Recommended Items

-

The Fighter of Auschwitz: The incredible true story of Leen Sanders who boxed to help others survive

**A SUNDAY TIMES BESTSELLER**‘He had the dream again last night… He taps the gloves of his unbeaten Polish opponent. There are rumours that the loser will be sent to the gas chamber.’

In 1943, the Dutch champion boxer, Leen Sanders, was sent to Auschwitz. His wife and children were put to death while he was sent ‘to the left’ with the others who were fit enough for labour. Recognised by an SS officer, he was earmarked for a ‘privileged’ post in the kitchens in exchange for weekly boxing matches for the entertainment of the Nazi guards. From there, he enacted his resistance to their limitless cruelty.

With great risk and danger to his own life, Leen stole, concealed and smuggled food and clothing from SS nursing units for years to alleviate the unbearable suffering of the prisoners in need. He also regularly supplied extra food to the Dutch women in Dr. Mengele’s experiment, Block 10. To his fellow Jews in the camp, he acted as a rescuer, leader and role model, defending them even on their bitter death march to Dachau towards the end of the war.

A story of astonishing resilience and compassion, The Fighter of Auschwitz is a testament to the endurance of humanity in the face of extraordinary evil.

Read more

£7.90£8.50 -

Sign Language: Travels in Unfortunate English from the Readers of The Daily Telegraph (Telegraph Books)

A hilarious tour of the state of our mother tongue, from the people who brought you Am I Alone In Thinking . . . ?, Sign Language is a collection the most inappropriate, confusing, poorly translated and mind-bogglingly bizarre signs from around the world.

Few things amuse and appal Telegraph readers as much as the abuse, misuse, mistranslation and outright mangling of the English language. So, for the past three years the Telegraph has run a weekly feature inviting members of the public to send in photographs of menus, health and safety warnings, road signs, adverts, headlines and personals columns – anything in which the language has gone egregiously, hilariously and, usually, unintentionally wrong.

Entitled Sign Language, the published selection of the very best images has become one of the newspaper’s most popular features, attracting over 300,000 online visitors every week and attracting thousands of submissions from around the world.

Now, we present the very best of Sign Language – both seen and unseen – and offer a timely warning about the imperilled state of modern English.

Read more

£2.70 -

Baby Fairies 2: A Greyscale Coloring Book – Relax and Improve Your Drawing Skills

Step into the enchanting world of “Baby Fairies 2: A Greyscale Coloring Book – Relax and Improve Your Drawing Skills,” the highly anticipated sequel by artist Kristina Lewis.

- Explore20 unique baby fairy portraits, each showcasing different ethnicities and adorned with special features for a truly enchanting and diverse coloring experience.

- Suitable for both beginners and advanced colorists, this book caters to a wide range of skill levels, ensuring enjoyment for all.

- Embrace the scientifically proven benefits of coloring as art therapy, as it can promote relaxation, reduce stress, and enhance focus, making it a wonderful tool for mindfulness.

- Improve your drawing skills as you master the art of creating depth and dimension with various shades of colors.

- Enjoy versatility with a range of coloring tools like pens, pencils, watercolor pencils, and markers, unleashing your creativity in your preferred medium.

- Single-sided prints to prevent bleed-through

- Use the provided coloring test page to discover your perfect palette and experiment with delightful color combinations.

- Give the gift of inspiration and relaxation to adults, teens, girls, seniors, or anyone seeking to express their artistic flair through coloring.

We are beyond excited to see how you will infuse life and magic into these adorable tiny fairies!In this magical world, you have the power to make these fairies truly your own. Whether you use vibrant hues or subtle shades, each choice will be a reflection of your inner world and imagination. Your colors will give wings to their dreams, and your creativity will weave a tapestry of captivating stories. So, take your time, savor each moment, and let the enchantment unfold on every page. We can’t wait to be a part of this incredible journey with you and witness the beauty you’ll create. Happy coloring, and may the magic of “Baby Fairies 2” fill your heart with joy!

Read more

£8.20 -

The Ultimate Survival Medicine Guide: Emergency Preparedness for ANY Disaster

No one knows what the next disaster will be: earthquake, Coronavirus, flu epidemic, flood, terrorist attack. But everyone should know how to survive a medical emergency if a medical professional isn’t available.From Dr. Joe Alton and Amy Alton ARNP comes an updated edition of their bestseller The Survival Medicine Handbook. This unique medical book is meant to enable the average person to handle injuries and illness in situations in which modern medical facilities and professionals aren’t available due to a disaster.

This book is written by America’s top medical preparedness experts: Joe Alton, MD, and Amy Alton, ARNP. Their mission: to put a medically prepared person in every family for when medical help is not on the way. Using decades of medical experience, they address, in plain language, dozens of medical issues associated with surviving disasters and epidemics. The Altons also discuss the medical supplies needed to become a medical asset to your family and community as well as alternative and natural strategies for when pharmaceuticals aren’t available. Topics include:

- Appendicitis and Conditions that Mimic It

- Urinary Tract Infections

- Mosquito-Borne Illnesses

- Allergic Reactions and Anaphylaxis

- Head Injuries

- Animal Bites

- Snake Bites

- Head injuries

- Kidney Stones

- Dislocations and Fractures

- Nosebleeds

- Pain Medications

- Natural Pain Relief

- And much much more!

Most medical books will send you to the doctor or hospital when an emergency happens. The Altons assume that the worst might actually happen—that the average person could be left without medical help in a disaster. With their book, you can keep your family healthy in times of trouble.

Read more

£13.90£15.20 -

Alien Adoption Agency: Collection 2 (Alien Adoption Agency – Collections)

If you like strong women, dragon-shifting warriors, adorable baby aliens, wild adventures, steamy sensual scenes, and happily-ever-afters, then you’ll love exploring exotic frontier worlds with the Alien Adoption Agency!This exclusive collection includes all three dragon-shifting warrior romances that take place on the frontier moon of Lachesis:

Zane:

She hungers for justice, but this troubled soldier hungers only for her.

