Recommended Items

-

LA Woman

Estevan Oriol is hailed as the eye of the new wave Latino aesthetic. Coming up from the streets and the Hip Hop scene, his rough and ready images of his neighborhood homies caught the attention of major media and music players. Oriol has since been commissioned by Nike and Cadillac, as well as directing music videos for Eminem, Linkin Park, D12 and Xzibit. He began taking pictures of his neighborhood and low-rider culture and soon discovered his incredible talent for capturing raw street life. He is now one of the most sought after photographers in the urban community.Read more

£543.90LA Woman

£543.90 -

Nancy Drew Complete Set 1-56 (Nancy Drew Mystery Stories)

Nancy Drew Hardcover Set 1-56 HardcoverRead more

£539.81 -

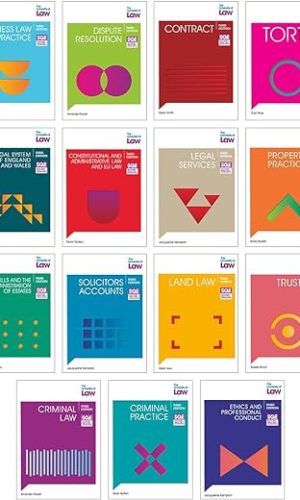

SQE Bundle FLK 1 & 2: 3e (SQE1)

The Law & Professional Practice (FLK1 & FLK2) bundle contains all 15 study manuals that have been specially collated to focus on the Law area of the Solicitors Regulation Authority (SRA) syllabus for the Solicitors Qualifying Examination (SQE1) in a concise and tightly focused manner.

Published and updated regularly, these user-friendly study manuals are designed to help you successfully prepare for the SQE1 exams. They provide solid knowledge and understanding of fundamental legal principles and rules, while bringing the law and practice to life with example scenarios based on realistic client problems.

Each title is complemented by worked examples and sample assessment questions that enable you to test your knowledge and understanding through single best answer questions that have been modelled on the SRA’s sample assessment questions.

For students at The University of Law, the study manuals are used alongside other learning resources and the University’s assessment bank to prepare students not only for the SQE1 exams, but also for a future life in professional legal practice.

The legal principles and rules contained within this study manual are stated as at 1 April 2023 (titles with tax elements to 30 April 2023)

Titles included in this bundle:

- Business Law and Practice

- Dispute Resolution

- Contract

- Tort

- Legal System of England and Wales

- Constitutional and Administrative Law and EU Law

- Legal Services

- Property Practice

- Wills and the Administration of Estates

- Solicitors Accounts

- Land Law

- Trusts

- Criminal Law

- Criminal Practice

- Ethics and Professional Conduct

Read more

£407.80£455.90SQE Bundle FLK 1 & 2: 3e (SQE1)

£407.80£455.90 -

Personal Injury Pleadings

Personal Injury Pleadings is the authoritative stand-alone source to assist the professional draftsman settling claimants and defendants statements of case. The sixth edition deals with contemporary challenges in litigation as diverse and demanding as the requirements for pleadings in fundamentally dishonest QOCS cases; relief from sanctions applications; cases involving foreign travel; the consequences of BREXIT in Personal Injury litigation; post-ERRA pleadings requirements as to breach of statutory duty; and much more. It provides informed, accurate, in-depth model pleadings, covering the whole gamut of personal injury work, drawn from many years practical experience of real cases. Comprehensive subject coverage is combined with up-to-date informed analysis of recent case law, legislation and subordinate legislation, changes in the Civil Procedure Rules, costs issues, and the minutiae of troublesome practical problems such as the special difficulties involved in fatal accident and late-onset terminal disease claims.Read more

£248.00Personal Injury Pleadings

£248.00 -

Tolley’s Health & Safety at Work Handbook 2022

This essential title provides an authoritative reference source covering key aspects of health and safety law and practice. Adopting a user-friendly A-Z format, the handbook presents clear narrative on the latest legislative changes, how to comply with current law and practice, and how they affect the role of the health and safety manager. Leading experts in health and safety offer insight and guidance on a range of subjects, from accident reporting, welfare facilities, mental ill-health, an aging workforce, absenteeism, travel safety and personal safety. This essential handbook also provides an authoritative reference source covering key aspects of health and safety law and practice, as well as related environmental and employment information. Updated annually, this title fully equips busy practitioners with everything to deal with day-to-day issues quickly.Read more

£237.50 -

Diagnostic Pathology: Kidney Diseases

This expert volume in the Diagnostic Pathology series is an excellent point-of-care resource for practitioners at all levels of experience and training. Covering the full range of common and rare nonneoplastic renal diseases, it incorporates the most recent scientific and technical knowledge in the field to provide a comprehensive overview of all key issues relevant to today’s practice. Richly illustrated and easy to use, Diagnostic Pathology: Kidney Diseases, fourth edition, is a visually stunning, one-stop resource for every practicing pathologist, nephrologist, resident, student, or fellow as an ideal day-to-day reference or as a reliable training resource.-

