MONEY WORK FOR YOU by matching your spending and investments to your values

CONTROL YOUR SPENDING BEHAVIOUR by gathering and tracking financial information efficiently

SIMPLIFY YOUR FINANCIAL MANAGEMENT by learning to use the right tools effectively

REALIZE YOUR SAVINGS GOALS by understanding what you want to and can achieve

Introducing Personal Finance, by economics expert Michael Taillard, teaches you everything you need to know about managing your financial life. It’s crammed full of practical advice on how to save, earn and get the most out of your money.

Read more

£3.20 -

Girls That Invest: Your Guide to Financial Independence through Shares and Stocks

Your step-by-step guide to financial independence―from the creator of the #1 investing education podcast, Girls That Invest.

Ever wondered how on earth the stock market works, but felt too intimidated to ask “those” questions? This is the book for you! In this guide to investing in stocks (aka shares), Simran Kaur teaches the essential principles you can apply to any market, anywhere in the world.

Because money provides freedom: The freedom to say yes or no, the freedom to handle whatever life throws at you, and the freedom to grow and prosper. This book is your invitation to join the thriving community of women who are building a better financial future.

- Understand the stock market and different types of investments

- Grow your money, beat inflation and secure your future

- Decode the jargon around markets, diversification, earnings and more

- Explore different investor strategies and find the right one for you

- Put it all together, step-by-step, and start your investment portfolio

Investing is for everyone. Pick up Girls That Invest, become an investor-in-training, and claim a space for yourself in the world of finance―so you too can find financial independence and create generational wealth.

Read more

£11.40£14.70 -

Money Box: Your toolkit for balancing your budget, growing your bank balance and living a better financial life

‘Everyone will find something they didn’t know in this unexpectedly funny womb-to-tomb guide to looking after your money in Britain today – the laws, the loopholes, the pitfalls, and who to call if it all goes wrong’ – The Telegraph

Manage your money, manage your life.

In a time of such economic uncertainty, it has never been more important to take control of your money. For over 40 years, Money Box has been arming you with the most up-to-date knowledge, giving you the confidence to take on the financial world.

From understanding credit cards and buying your first flat to investing, relationships and finance, and will writing, Paul Lewis’ Money Box gives you the tools to balance your budget, grow your bank balance and live a better financial life.

Paul answers all of your questions, breaking down complicated financial jargon into simple, understandable nuggets of useful information. He also shows you how to beat the banks at their own game, and treat the finance industry not like a friend, but more like a vague acquaintance you don’t really trust, but have to see from time to time (and who always makes you pay for the drinks).

CONTENTS

1 Birth and before

2 Childhood 1-11

3 Teens 12-18

4 Starting out 18-23

5 The working world 23-41

6 Spending 23-41

7 Getting sensible 41-60

8 Preparing to wind down 55-70

9 Wound down 70-99

10 To infinity and beyondRead more

£11.00£16.10 -

Corporate Finance, Global Edition

Think Finance” from theory to practice, and study core modern financial principles to improve your decision-making skills.

Read more

£59.40£73.10Corporate Finance, Global Edition

£59.40£73.10