Sarah Flynn is committed to avenging her father’s death at any cost. Even if that means adopting a baby and traveling to a remote frontier moon. She’s built a wall around her heart so she can do what needs to be done. But when she meets her new son and the handsome dragon warrior assigned to protect him, she can feel her defenses beginning to crumble.Odin:

This young widow swore she would never love again, but a dragon warrior’s heat might just melt her resolve…

Liberty has come to Lachesis for a chance to raise a child and get a fresh start on a far away frontier moon. But she isn’t ready for the baby to come with Odin, an Invicta dragon warrior who has sworn to protect the child with his life. And she certainly doesn’t expect the burly warrior to awaken feelings in her that she thought she left behind forever.Rexx:

It’s love at first sight for sunny Abigail. Now she just needs to survive the train ride to get to her new home.

Abigail Shaw can’t believe her good luck. The Alien Adoption Agency has selected her to adopt adorable baby Rio. And baby Rio comes with Rexx, a handsome Invicta warrior guard, whose dark eyes seduce Abigail before he even opens his mouth. When he offers her his mate bond, she thinks things can’t get any better. She’s finally going to have a family of her own. And they’re getting a free ride on the famous Iron Peregrine express train to their new home. But things on the Peregrine aren’t always what they seem…Indulge in all five Alien Adoption Agency collections:

Collection 1: Clothos

Collection 2: Lachesis

Collection 3: Atropos

Collection 4: Han-2

Collection 5: Sigg-3Read more

£9.50 -

Katie Morag and the Dancing Class (Katie Morag, 2)

Welcome to the Island of Struay, home of one of the best-loved characters in children’s books and as seen on TV – Katie Morag McColl!

Everyone is excited about the new ballet and tap classes. Everyone, that is, except Katie Morag! But the two grandmothers have decided – she will go to ballet and she will wear a frilly skirt! What is Katie Morag going to do?

Read more

£7.00£7.60 -

True Tales Of The Supernatural: Real Christmas Ghost Stories: Volume Five (Real Ghost Stories: True Supernatural Tales)

12 GHASTLY REAL GHOST STORIES FOR CHRISTMAS

According to ancient folklore, the 12 Days of Christmas, beginning on Christmas Day, mark a period when the barrier between the living and the dead becomes blurred, allowing phantoms to wander our world. What better way to honour those 12 disquieting days than with the same number of ghostly tales?

Brace yourself for harrowing accounts such as:

- The eerie hotel resident who liked to watch in Rapunzel…

- The terrible act of kindness in One Last Holiday…

- The man with death in his eyes in Deadbeat Daniel…

- The wraith who craved togetherness in Misery Loves Company…

- The unholy horror in the library in By The Book…

- The unnatural echoes that tormented a family in Upstairs, Downstairs…

And remember, amidst the sparkle of tinsel and the joy of gift-giving, the spirit of Christmas isn’t always merry. Sometimes, it lurks in the shadows, eager to trace icy fingers down your spine…

Ready for those delicious, spine-tingling chills? Scroll up and hit buy now!

Read more

£2.99

-

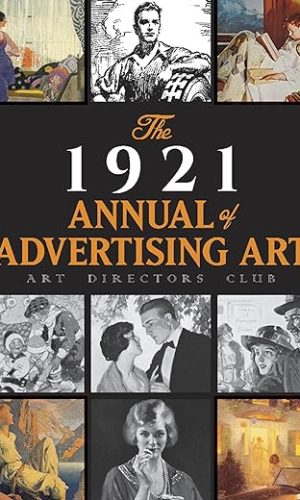

The 1921 Annual of Advertising Art: The Catalog of the First Exhibition Held by The Art Directors Club: The Catalog of the First Exhibition Held by The Art Directors Club

In 1920, the newly formed Art Directors Club resolved to prove their work worthy of artistic consideration, rather than be seen as just signage for selling products. This reproduction of their first exhibition’s catalog features more than 300 of the finest illustrations of the day, including magnificent advertising art by Maxfield Parrish, Norman Rockwell, N. C. Wyeth, Sarah Stilwell Weber, and other luminaries.Read more

£9.50£16.10 -

The Fall of Advertising and the Rise of PR.

Reveals a shift in marketing trends from advertising to publicity, citing the successes of such top brands as the Body Shop, Starbucks, and Wal-Mart while sharing strategies on establishing credibility and implementing a slow PR build.Read more

£23.20 -

Drawn to Drink: Fifty Years of the Advertising and Illustration of Drinks (50 Years)

A miscellany of illustrations for advertisements, leaflets, posters, articles, and books on drinks – both alcoholic and non-alcoholic.Read more

£9.20£9.50 -

Advertising For Dummies

So, you need to create an advertising campaign that brings in more customers, adds more dollars to your bottom line, and validates all the reasons you went into business in the first place. But how can you make your ad look and sound like champagne if your budget can only afford beer? Are you wasting your time trying to sell ice to an Eskimo?The world of advertising can seem like a daunting place—but it doesn’t have to be. Advertising for Dummies coaches you through the process and shows you how to:

- Identify and reach your target audience

- Define and position your message

- Get the most bang for your buck

- Produce great ads for every medium

- Buy the different media

- Create buzz and use publicity

- Research and evaluate your competition

Advertising for Dummies offers newbies a real-world look at the ins and outs of advertising—from online and print to TV, radio, and outdoor formats—to show you how you can easily develop and execute a successful campaign on any budget. Plus, you’ll find a glossary of common buzzwords you may encounter along the way so you can talk the talk like the advertising guru you (almost) are! With simple tips on how to write memorable ads and timeless lessons from the legends, this book is packed with everything you need to have people from New York to Los Angeles whistling your jingle.

Read more

£11.40Advertising For Dummies

£11.40 -

Amazon Advertising: An Author’s Guide to Selling More Books – How to Make Your Ads Work

How to turn your Amazon Ads into a well oiled machine that earns you money while you sleep!

I’ll cut to the chase. Amazon Ads work, plain and simple. You just need to understand the system. Here are just some of the things this book will show you…

- Understand Amazon search: This is where most buyers start but it’s not as straightforward as you might think.

- Categories: Learn the importance of categories and how they affect sales.

- Relevancy: Easy to get wrong. Bad news when you do. Learn what it is and why it’s so important.

- Copywriting: Learn the basics of creating better sales copy.

- Sponsored Ads: Understand the difference types of Ads and their limitations.