Provides a comprehensive source for key pathologies and clinical features of more than 265 kidney diseases

-

Features two dozen new chapters on a variety of timely topics, including COVID-19 nephropathies, xenografts, artificial intelligence (AI), digital pathology analysis, harmonized nephropathology terminology, newly identified types of amyloidosis, common artifacts and pitfalls on kidney biopsy, vaccination-associated renal disease, crystal nephropathies, and much more

-

Includes updates from the International Kidney and Monoclonal Gammopathy (IKMG) research group, the American College of Rheumatology/European League Against Rheumatism (ACR/EULAR) classification criteria for IgG4-related disease, Banff Foundation for Allograft Pathology, and others

-

Details updated genetic causes of nephrotic syndromes and antinephrin antibodies in podocytopathies-by the investigator who discovered it

-

Discusses the newly identified variant IgG nephropathy and novel membranous autoantigens

-

Contains chapters on techniques, including immunofluorescence on paraffin sections, C4d staining, and polyomavirus detection in tissue

-

Contains more than 4,300 print and online images, including high-resolution photographs and histologic images, full-color medical illustrations, radiologic images, and more

-

Employs consistently templated chapters, bulleted content, key facts, a variety of tables, annotated images, pertinent references, and an extensive index for quick, expert reference at the point of care

-

Shares the expertise of internationally recognized authors who provide fresh perspectives on multiple topics, with a particular emphasis on practical information that directly assists in making and supporting a diagnosis

-

Includes an eBook version that enables you to access all text, figures, and references, with the ability to search, customize your content, make notes and highlights, and have content read aloud

Read more

£220.70£237.50Diagnostic Pathology: Kidney Diseases

£220.70£237.50 -

-

Handbook of Conspiracy Theory and Contemporary Religion: 17 (Brill Handbooks on Contemporary Religion)

The Handbook of Conspiracy Theories and Contemporary Religion is the first collection to offer a comprehensive overview of conspiracy theories and their relationship with religion(s), taking a global and interdisciplinary perspective.Read more

£195.40

-

Accounting Guide For Complete Beginners: Grasping Essential Concepts with Ease | Navigating the World of-Accounting-and Adjusting Entries

“Accounting Guide For Complete Beginners” is your key to unraveling the mysteries of accounting with simplicity and clarity. Whether you’re a small business owner, a student, or simply someone curious about the world of finance, this book provides a straightforward path to understanding fundamental accounting concepts.

Your Accounting Journey Begins Here: This comprehensive guide starts from scratch, ensuring that even those with no prior knowledge of accounting can grasp its principles quickly and effortlessly.

Demystifying Financial Statements: Financial statements don’t have to be intimidating. “Accounting Guide For Complete Beginners” breaks them down into digestible pieces, making it easy for you to understand and interpret them with confidence.

Mastering Adjusting Entries: Adjusting entries are a crucial part of the accounting process, and this book makes them crystal clear. You’ll learn how to ensure your financial records accurately reflect the financial health of your small business.

A Valuable Resource for Small Business Owners: Running a small business comes with its own set of financial challenges. “Accounting Guide For Complete Beginners” equips you with the knowledge and skills needed to manage your finances effectively, enabling your business to thrive.

Practical Examples and Exercises: Reinforce your learning with practical examples and exercises that allow you to apply what you’ve learned. These hands-on activities make accounting principles come to life.

Clarity and Confidence: By the time you finish “Accounting Guide For Complete Beginners,” you’ll have the clarity and confidence to tackle accounting tasks and make informed financial decisions.

Your Journey to Financial Literacy Starts Now: Are you ready to demystify accounting, master financial statements, and become proficient in adjusting entries? “Accounting Guide For Complete Beginners” is your guide to achieving these goals. Take action now and add this invaluable resource to your collection.

Empower yourself with financial knowledge and make informed decisions for your small business or academic pursuits. Buy your copy of “Accounting Guide For Complete Beginners” today and embark on a journey to accounting mastery. Don’t wait—grab your book now and transform your understanding of basic accounting principles.

Read more

£10.10 -

MANAGEMENT ACCOUNTING TECHNIQUES WORKBOOK

Comments – New Store StockBecause we have over 2 million items for sale, we have to use stock images, not actual images of the items for sale. Unless explicitly mentioned in this listing, the purchase of this specific item is made with the understanding that the image is a stock image and not the actual item for sale. For example, some of our stock images include stickers, labels, price tags, hyper stickers, obi’s, promotional messages, and or writing on the sleeve or disk label. When possible we will add details of the items we are selling to help buyers know what is included in the item for sale. The details are provided automatically from our central master database and can sometimes be wrong. Books are released in many editions and variations, such as standard edition, re-issue, not for sale, promotional, special edition, limited edition, and many other editions and versions. The Book you receive could be any of these editions or variations. If you are looking for a specific edition or version please contact us to verify what we are selling. Christmas Gift Ideas This is a great gift idea. Hours of Service We have many warehouses, some of the warehouses process orders seven days a week, but the Administration Support Staff are located at a head office location, outside of the warehouses, and typically work only Monday to Friday. Contact Us Please contact us to check and verify the details of the item before purchasing if there is a specific image, edition, or variation you are looking for. If we have resources available we will share images. Location ID 245ziHaveit SKU ID 149897405Unique Reference Number 1999107144Read more

£15.20 -

I Love Accounting, It Makes People Cry: Accountant Blank Lined Journal Notebook Diary

Embrace the Digits: Our accountant-inspired blank lined journal pays tribute to the often overlooked heroes of finance! Infused with humor and a sprinkle of professionalism, its design highlights keywords such as accounting, taxation, auditing, and more. Whether you’re a CPA deciphering figures or a financial maestro reconciling accounts, carry this journal with confidence as you navigate ledgers, conquer tax puzzles, and transform spreadsheets into masterpieces. Declare to the world that you’re the financial virtuoso they can rely on!Read more

£6.80 -

ICAEW Principles of Taxation: Passcards

BPP Learning Media’s unique Passcards make the best use of your revision time. They summarise key topics to jog your memory and are packed with exam and assessment targeted guidance. Their innovative card format helps you revise at a glance. They are part of a market leading suite of materials BPP Learning Media has produced to help support students.Read more

£10.30 -

Preparing Financial Statements: Quiz Book (Accountancy Revision Workbooks)

100 quiz questions with answers to help with revision for Level 3 Preparing Financial Statements.Read more

£5.00 -

ICAEW Management Information: Passcards

BPP Learning Media’s unique Passcards make the best use of your revision time. They summarise key topics to jog your memory and are packed with exam and assessment targeted guidance. Their innovative card format helps you revise at a glance. They are part of a market leading suite of materials BPP Learning Media has produced to help support students.Read more

£10.30 -

Analysis Book: 14 Cash Columns Analysis Account Book, 96 Pages, A4 Size | Book Keeping Analysis Paper Pad – 14 Column Cash Book | Accounting Book for … Home-based, Home Office…

14 Column Analysis Book – A4

This 14 money column analysis book makes it easy to keep your accounts in order.

Ideal for manual book keeping, as well as perfect for keeping track of your accounts.

It allows you enter and organise all different transactions and accounts using this A4 sized analysis book.

The 14 cash columns spread across each double page, together with column and line numbering make it easy for you to keep records of incoming and outgoing money.

Suitable for office, small business or home-based business use.Features:

- A4 size

- 96 pages per book

- 14 cash columns across each double page spread

- 41 lines per page with column and line numbering

- Printed on high-quality 90gsm white paper

- Durable matte finish bound cover

Read more

£5.70 -

Revise SQE Solicitors’ Accounts: SQE1 Revision Guide 2nd ed

Up to date for the 2023 SQE1 specification, this book enables candidates for SQE1 to develop their knowledge and understanding of Solicitors’ Accounts as assessed in the SQE1 exam.Each chapter covers relevant SRA Accounts Rules and ledger entries. Readers will have the opportunity to test and improve both their subject knowledge and their ability to apply the Accounts Rules to problem scenarios, through multiple-choice questions in the style of the SQE1 assessment. This will include identification of appropriate ledger entries required for a range of transactions.

Read more

£14.30 -

AAT Financial Accounting: Preparing Financial Statements: Passcards

Our unique Passcards make the best use of your revision time. They summarise key topics in your module to jog your memory when it matters, and are packed with rapid bites of exam-relevant guidance. Revise at a glance and accelerate revision with summaries and visual aids.Read more

£7.60 -

CIMA BA2 Fundamentals of Management Accounting: Passcards

Passcards are a handy and portable revision tool. They are A6, spiral bound revision aids which students can carry to revise wherever, whenever.Read more

£9.50 -

Accounting for M&A: Uses and Abuses of Accounting in Monitoring and Promoting Merger (Routledge Studies in Accounting)

Spending on M&A has, in aggregate, grown so fast that it has even overtaken capital expenditure on increasing and maintaining physical assets. Yet McKinsey, the leading management consultancy, reports that “Anyone who has researched merger success rates knows that roughly 70% fail”. The idea that businesses might be using huge and increasing sums of shareholders’ money for an activity that more often than not leads to failure calls into question the information on which M&A decisions are based.

This book presents statistical studies, case material, and standard-setters’ opinions on company accounting before, during, and after M&A. It documents the manipulation of annual accounts by acquirers ahead of share for share bids, biased forecasts of post-merger earnings by bidders, and devices to flatter earnings when recording the deal. It explores the challenges for standard-setters in regulating information flows during and after M&A, and for account-users wishing to learn from financial statements how a deal has affected performance.