- Optimisation: Ads don’t always start out perfect. Learn how to interpret the dashboard data and refine your ads over time.

- Reports: Learn how to use reports to filter out the things that aren’t working and improve the things that are.

- What to do if all else fails: I won’t lie, it can happen. If it does, then there will be only a handful of possible causes. I’ll show you how to pinpoint them.

Apparently, a picture is worth a thousand words. That’s handy …

Includes over 100 images and screenshots.

You’ve done the writing. Now it’s time to do the selling. Get started now.

Read more

£7.60 -

Are You Ready For Paid Ads?: How to get your business ready for massive growth

Have you ever wondered what paid advertising actually is?

Wondered how to master the magic art of Google Ads so your pay per click spend drives revenue?

Tried Facebook, Instagram and LinkedIn advertising but not reaped the rewards?

It’s time to choose a digital marketing book that unearths the expert’s secrets to success, so your paid advertising starts to work in your favour.

If you are responsible for the marketing strategy in your company – or want to understand more about entrepreneurial marketing, then this book is the perfect introduction to paid ads.

Not only will you learn to avoid eye wateringly expensive mistakes, but you will understand the role PPC ads plays in the larger marketing ecosystem.

Key breakthroughs you will discover include;

- Understanding how paid advertising works top level and being comfortable talking about goals and objectives in management meetings

- Knowing where and when paid advertising sits in your overall marketing strategy to actively drive your business goals

- How to avoid misguided decisions caused y the dangerous marketing myth ‘paid ads = sales’

- Discovering that good advertising campaigns are based on many different factors not just sales

- Understanding how and why your website needs to track visitor activity before you invest any money on advertising

- How to hire a good paid ads agency or an in-house specialist

Think of this book like a long letter from a friend who wants to see you succeed. By reading this book you will get a non-technical, to the point understanding of paid advertising overall – without losing time and valuable budget and instead make your money work for you!

Read more

£5.70 -

Coca Wine: Angelo Mariani’s Miraculous Elixir and the Birth of Modern Advertising

A lavishly illustrated history of coca wine and the revolutionary advertising methods that made it a world-wide successOne of the oldest and most potent natural stimulants, the leaves of the coca plant are the organic source from which cocaine is synthesized. Fresh coca leaves and products made from them have verified medicinal and healing properties–and not the same addictive qualities or negative side effects as cocaine. In the late 19th century coca products became hugely successful in Europe and the United States. The most famous was Vin Mariani, a coca-based tonic wine developed by Corsican pharmacist Angelo Mariani (1838-1914). Many celebrities sang its praises, including Pope Benedict XV, Sarah Bernhardt, Thomas Edison, H. G. Wells, and the doctors of Ulysses S Grant, who credited Vin Mariani with giving him the strength to finish his memoirs before his death.

In this full-color illustrated history of coca wine, author Aymon de Lestrange follows Mariani’s interest in coca from its medicinal applications as an anesthetic to the creation of the tonic wine. The author explores the botany of coca, how it differs from cocaine, its traditional use in pre-Columbian America, and scientific studies on coca from the 17th through 19th centuries, including from Sigmund Freud, who was a known user.

Looking to the future of coca, the author shows how it has gained renewed interest in the scientific community for its therapeutic and nutritional properties and in the spiritual community, which is seeking to rehabilitate the reputation of coca, the sacred plant of the Incas.Read more

£9.50£23.80 -

Advertising Sin and Sickness: The Politics of Alcohol and Tobacco Marketing, 1950-1990

Temperance advocates believed they could eradicate alcohol by persuading consumers to avoid it; prohibitionists put their faith in legislation forbidding its manufacture, transportation, and sale. After the repeal of the Eighteenth Amendment, however, reformers sought a new method of attack – targeting advertising. In “Advertising Sin and Sickness”, Pamela E. Pennock documents three distinct periods in the history of the national debate over the regulation of alcohol and tobacco marketing. Tracing the fate of proposed federal policies, she introduces their advocates and opponents, from politicians and religious leaders to scientists and businessmen. In the 1950s, the Woman’s Christian Temperance Union and other religious organizations joined hands in an effort to ban all alcohol advertising. They quickly found themselves at odds, however, with an increasingly urbane mainstream American culture. In the 1960s, moralists took backstage to consumer activists and scientific authorities in the campaign to control cigarette advertising and mandate labeling. Secular and scientific arguments came to dominate policy debates, and the controversy over alcohol marketing during the 1970s and 1980s highlighted the issues of substance abuse, public health, and consumer rights. The politics of alcohol and tobacco advertising reflect profound cultural dilemmas about consumerism and private enterprise, morality and health, scientific authority and the legitimate regulation of commercial speech. Today, the United States continues to face difficult questions about the proper role of the federal government when powerful industries market potentially harmful but undoubtedly popular products.Read more

£31.20 -

NovaPulse Advertising: A Roadmap To Financial Success: UNLOCKING BUSINESS CREDIT: Master the Art of Building and Managing Business Credit for Prosperity and Growth” by Crystal…

Introducing “Unlocking Business Credit: A Roadmap to Financial Success” In the dynamic world of business, one key element stands between a dream and a thriving reality: financial stability. For entrepreneurs and established companies alike, the path to success often hinges on their ability to access and manage credit effectively. In “Unlocking Business Credit,” we embark on a journey that demystifies the complex landscape of business credit, providing you with a comprehensive roadmap to navigate the financial intricacies that can make or break your venture. This book is your ultimate guide to harnessing the power of business credit to fuel growth, secure investments, and ultimately, achieve the financial success you’ve always aspired to. So, if you’re ready to unlock the doors to financial prosperity, join us on this transformative journey as we unveil the secrets to mastering business credit. Your path to success begins here.Read more

£18.90 -

Advertising the American Dream: Making Way for Modernity, 1920-1940

It has become impossible to imagine our culture without advertising. But how and why did advertising become a determiner of our self-image? Advertising the American Dream looks carefully at the two decades when advertising discovered striking new ways to play on our anxieties and to promise solace for the masses.As American society became more urban, more complex, and more dominated by massive bureaucracies, the old American Dream seemed threatened. Advertisers may only have dimly perceived the profound transformations America was experiencing. However, the advertising they created is a wonderfully graphic record of the underlying assumptions and changing values in American culture. With extensive reference to the popular media—radio broadcasts, confession magazines, and tabloid newspapers—Professor Marchand describes how advertisers manipulated modern art and photography to promote an enduring “consumption ethic.”