Drawing on a wide range of international examples, this readable book is targeted not just at accounting specialists but at anyone who is comfortable reading the serious financial press, is intrigued by what is going on in the massive M&A market, and is concerned with achieving better-informed M&A. As such it might be of particular interest to business executives, lawyers, bankers, and investors involved in M&A as well as graduate students interested in researching or learning about the role of accounting in M&A.

Read more

£123.50 -

The Routledge Handbook of Public Sector Accounting (Routledge International Handbooks)

The Routledge Handbook of Public Sector Accounting explores new developments and transformations in auditing, management control, performance measurement, risk management and sustainability work in the contemporary world of the public sector and the functioning of accounting and management in that realm. It focuses on critical analysis and reflection with respect to changing risk and crisis management patterns in the public sector in the current Covid- 19 and post- Covid- 19 era, across diverse social, political and institutional settings globally.

This research-based edited book, targeted at scholars, professionals, teachers and consultants inthe fields of public sector accounting, auditing, accountability and management, offers high-level insights into the new architecture and execution of such activities in the emerging post-pandemic world. The chapters are written by leading scholars in the accounting and public administration disciplines internationally and provide important assessments, frameworks and recommendations concerning a wide variety of institutions, practices and policies with a view to addressing the many emerging societal, governmental and professional issues. Spanning theoretical, empirical and policy discussion contributions, the book’s chapters will be readily accessible to accounting, auditing and management audiences alike.

Read more

£36.80 -

AAT Level 3 Management Accounting Techniques: Study Text and Exam Practice Kit (Q2022) (AAT level 3 Q2022)

AAT Level 3 Management Accounting Techniques

Study Text and Exam Practice Kit (Q2022)This Study Text and Exam Practice Kit is produced by our expert team of AAT tutors. Our team have extensive experience teaching AAT and writing high quality study materials that enable you to focus and pass your exam. Our Study Text and Exam Practice Kits cover all aspects of the syllabus in a user friendly way and build on your understanding by including real style exam questions for you to practice.

We also sell FIVE AAT mock practice assessments for this subject. They are produced by our expert team of AAT tutors, giving real AAT exam style and standard questions that ensure the very best for exam success. All exam style questions have solutions fully explained and revision summaries are also included to revise the syllabus.

Our AAT tutors work extensively to produce study material that is first class and absolutely focused on passing your exam. We hope very much that you enjoy this product and wish you the very best for exam success! For feedback please contact our team aatlivelearning@gmail.com or safina@acornlive.com

Read more

£18.00 -

Final Accounts Preparation Tutorial (AAT Advanced Diploma in Accounting)

An essential teaching text for the AAT AQ2016 Advanced Diploma in Accounting (Level 3) Unit ‘Final Accounts Preparation’. Presented in a clear and accessible style the text is written closely to the AAT syllabus and contains Case Studies, Key Terms, Activities and answers.Read more

£18.10 -

Cost Accounting For Dummies (For Dummies (Business & Personal Finance))

Take control of overhead, budgeting, and profitability with cost accounting

Cost accounting is one of the most important skills in business, and its popularity as a course in undergraduate and graduate business and management programs speaks to its usefulness. But if you’ve ever felt intimidated by the subject’s jargon or concepts, you can stop worrying. Cost accounting is for everyone!

In Cost Accounting For Dummies, you’ll be taken step-by-step through the basic and advanced topics found in a typical cost accounting class, from how to define costs and how to allocate them to products or services. You’ll learn how to determine if a capital expenditure is worth it and how to design a budget model that forecasts changes in costs based on activity levels.

Whether you’re a student in your first cost accounting course or a professional trying to get a grip on your books, you’ll benefit from:

- Simple methods to evaluate business risks and rewards

- Explanations of how to manage and control costs during periods of business change and pivots

- Descriptions of how to use cost accounting to price IT projects

Cost Accounting For Dummies is the gold standard in getting a firm grasp on the challenging and rewarding world of cost accounting.

Read more

£18.20£21.80 -

Incoming and Outgoing Ledger Book: Simple Income and Expenditure Ledger | Accounting Ledger Book for Bookkeeping and Small Business | 120 Pages (6″ X 9″)

Incoming and Outgoing Ledger Book

- 6 x 9 in (15.24 x 22.86 cm)

- 120 Pages

- White Paper

Read more

£3.80 -

Good With Money

Have you ever avoided looking at your banking app after a big night out? Placed an online order during a late-night doomscroll? Or felt helpless when your new budget simply failed to stick, despite your best intentions?If that sounds familiar, this is the book for you.

In the age of smartphones and social media, we’re surrounded by an endless stream of stuff to buy. From social conditioning around what makes us happy to fast fashion, algorithmic advertising and ‘where did you get that’ culture, there are a fair few traps that keep us from being ‘Good With Money’.

Financial behaviour expert Emma Edwards will help youunpack the reasons you’re so emotionally tangled with your money (spoiler: it’s absolutely not your fault) and look at what might be keeping you stuck. She’ll teach you to reclaim your decision-making, deep-dive into your beliefs, identity and habits, and come out the other side feeling ‘Good With Money’.

With a step-by-step guide to creating a money management system that actually works, Good With Money will change the way you think about budgeting, consumption and yourself, and put you back in the driver’s seat of your own financial future.

Read more

£16.10Good With Money

£16.10 -

CIMA BA3 Fundamentals of Financial Accounting: Exam Practice Kit

The Exam Practice Kit is an essential revision tool. It allows students to test knowledge by putting theory into practice and refine exam technique.Read more

£19.00 -

FIA Foundations in Management Accounting FMA (ACCA F2): Workbook

Foundations in Accountancy (FIA) awards are entry-level, core-skill focused qualifications from ACCA. They provide flexible options for students and employers, and as an ACCA Approved Content Provider, BPP Learning Media s suite of study tools will provide you with all the accurate and up-to-date material you need for exam success.Read more

£34.40£36.10 -

Financial Accounting with International Financial Reporting Standards

An essential and intuitive treatment of financial accounting with an international perspective

The use of International Financial Reporting Standards is growing rapidly, both outside of the United States and within, especially as IFRS incorporates more US GAAP rules. In the newly updated fifth edition of Financial Accounting with International Financial Reporting Standards, a team of accomplished financial practitioners and educators delivers the newest version of their highly anticipated text. This important work offers practical end-of-chapter exercises and practice problems complete with foreign currency examples, as well as an emphasis on non-US companies and examples. It is perfect for accounting students seeking exposure to internationally utilized accounting standards.

Read more

£56.80 -

Accounting Ledger Book for Small Business, Home Income and Expense, Bookkeeping, Personal Use & Finance – Large – Black

Are you Looking for a Simple and Effective Way to Keep Records of Your Transactions? Do you want to feel in touch or connected to your money rather than storing information on a computer that you have to log in to or stare at on a cold screen?

We Have the Perfect Log Book For You :

- SIMPLE & EASY TO USE TOOL: Most individuals struggle with tracking their transactions and keeping their books organized. We designed this accounting ledger book to help you record your income, and expenses and become better at bookkeeping. This ledger logbook is a simple and helpful way to methodically keep a log of your transactions and is helpful for tax purposes. Keep up with every cent in your trusty accounts ledger!

- TAKE CONTROL OF YOUR FINANCES – Accounting and bookkeeping don’t have to be disorganized and overcomplicated. This income log book and the expense log book an efficient tools to easily track payments, deposits, and balances in each of your accounts. With this ledger logbook, you’ll finally have a clear and detailed record of your transactions and be able to take full control of your finances.

- IDEAL FOR PERSONAL USE FINANCES OR SMALL BUSINESS ACCOUNTING – This accounting ledger book is perfect for a small business or tracking personal finances. For each transaction, you will log its number, date, description (memo), account, income (deposit/credit), expense (payment/debit) and total (balance). This ledger book for bookkeeping is an effective way to keep an eye on your financial activity, and mistakes and spot any unexpected transactions or fraudulent charges that might occur. This check and debit card register helps you take control of your money, balance your finances and prepare accurate financial statements whenever required.

- RECORD & MANAGE YOUR MONEY IN MULTIPLE ACCOUNTS – Keep track of your deposits, withdrawals, and activity in multiple accounts when using the dedicated column to add the bank account number every time you make a record. Using this ledger book for small businesses, you will be able to analyze your financial activity easily and prepare accurate financial statements quickly. Use your accounting journal records to assess your spending and income regularly in multiple accounts. Improve your financial performance with this accounting log book by discovering any unnecessary expenses you can cut.

- PREMIUM DESIGN FOR DAILY USE: This columnar book has a soft glossy cover, printed on double-sided non-perforated premium paper. This book will easily stand wavy everyday use to last a long time. This ledger book for home expenses’ simple design and layout allows you to keep track of multiple accounts at once (checking, savings, credit card, etc.).

- PLENTY OF WRITING ROOM & 2,860 ENTRY LINES – Each accounting notebook measures 8 x 10 inches and has 110 pages with 2860 entries (26 lines per page & 108 pages per register). This large format gives you plenty of room to write your transactions, track bills, budget and general cash flow. This is perfect for any money planner who doesn’t want to have to write too small in their accounting journal. This accounting book is perfectly sized to fit into your backpack, laptop bag or home office because it’s not big or bulky; a large accounting ledger book. The best columnar journal for tracking transactions, daily finance logs, balance & and money.

Accounting Ledger Book Details:

- Glossy Cover

- 108 pages

- 2780 entry lines

- 8 x 10 inches

Read more

£4.60 -

Self Employed Accounts Book: Simple Accounting Book for Small Business and Sole Trader

Are you looking for an Accounting Book to keep record of your financial transactions ?

If the answer is yes, then this bookis a good choice for you !It has been designed for the well organized small business owner or for anyone seeking to stay on top of their personal finances, it contains 110 pages and each page contains a table with the following columns :

- #

- Date

- Details

- Income

- Expenses

- Mode Of Payment

- Total

Features :

- 110 Pages.