Read more

£31.60 -

Ad Law: The Essential Guide to Advertising Law and Regulation

Ensuring marketers and advertisers are aware of the laws and regulations of advertising is now more important than ever. If a campaign is found to be potentially offensive, harmful, or misleading, it can ‘go viral’ in just the click of a mouse, and the implications of breaching those laws are likely to be both damaging and costly to a brand’s reputation, its creative work, and the strategic planning behind it.

Now offering level-headed advice on everyday questions encountered when designing and running promotional campaigns, Ad Law, the new book from the Institute of Practitioners in Advertising (IPA), is the ultimate handbook to the law and regulation of advertising and marketing communications. Containing guidance based on real-world experiences from media and advertising lawyers and the IPA legal team, this book expertly leads readers through the most applicable laws and regulations, common pitfalls and the practicalities behind them, such as the new industry-standard client/agency agreement.

Covering issues such as intellectual property, privacy and defamation, plus the self-regulatory framework, Ad Law is the ideal companion for any advertising and marketing professional, or lawyer working within these sectors.

Read more

£40.20 -

Creative Advertising: Ideas and Techniques from the World’s Best Campaigns

Entertaining and inspirational, Creative Advertising is a ‘must have’ for all designers, art directors, copywriters, and students of advertising – in fact, for anyone who makes a living from good ideas and for whom creativity is the key qualification.Unravels the creative processes behind some of the most original and effective campaigns of recent years, showcasing over two hundred examples of international advertising from media including magazines and billboards, television, cinema and the Internet.

Highlights different methods for creating original and unforgettable advertisements, from finding the elusive ‘big idea’ to re-working classic techniques. Covers award-winning work from some of the biggest and most influential names in the industry, alongside exciting young agencies. All brilliantly demonstrate a fascinating range of approaches including

• Ways of visualizing concepts

• The art of illusion and paradox

• Using metaphor and analogy

• Deploying shock tactics and humour

Includes interviews with international professionals, providing unique insights into the working practices of top creatives.

Read more

£8.80 -

Guerrilla Advertising: Unconventional Brand Communication

This book shows the best international examples of the varied and inventive tactics that are being used today by big-name brands, non-profit organizations and individuals to promote themselves, their ideas and their products. Over 70 international campaigns are featured/grouped according to their approach: Stunts, Street Propaganda, Sneaky Tactics, Site-specific campaigns and Multi-fronted attacks.Read more

£8.20 -

Mad Men & Bad Men: What Happened When British Politics Met Advertising

From the moment Margaret Thatcher met the Saatchi brothers, elections campaigns would never be the same again. Suddenly, every aspiring PM wanted a fast-talking, sharp-thinking ad man on their team to help dazzle voters. But what were the consequences of their fixation with the snappy and simplistic?

Sam Delaney embarks on a journey to expose the shocking truth behind the general election campaigns of the last four decades. Everything is here – from the man who snorted coke in Number 10 to the politician who fell in love with her own ad exec, from the fist-fights in Downing Street to the all-day champagne binges in Whitehall offices. Sam Delaney talks to the men at the heart of the battles – Alistair Campbell, Peter Mandelson, Tim Bell, Maurice Saatchi, Norman Tebbit, Neil Kinnock – and many more.

Dark, revealing and frequently hilarious, Mad Men and Bad Men tells the story of how unelected, unaccountable men ended up informing policy – and how the British public paid the price.Read more

£6.20 -

Graphis Advertising Annual 2023

Graphis Advertising Annual 2023

Explore the A to Z of modern advertising.

Graphis Advertising 2023 From Issey Miyake’s architectural style to Netflix key art, this comprehensive volume features over 400 award-winning pieces of styles, movements, and trends that have shaped international advertising this past year.

A phenomenal homage to some of the finest work selected by an acclaimed international jury of ad agencies creative directors. Each ad takes readers behind the scenes of the imagery with personal tales of inspiration and the passion, intent, and results behind each project.

Read more

£54.20 -

The Theory Of Psychology And Advertising: Discover The Aspects Of The Psychology Of Advertising

5,000. That is the number of advertisements that the typical client is introduced to every day. You are logical thinking… “How on earth would I have the option to make people notice my promotions?” Advertisers have since a long time back observed that they can utilize cerebrum examination to find what sticks out, has an impression, persuades, and prompts the exhibit of acquisition. That being said, you can use mind exploration to guarantee that your advancement is truly working. Okay, that is extraordinary. Nonetheless, how? To sort out some way to make your promotions truly work, by work I mean to make people buy your thing, keep on examining

This book covers all of the fundamentals of selling with a more significant understanding of the association between our human mental inclinations and making an advertisement that passes on the message you really want them to get. You will find:

-Area 1 – Overview: Psychology Of Advertising

-Area 2 – Advertising and Psychology: Understanding The Link

-Area 3 – What Is The Psychology of Salesmanship?

-Area 4 – Learn The Psychology of Colors

-Area 5 – Advertising Yourself As A Brand

-Segment 6 – Decoding The Subliminal Messages

-Segment 7 – Attracting Your Targeted Customers

-Segment 8 – Your Key To Success Advertising “Truth”Read more

£7.00 -

Advertising Copywriter Because Badass Miracle Worker Isn’t An Official Job Title: Blank Lined Notebook Journal, Sarcastic Humor Present for Advertising Copywriter

Beautifully designed Blank lined notebook/journal to write down notes, thoughts, ideas…. Simple & funny to give as a gift for Advertising Copywriter.Read more

£5.30 -

Targeted: How Technology Is Revolutionizing Advertising and the Way Companies Reach Consumers

Far from the catchy television spots and sleek magazine spreads are the comparatively modest ads that pop up on websites and in Internet searches. But don’t befooled – online advertising is exploding. Growing at a compound annual rate near 20%, it is now the second-largest advertising channel in the United States.Part history, part guidebook, part prediction for the future, Targeted tells the story of the companies, individuals, and innovations driving this revolution. It takes readers behind the scenes – examining the growth of digital advertising, its enormous potential, and the technologies that are changing the game forever. Leading the way is real-time bidding, which offers advertisers unprecedented precision in targeting ads and measuring their effectiveness.