- A4 format (8.5 x 11 Inches)

- High quality interior paper and professional cover design.

- Very easy to use.

Read more

£3.80 -

Multipurpose Log Book: 7 Columns, Customise To Suit Your Needs: Pink Marble Gold Glossy Cover: Track Income, Expenses, Mileage, Orders, Debit, Credit

DescriptionBegin 2023 with this stylish multipurpose log book. This book features 7 Columns to track your day to day activity. You can customise it to suit your need.

Below are some examples you can use it for.

• Income and Expenses Log Book

• Accounting Ledger Book

• Petty Cash Log Book

• Inventory and Equipment Log Book

• Online Order Log Book

• Vehicle Maintenance Log Book

• Mileage Log Book

• Donation Log Book

• Visitor Log Book

• Daily Activity Log Book

• Time Sheet Log BookRead more

£10.40 -

Accounting Book Ledger: Bookkeeping Log Book | 7 Column Income & Expenses | Large 8.5 x 11 A4 | Small Business | Craft

What you’ll find inside:

- ✅ Easy To Track & Organize Accounting More Efficiently: Our Accounting Book Ledger is special designed for organizing your complicated accounting and bookkeeping, it can track your payments, income, expenses and balance efficiently in every accounts, so you can take full control of your finances and balance it.

- ✅ Ideal For Your Personal Use Or Small Business :Using this accounting book ledger, you can record each transaction, you make clearly and state its number, description, account, income & expense amount, total balance. It can supply accurate financial statements for you any time and improve your financial or your business’s performance.

- MANAGE YOUR FINANCES & SUCCEED – Use this accounting log book, You will be able to easily analyze your financial activities and quickly prepare accurate financial statements. Use your records to regularly assess your spending and income and find any unnecessary expenses you can cut to improve your financial performance.

- ✅ Super Functional and Ample Space: This accounting book ledger has 31 lines per page with 4 additional note pages for most important transactions so you can access them quickly. 8.5 x 11 inches (A4) size large enough to clearly write your traction while still fitting in your bag for travel.

- THE PERFECT GIFT – Use our accounting book ledger for your personal or business finances, give it to your friends, colleagues as a gift for Birthday, Fathers / Mothers Day, Thanksgiving, Christmas (Secret Santa).

Get yours today!!

Read more

£5.70 -

Principles of Accounting

The accounting student faces the formidable task of learning every aspect of accounting, which covers an immense range of topics. The Principles of Accounting textbook covers the essentials, including how to record transactions, close the books, and produce financial statements. It also addresses the accounting for cash, investments, receivables, inventory, fixed assets, liabilities, and equity. In addition, the textbook describes how to account for payroll, the many ways to track costs, and the various approaches to setting up a budget and deciding whether to purchase assets. The intent is to provide the student with a firm grounding in fundamental accounting concepts, which we reinforce with hundreds of examples. Principles of Accounting is so comprehensive that it may be used as a desk reference after students have become professional accountants.Read more

£36.30Principles of Accounting

£36.30 -

6 Column Excel Notebook: Ledger Books For Bookkeeping, Financial Workbook to Record any list and Information, Simple Accounting Ledger Book For Small Business

6 Column Excel Notebook

This six columnar notebook provide an amazing way to record any kind of list and information. If you want to use it customly, you can do it.

Also you can use it as a accounting ledger.Book Features:

- 110 pages

- Perfect size 8.5″ x 11″

- 6 colum and 34 rows

- Flexible Paperback

- Printed on high quality paper

- Premium matte cover

- Black and white paper

- Unique design

Scroll to the top of this page and click the Add to Cart button to get your copy now!

Read more

£5.10 -

Public Net Worth: Accounting – Government – Democracy

As individuals, we depend on the services that governments provide. Collectively, we look to them to tackle the big problems – from long-term climate and demographic change to short-term crises like pandemics or war. Funding this activity, and managing the required finances sustainably, is difficult – and getting more so.

But governments don’t provide – or use – basic financial information that every business is required to maintain. They ignore the value of public assets and most liabilities. This leads to inefficiency and bad decision-making and piles up problems for the future.

Governments need to create balance sheets that properly reflect assets and liabilities, and to understand their future obligations and revenue prospects. Net Worth – both today and for the future – should be the measure of financial strength and success.

Only if this information is put at the centre of government financial decision-making can the present challenges to public finances around the world be addressed effectively, and in a way that is fair to future generations.

The good news is that there are ways to deal with these problems and make government finances more resilient and fairer to future generations.

The facts, and the solutions, are non-partisan, and so is this book. Responsible leaders of any political persuasion need to understand the issues and the tools that can enable them to deliver policy within these constraints.

Read more

£31.30 -

Intermediate Accounting IFRS, 4th Edition

Essential knowledge of International Financial Reporting Standards for students of global accounting

This important work provides the tools global accounting students need to understand international financial reporting standards (IFRS) and how they are applied in practice. This text emphasizes fair value, proper accounting for financial instruments, and new developments in international accounting. By presenting IFRS in light of current accounting practice, this book helps students gain practical knowledge of the topic that they can apply as they advance into their global accounting careers.

With this revised and updated Fourth Edition, students will develop a firm conceptual understanding of IFRS, as well as the ability to integrate their learning through practical exercises. Throughout this text, Global Accounting Insights highlight the important differences that remain between IFRS and U.S. GAAP, discussing the ongoing joint convergence efforts to resolve them. Comprehensive, up-to-date, and accurate, Intermediate Accounting IFRS includes proven pedagogical tools designed to help students learn more effectively.

- Comprehensively covers the latest International Financial Reporting Standards and how they are applied in practice

- Takes a comparative approach to help students understand the differences between IFRS, U.S. GAAP, and other important standards

- Emphasizes practical application of knowledge with end-of-chapter Review and Practice sections

- Provides authoritative references and citations to ensure content reliability and provide opportunities for further study

- Includes access to video walkthroughs, interactive content, and digital resources to support student engagement and ensure positive learning outcomes

As IFRS gains broad acceptance around the world, students of global accounting will need to be intimately familiar with these standards, and prepared to keep up with the rapid changes in the international environment. Intermediate Accounting IFRS answers to these pressing needs, making it the clear choice for accounting courses at the intermediate level.

Read more

£30.40 -

Financial Accounting and Reporting

For second year Financial Accounting modules or modules on Financial Reporting on undergraduate and MBA courses. Available with MyLab Accounting

‘Well-structured, informative, and enriched with relevant examples. The coverage of established and contemporary issues within financial accounting and reporting is comprehensive.’

Dr Chloe Wu, Lecturer and Assistant Professor in Accounting and Finance, University of Leeds

Gain a comprehensive understanding of financial accounting and reporting, and learn to prepare and discuss financial statements

The 20th edition of Financial Accounting and Reporting by Jamie Elliott and Barry Elliott provides a comprehensive overview of financial accounting and reporting, equipping you with the knowledge to prepare and critically discuss IFRS compliant financial statements, and introducing you to the commercial issues surrounding these. Now with enhanced coverage of interpretation of financial statements, ethical issues and accountability, the authors provide essential knowledge for advancing your studies and career.

Key features

- Exercises of varying difficulty including questions from past exam papers of professional accounting bodies

- Illustrations taken from real-world international company reports and accounts, which have been updated for this edition and help to demonstrate the applications of key principles in the life of real companies

- Up-to-date content including new material on accountability, sustainability, ethical problems and the future of audit services

- Includes the latest accounting standards set out in the IFRS, IAS and the Conceptual Framework for Financial Reporting, plus a discussion of the proposed IFRS on General Presentation and Disclosure

- Improved flow of topics and revised explanations makes the text even easier to follow and use

Instructors, pair this text with MyLab Accounting

By combining trusted author content with digital tools and a flexible platform, MyLab™ personalises the learning experience and improves results for each student. MyLab Accounting has been expanded for this edition to better align with feedback received from accounting course leaders and now includes over 1600 questions that can be assigned to students, including more exercises on accounts preparation for group accounts.

Pearson, the world’s learning company.

Read more

£48.30£56.00Financial Accounting and Reporting

£48.30£56.00 -

CIMA BA3 Fundamentals of Financial Accounting: Course Book

The Course Book provides all the knowledge required in a user friendly format with easy navigation. It is specifically designed to make your studies as effective and efficient as possible throughout.Read more

£33.30 -

Advanced Accounting

In the newly revised eighth edition of Advanced Accounting, a decorated team of accounting professionals delivers authoritative and comprehensive coverage of all three methods of consolidated financial reporting: cost, partial equity, and complete equity. This invaluable work compares and contrasts United States and international principles, drawing reader attention to enduring differences between the two frameworks.

The authors draw on their extensive experience with US and international accounting to connect advanced accounting methods to practical applications with challenging exercises that feature the financial statements of real-world companies. With a consistent focus on clarity and accessibility, the authors highlight current business news stories and their relevance to core concepts. Ideal for accounting majors seeking an insightful and robust exploration of complex accounting methods, Advanced Accounting also includes:

- The latest changes by the Financial Accounting Standards Board and the Governmental Accounting Standards Board

- Discussions of the tax consequences of a variety of business combinations

- New end-of-chapter materials with additional problems, exercises, and questions

- New “In the News” boxes with updated stories

- Updated tutorial videos and international comparisons

- Revised test bank questions

Read more

£90.50Advanced Accounting

£90.50 -

A4 Book Keeping Journal: Bookkeeping Journal Double Cash | 32 Pages (16 Sheets) | Journal Accounts Books | Accounting Journal Entry Notebook | Journal Book-keeping Book A4 (32…

A4 Book Keeping Journal / Double Cash Bookkeeping Journal / Accounts & Journals Books