From keyword micro-markets and ad serving systems to aggregated virtual audiences and new business models, Targeted is sweeping in scope and stripped of technical complexity. It is an essential resource for anyone interested in finding and connecting with customers in the vast and shifting Internet universe.

Read more

£3.60 -

Laughing@Advertising

In Laughing@Advertising Bob Hoffman has collected his most irresponsible and inappropriate blog posts, essays, and cave drawings. You might say it’s 200 pages of insults, wise cracks, cheap shots, and dirty words. In other words, fun for the whole family! Hoffman is out to disrupt the disruptors — those somber, imperious souls who have made marketing and advertising such an earnest and humorless endeavor. This may be the silliest, most injudicious book about the ad industry you’ve read. And in some unwholesome way, the truest and funniest.Read more

£5.90Laughing@Advertising

£5.90 -

Subprime Attention Crisis: Advertising and the Time Bomb at the Heart of the Internet (FSG Originals x Logic)

In Subprime Attention Crisis, Tim Hwang investigates the way big tech financialises attention. In the process, he shows us how digital advertising – the beating heart of the internet – is at risk of collapsing, and that its potential demise bears an uncanny resemblance to the housing crisis of 2008. From the unreliability of advertising numbers and the unregulated automation of advertising bidding wars, to the simple fact that online ads mostly fail to work, Hwang demonstrates that while consumers’ attention has never been more prized, the true value of that attention itself – much like subprime mortgages – is wildly misrepresented. And if online advertising goes belly-up, the internet – and its free services – will suddenly be accessible only to those who can afford it. Deeply researched, convincing, and alarming, Subprime Attention Crisis will change the way you look at the internet, and its precarious future. FSG Originals × Logic dissects the way technology functions in everyday lives. The titans of Silicon Valley, for all their utopian imaginings, never really had our best interests at heart: recent threats to democracy, truth, privacy, and safety, as a result of tech’s reckless pursuit of progress, have shown as much. We present an alternate story, one that delights in capturing technology in all its contradictions and innovation, across borders and socioeconomic divisions, from history through the future, beyond platitudes and PR hype, and past doom and gloom. Our collaboration features four brief but provocative forays into the tech industry’s many worlds, and aspires to incite fresh conversations about technology focused on nuanced and accessible explorations of the emerging tools that reorganize and redefine life todayRead more

£10.40 -

Selling Local Advertising: The Best Kept Insider Secrets To Create Local Advertising Sales, FAST!

Unlock the Secrets of Successful Local Advertising Sales with Selling Local Advertising. This book is specifically designed for advertising sales reps and their managers selling to small business owners. Say goodbye to the myths and misinformation that are holding you back and start selling with confidence.

With insights from an experienced advertiser and business owner who has bought and sold hundreds of thousands of dollars in local advertising, Selling Local Advertising will give you a unique perspective on the mind of your prospects. Say goodbye to the common challenges faced by sales reps such as unqualified prospects, budget limitations, and price objections.

Transform yourself from a “pest” to a valuable business advisor and never run out of eager prospects again. The complete system for selling advertising is revealed in detail, from finding the right prospects to closing the sale. With a focus on real-world, tested, and proven methods, you’ll be able to sell more advertising and see better results for your clients.

Take advantage of the author’s personal experience and expertise in selling advertising to small businesses. No more trying to sell advertising to closed-minded prospects. Concentrate on easy and effortless sales, and see your clients look forward to your visits and refer you to their business friends.

Discover:

- The insider’s guide to selling advertising to local small businesses

- The truth behind the lies and myths holding you back from success

- A unique perspective on the mindset of small business owners

- Strategies for overcoming common sales challenges

- How to transform yourself into a valuable business advisor

- A comprehensive system for selling advertising

- Proven methods for boosting your sales

- Personal insights from an experienced advertiser and business owner

- A streamlined guide that only includes what works

- The key to closing more sales and building lasting relationships with clients.

This book is not 300 pages because it only includes what works. Read it fast, take notes, and hit the ground running. You’ll be glad you did. Order your copy of Selling Local Advertising today.

Read more

£11.40 -

Do Instagram and Facebook Ads Like a Boss: An Ultimate Facebook and Instagram Advertising Guide For Beginners (Instagram marketing, online ads, social media marketing)

Facebook has 2.32 billion users, Instagram has 1 billion users. In total, the Internet has 4.38 billion users.

Do you want to get customers from these social media for cheap? Read on!With Facebook and Instagram advertising you can reach specific people, based on their interests, behavior, geographical position, and demographical characteristics.

These options provides you with the possibility toof showing your ads to those people who you really need it.

However, you need to know how to do it efficiently.

Otherwise, you may lose your money!This book will provide you with the ultimate guide on creating ads within Facebook and Instagram.

– What is the key to success in Facebook Advertising?

– How to correctly setup an ad account?

– What are the 4 key steps to create advertisement in Facebook Ads Manager?

– How to setup Instagram Ads?

– How to monitor an ads’ performance effectively?

– How to avoid common mistakes?

And all this you get for the price of a cup of coffee.

So, scroll to the top of the page and click the “BUY NOW” button!

And you can still get this Kindle book for free since it is enrolled in Kindle Matchbook program. The book will be available for free when you purchase the paperback version from Amazon.com.

Read more

£11.80 -

Reason Why Advertising: the forgotten book that reshaped marketing in America -18 years before Hopkins’ Scientific Advertising!

The forgotten book that defined Advertising as salesmanship in print… finally available!

If you’re familiar with the marketing masterpiece titled Scientific Advertising you’re probably familiar with its author as well, Claude Hopkins.

John E. Kennedy, Albert Lasker, and Hopkins worked together at Lord & Thomas, the #1 advertising firm at the time in America. Together they completely reshaped the way the world advertised, using a scientific approach to determine what worked best and what was worth investing in.

But while Hopkins’ book became a must for all the marketing experts and the advertisers around the world during the past and the current century, Kennedy’s book is still a hidden gem that needs to be discovered by the international marketing community.

This fresh, annotated edition of the untouched original manuscript will serve this purpose.

Furthermore, this book will help you face the biggest challenge Kennedy, Hopkins, and Lakser had to face at their time: believability.

«The History of Advertising could never be written without first place in it being given to

John E. Kennedy, for every copywriter throughout the length and breadth of this land, is today being guided by the principles he laid down.»Albert Lasker

Read more

£10.50 -

Advertising and Promotion: An Integrated Marketing Communications Perspective

Belch/Belch 9th edition continues its Advertising focus with an emphasis on IMC. It includes very comprehensive coverage of Agency issues and creative work and how it is related to the IMC mix. The authors understand that marketers must look beyond traditional media in order to achieve success. In order to best communicate with consumers, advertisers must utilize a myriad of tools (advertising, public relations, direct marketing, interactive/Internet marketing, sales promotion, and personal selling); Belch/Belch is the first book to reflect the shift from the conventional methods of advertising to the more widely recognized approach of implementing an integrated marketing communications strategy. The text underscores the importance of recognizing that a firm must use all promotional tools available to convey a unified message to the consumer. The integrated marketing communications perspective (the theme of the text) catapults the reader into the business practices of the 21st century.Read more

£0.70 -

Universal Principles of Branding: 100 Key Concepts for Defining, Building, and Delivering Brands (6) (Rockport Universal)

Universal Principles of Branding presents 100 concepts, theories, and guidelines that are critical for defining, building, and delivering brands today.

Richly illustrated and easy to navigate, this comprehensive reference pairs clear explanations of each principle with visual examples of it applied in practice. By considering these concepts and examples, you can learn to make more informed, and ultimately better, branding decisions.

Featured principles are as diverse as:

- Authenticity

- Social Responsibility

- World Building

- Gatekeepers

- Rituals and routine

Each principle is presented in a two-page format. The left-hand page contains a succinct definition, a full description of the principle, examples of its use, and guidelines for use. Sidenotes appear to the right of the text, and provide elaborations and references. The right-hand page contains visual examples and related graphics to support a deeper understanding of the principle.

The titles in the Rockport Universal series offer comprehensive and authoritative information and edifying and inspiring visual examples on multidisciplinary subjects for designers, architects, engineers, students, and anyone who is interested in expanding and enriching their design knowledge.

Read more

£21.00£26.60 -

Food Advertising and Childhood Obesity: Examining Food Type, Brand Mascot Physique, Health Message, and Media (Routledge Studies in Marketing)

This book explores the ways in which the environmental factor of advertising can influence children’s food choice and health status, and how it contributes to the significant public health issue of childhood obesity.

Food Advertising and Childhood Obesity seeks to gain a better understanding of children’s food choice based on children’s exposure to different advertising by analyzing food type, brand mascot physique, health messages, and media. The book begins by reviewing the ways in which children become consumers and the role of advertising in this process. It then explores a range of advertising variables in children’s food choice and consumption. This includes theoretical and practical discussion of foods and brand mascots, health messages embodied in food advertising, and comparisons of the effects of different advertising based on entertainment level, such as using new media to present ‘advergames’ supported by television advertising. Each chapter is supported with relevant theories and a research summary is presented on each topic for clarification. The book also introduces some ways of constructive working with children and concludes with a chapter dedicated to market research and children.

Written for students and practitioners of marketing, market research, and advertising, especially within the global food industry, this book offers readers a new approach to understanding child food choice and consumption that will inform effective corporate social responsibility strategies to address this issue.

Read more

£16.50 -

Art of Advertising, The

Advertisers in the nineteenth and early twentieth century pushed the boundaries of printing, manipulated language, inspired a new form of art and exploited many formats, including calendars, bookmarks and games. This collection of essays examines the extent to which these standalone advertisements – which have survived by chance and are now divorced from their original purpose – provide information not just on the sometimes bizarre products being sold, but also on class, gender, Britishness, war, fashion and shopping. Starting with the genesis of an advertisement through the creation of text, image, print and format, the authors go on to examine the changing profile of the consumer, notably the rise of the middle classes, and the way in which manufacturers and retailers identified and targeted their markets. Finally, they look at advertisements as documents that both reveal and conceal details about society, politics and local history. Copiously illustrated from the world-renowned John Johnson Collection of Printed Ephemera and featuring work by influential illustrators John Hassall and Dudley Hardy, this attractive book invites us to consider both the intended and unintended messages of the advertisements of the past.Read more

£26.20£28.50Art of Advertising, The

£26.20£28.50 -

The Art of Advertising: George Lois on Mass Communication

A very successful art director provides insights into many of his most famous advertising campaigns in every print medium and on television and reveals the influences of past and present art movements in modern graphic workRead more

£110.80 -

All Made Up: 100 Years of Cosmetics Advertising (Popular Culture)

A history of printed cosmetics advertising throughout the 20th-century, this study charts the growth of mass-circulation magazines and how they led to a huge increase in advertising space and, by beginning of the 21st century, had to compete with those in other media such as television and the internet. Showing how advertising became the engine of capitalism that directed political destinies and even influenced international conflicts and military victories by means of propaganda, this references pays special attention to the ways in which the cosmetic advertising industry became a dominant driving force in Western culture. Eighty beautiful, full color reproductions of ads, taken from the Library of Historic Advertising, are also included in this fascinating look at the history of how cosmetics have been sold.

Read more

£1.00 -

Advertising Now! Print (Midi Series)

The world’s sharpest creative minds are in high demand in the advertising world, because making effective ads takes a whole lot more than just marketing know-how. A great ad grabs the viewer’s attention and gets the point across in an original, surprising, funny, touching, or even shocking way. Because ads reflect global and regional mentalities, studying them is interesting not only for their selling points but also for what they have to say about their clients and target audiences. This mega-roundup of the world’s best contemporary advertisements highlights the work of designers in over 40 countries. Organized by subjects, such as socio-political, food and beverage, cars, technology, and media, the ads are dated and annotated with information on the design agencies, clients, and products. Also included are case studies illustrating, for example, how an ad campaign can be made on a small budget or how an advertisement can be adapted for different cultures. This guide is a must-have for advertising students and professionals, graphic designers, and anyone who’s interested in the different ways products are advertised around the world.Read more

£35.80 -

Advertising Revolution: The Story of a Song, from Beatles Hit to Nike Slogan

The story of “Revolution” by the Beatles, from its origin as a protest song of the 1960s, to it becoming the musical backdrop for one of the most famous, influential, and controversial adverts of all time.In 1987, Nike released their new sixty-second commercial for Air shoes—and changed the face of the advertising industry. Set to the song “Revolution” by the Beatles, the commercial was the first and only advert ever to feature an original recording of the FaUb Four. It sparked a chain of events that would transform the art of branding, the sanctity of pop music, the perception of advertisers in popular culture, and John Lennon’s place in the leftist imagination.

Advertising Revolution traces the song “Revolution” from its origins in the social turmoil of the Sixties, through its controversial use in the Nike ad, to its status today as a right-wing anthem and part of Donald Trump’s campaign set list. Along the way, the book unfolds the story of how we came to think of Nike as the big bad wolf of soulless corporations, and how the Beatles got their name as the quintessential musicians of independent integrity. To what degree are each of these reputations deserved? How ruthlessly cynical was the process behind the Nike ad? And how wholesomely uncommercial was John Lennon’s writing of the song?

Throughout the book, Alan Bradshaw and Linda Scott complicate our notions of commercialism and fandom, making the case for a reading of advertisements that takes into account the many overlapping intentions behind what we see onscreen. Challenging the narratives of the evil-genius ad conglomerate and the pure-intentioned artist, they argue that we can only begin to read adverts productively when we strip away the industry’s mysticism and approach advertisers and artists alike as real, flawed, differentiated human beings.

Read more

£6.70 -

Visual Persuasion: The Role of Images in Advertising

“Paul Messaris is an extremely thoughtful commentator on the world of visuals. He has studied advertising visuals for many years and his insights are always stimulating and sometimes, even controversial. This book makes an important contribution to the literature in two fields: visual communication and advertising. I recommend it for faculty and students as well as professionals in the advertising field.”

–Sandra Moriarty, Professor University of Colorado

“With an informal writing style and examples both thoughtful and illustrative, Paul Messaris in his Visual Persuasion leads the reader through the often complex field of visual literacy related to advertising images with high style and intellect. When so much information is conveyed through quickly edited and carefully controlled mass media images, Visual Persuasion is a vital book toward understanding the impact on individuals, cultures, and society of persuasive visual messages.”

–Paul Martin Lester, Ph.D, Author of Visual Communication with Messages

“A smartly reasoned and elegantly written treatment of visual argumentation authored by one of America′s most respected authorities on visual communication. “

–James Lull

The pictures in TV commercials, magazine ads, and other forms of advertising often convey meanings that cannot be expressed as well, or at all, through words or music. Visual Persuasion is an exploration of these unique aspects of advertising. By virtue of their ability to simulate the appearance of the physical world, pictures can become surrogate objects of desire or other emotions which ads subsequently associate with products. By exploiting viewers′ assumptions of a direct, automatic connection between photography and reality, images can serve as proof of advertising claims. Because of the implicit nature of visual argumentation and the relative lack of social accountability that images enjoy in comparison with words, pictures can be used to make advertising claims that would be unacceptable if they were spelled out verbally. Using these characteristics of visual persuasion as a starting point, this important book analyzes a variety of commercial, political, and social-issue advertisements. A separate chapter examines the role of pictures in cross-cultural advertising. Visual Persuasion is recommended for upper-level undergraduate students and graduate students in communication and media studies. It also contains insights that will be valuable to students in courses in cultural studies, sociology, anthropology, and advertising.

Read more

£63.80 -

Instant Advertising (Instant Success Series)

From the international go-to guys in small business know-how:

Your source for the strategies, skills and confidence every business owner needs to succeed

Remember what it was like learning how to ride a bicycle? Now imagine how it would’ve been if you’d tried to do it blindfolded.

Pretty scary, right?

Yet, right now, all over the world, millions of men and women are trying to make a go of running small businesses without a clear picture of where they’re going or how to get ahead. No wonder so many small businesses fail in their first year of operation.

Don’t become another statistic. Let the Instant Success Series show you how to get up on that Schwinn and ride it to success.

Written by whiz kid entrepreneur and renowned international business coach Bradley Sugars, the Instant Success Series arms hardworking independent business owners like you with all the tools for success. Instant Success books tackle an array of business topics using strategies developed by Sugars and the crack business coaches at Action International, a global network that has helped nearly half a million business owners, worldwide, realize their dreams of success.

Read more

£19.00 -

TGSC | Classic Advertising Wall Calendar 2024 | 16 Months | Monthly 2023 Calendar & 2024, Family Wall Planner 2023-2024. Wall Planners, Yearly Wall Planner 2023/24, Holiday…

- This high quality 2024 calendar is perfect for history lovers. While featuring a selection of carefully chosen classic posters that are recognisable the world over, the large grid is ideal for the home and office with space for birthdays and notes.

- Keep Organised | Stay inspired all year with our Classic Advertising wall family calendar. A home essential, with a spacious grid each month providing ample room to jot down crucial events like birthdays, anniversaries, appointments and more, perfectly designed for effortless scheduling even on the busiest of days!

- FSC Paper | This 2024 calendar family planner is printed on sustainable high-quality FSC-certified paper. Each month you’ll not only enjoy art and photographic imagery and an effortless planning experience, but also be able to stay organised while supporting the environment. Please visit our Amazon brand store to learn more on recycling our products.

- Dream, Plan & Achieve | This is a 2024 calendar month to view 16-months, with the last 4 months of 2023 leading into 2024. This is a truly stunning Classic Advertising calendar 2024 family planner. Plan the year you deserve with our 2024 planner!

- High Quality Images | Elevate your space, showcasing captivating Classic Advertising imagery in high-quality resolution. Each month comes to life with vivid colours and stunning details, making this premium calendar a perfect centrepiece for any room.

- Thoughtful Gift | Gift a loved one with the Classic Advertising calendar you know they will love! An ideal present for family members or colleagues to replace their 2023 wall calendar. Looking for headteacher gifts, or son / daughter starting university? Treat them to an essential 2024 academic planner as one of their university essentials.

- Versatile | Perfect for home or office. Adorn your living room with our stunning Classic Advertising organiser planner, or display above your desk as a 2024 monthly planner to keep track of those deadlines. Utilise it in the kitchen for tracking shopping and delivery dates. Our Gifted Stationery hanging wall calendars have all your needs covered.

- Perfect Size | Our family calendar measures 30 x 30cm (12″x12″) and is a perfect fit for any home! It arrives shrink wrapped and unfolds to a size of 30 x 60cm (12″x24″). The first page showcases the last 4 months of 2023, creating a 16-month overview. Each month of 2024 is featured on a separate page, with a captivating image at the top and a day-by-day breakdown below.

- Explore | From a vast selection of calendars from The Gifted Stationery Company, featuring Animals, Humour, Art, Floral, Food, Funny Corner, Icons, Natural World, and more. Find the perfect companion to inspire and organize your days with style and charm!

£9.50 -

Advertising and Integrated Brand Promotion

Gain an understanding of advertising and brand strategy from an integrated marketing, advertising and business perspective with Close Scheinbaum/O�Guinn/Semenik’s popular ADVERTISING AND INTEGRATED BRAND PROMOTION, 9E. Updates bring strategy to life in today’s digital and mobile society as new content addresses industry shifts, such as pandemic-prompted changes in consumer behavior and e-commerce, influencer marketing, celebrity endorsements and streaming content. New examples highlight contemporary ads and current forms of branding and marketing for well-known brands like Target, Chanel, Amazon, Southwest, Netflix, Disney, ESPN, Apple, TikTok, Instagram, Adidas and Nike. You examine concepts in the context of advertising practice as you follow the processes of an advertising agency. Leading theory and practice keeps content relevant and applicable whether you are pursing business, marketing communication or advertising. MindTap digital resources further strengthen understanding.Read more

£69.30 -

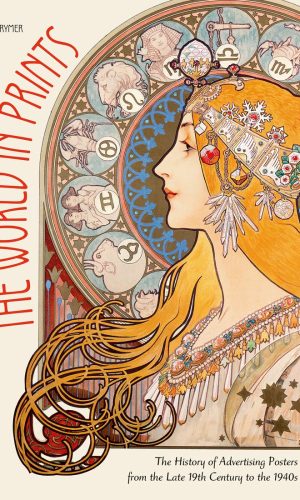

The World In Prints: The History of Advertising Posters from the Late 19th Century to the 1940s

- Chronicles the influence of the art poster in France and its rapid spread across Europe and United States

- Offers readers an artist’s poster tour of the development of the art poster

The lowly placard, a quick and efficient device used to spread news or advertise goods, ascended to the level of a respected art form in the late 1800s in France. The ‘art poster’ was born at the convergence of new aesthetic movements, technological advances and societal changes. Fine artists were swayed from their lofty perches to join the practical arts, influenced by the egalitarian spirit of the Arts and Crafts movement. Artist Jules Cheret, ‘Father of the Modern Poster,’ perfected a means of high-quality printing that produced large, colour saturated images. An emerging middle class was the ready target for the consumption of newly manufactured goods, literary publications, theatrical events and leisure time entertainment.

A sea of gorgeous images added a joie de vivre to everyday life, introducing a period of French life now known as the Belle Époque.

These posters, although ephemeral in intent, have been collected and continually reproduced over the subsequent decades, a testament to their timeless beauty and emotional depth. This book chronicles the influence of the art poster in France and its rapid spread across Europe and United States, and offers to the readers an artist’s poster tour of the development of the art poster.

Read more

£25.50£28.50 -

930 Matchbook Advertising Cuts of the Twenties and Thirties (Dover Pictorial Archive)

Add period flair to graphic projects with rare cuts of advertising art that once decorated matchbook covers. Hundreds of royalty-free images promote everything from holiday getaways to “Scientific Body Sculpturing.”Read more

£71.40 -

Advertising Account Planning: Planning and Managing Strategic Communication Campaigns

This practical and comprehensive text effectively provides advertising account planning principles within an integrated marketing communications framework. With a world-renowned textbook author team, this 4th edition has been fully updated to include:

- Fresh professional examples and mini-case studies within each chapter with a more global outlook than previous editions, bringing the theoretical concepts to life

- A new chapter on International Advertising addressing the challenges of managing a global campaign

- Pedagogical features and visual aids to support student learning and comprehension, including reflective questions and mini-cases drawn from current industry examples

- New and expanded content covering digital marketing and technologies; the customer journey; ethics and corporate social responsibility; global positioning of the brand; paid, earned and owned media; influencer marketing, and campaign measurement and analytics

Providing a full understanding of the advertising account planning process, this textbook is perfect for both the industry and classroom. The textbook will equip students of Marketing Communications, Advertising Management and Brand Management with the knowledge and skills they need to plan and manage a strategic communications campaign, including prominent advertising student competitions such as American Advertising Federation ( AAF) National Student Advertising Competition ( NSAC) or the Collegiate EFFIES.

Online resources include PowerPoint slides and a test bank.

Read more

£34.20 -

How To Write Your Book Without The Fuss: The definitive guide to planning, writing and publishing your business or self-help book

If you’re an entrepreneur with a message and you want to reach your best clients, raise your credibility as an expert and become an authority in your industry, then writing your book and getting it published is vital. Now it’s easier than ever to get published, it’s even more important that the book you write is not just good, but exceptional. ‘How To Write Your Book Without The Fuss’ will show you exactly how to write for maximum impact, influence and income, so that you will have a book that brings business. This incisive guide for expert entrepreneurs will enable you to:- Plan and write your best book by applying the AUTHOR Model

- Craft a winning title and sub-title to maximise interest and impact

- Overcome writer’s block for good with the WRITER Process

- Write a book that brings business and positions you as an authority

- Know your publishing options and choose the right route for you

- Develop and protect your valuable intellectual property. Lucy McCarraher is Managing Editor of Rethink Press and has published over 350 niche non-fiction books. She is the Publish Mentor for Key Person of Influence UK and Singapore where she coaches several hundred entrepreneurs each year on planning, writing and publishing books that bring business. Joe Gregory has a background in advertising and marketing and is Managing Publisher of Rethink Press. In 2003, after seeing first hand what writing and publishing a book could do for his own business, he decided to focus exclusively on publishing books by experts to increase their income and raise their authority.

Read more

£9.50