Bookkeeping Double Cash Book for keeping track of financial transactions – suitable for self employed, small business, office, personal use, accounting and bookkeeping students, etc.Features:

- 32 pages of journal entry format ruling

- Thick 90gsm white paper

- Size measures A4 – 297 x 210mm

- Durable matte finish bound cover for protection

Read more

£3.60 -

Financial Accounting ISE

Libby/Libby/Hodge wrote this text based on their belief that the subject of financial accounting is inherently interesting, but financial accounting textbooks are often not. They believe that accounting is an exciting field of study and one that is important to future careers in business. When writing this text, they considered career relevance as their guide when selecting material, and the need to engage the student as their guide to style, pedagogy, and design.Financial Accounting 11e successfully implements a real-world, single focus company approach in every chapter. The companies chosen are engaging and the decision-making focus shows the relevance of financial accounting regardless of if a student has chosen to major in accounting.

Libby/Libby/Hodge believes in the building-block approach to teaching transaction analysis. Most faculty agree that mastery of the accounting cycle is critical to success in financial accounting, and yet most financial texts introduce and develop transaction analysis in one chapter, bombarding a student early in the course with an overload of new concepts and terms. The authors slow down the introduction of transactions, giving students time to practice and gain mastery. This building-block approach leads to greater student success in their study of later topics in financial accounting such as adjusting entries.

Read more

£52.10£54.10Financial Accounting ISE

£52.10£54.10 -

Financial Accounting, Global Edition

For courses in introductory financial accounting.

A student-centered approach to financial accounting

Accounting is the language of business, and understanding the role accounting plays in business is critical to a student’s success in earning a business degree. Financial Accounting, International Financial Reporting Standards puts the focus on the purpose of accounting in business. With student-friendly examples and streamlined chapters, the 12th Edition delivers a student-centric approach to learning financial accounting.

While maintaining its hallmark features of accuracy and lucidity, the twelfth edition also includes updated coverage of the Conceptual Framework for Financial Reporting; new and updated financial statements; real-world examples, illustrations, and exhibits; and discussions on how the COVID-19 pandemic impacted organizations.

Read more

£73.10£76.90Financial Accounting, Global Edition

£73.10£76.90 -

A4 Book Keeping Cash: 32 pages (16 Sheets) Treble Cash Book-Keeping Pad A4 | Bookkeeping Cash Book A4 | 3 Column Accounts Book / Notebook (32 Page) – Blue Cover

A4 Book Keeping Cash / Bookkeeping Cash Book A4 / Treble Cash

Book keeping treble cash pad for keeping track of financial transactions – suitable for self employed, small business, office, personal use, accounting and bookkeeping students, cash record keeping and daily accounting, etc.Features;

- 32 pages

- Size measures A4

- Treble column cash ruling format

- Thick 90gsm white paper

- Durable matte finish bound cover

Read more

£3.60 -

Introduction to Accounting

Practical and crystal clear, the second edition of Peter Scott’s Introduction to Accounting and its accompanying online resources provide a supportive introduction to the subject, guiding students towards self-led practice.Reflecting current International Financial Reporting Standards (IFRS) and International Accounting Standards (IAS), and with coverage on both financial and cost and management accounting, the author walks the student carefully through the essential material to ensure they develop a solid foundation for more advanced modules. Scott’s lively writing style sets the numerical content within an easy-to-follow narrative, and the relevance of each tool or technique is explained at every turn. A multitude of worked and real-life examples help students to connect with the concepts, while each chapter ends with questions that are tiered according to difficulty to help students verify that they have mastered the essentials before progressing. Readers are directed towards additional support and exercises throughout to further encourage active participation and to prompt them to assess and consolidate their knowledge.

Digital formats and resources:

The second edition is available for students and institutions to purchase in a variety of formats, and is supported by online resources.The e-book offers a mobile experience and convenient access along with functionality tools, navigation features, and links that offer extra learning support: www.oxfordtextbooks.co.uk/ebooks

Online student resources supporting the book include:

– Interactive multiple-choice-questions for revising key topics;

– Numerical exercises for practicing the calculation of accounting information from given sets of data;

– ‘Go back over this again’ feature containing a mix of further examples, written exercises, true or false questions, and annotated accounting information to help consolidate learning and revise or revisit concepts;

– ‘Show me how to do it’ videos that provide practical demonstrations of dealing with more complex accounting tasks; and

– Web links for primary source material and articles through which readers can learn more about the companies and organizations discussed in the book.Online lecturer resources supporting the book include:

– Quizzes. A test bank of over 500 ready-to-use questions, written specifically to match the book’s content, giving lecturers the flexibility they need to manage, set and develop quizzes tailored to their course, and automatically graded to save time marking;

– Gradebook. Automatically grades student responses to quizzes, while its visual heat maps provide at-a-glance information about student achievement and engagement; and

– Course content. Additional material to support teaching, including a large double-entry case study, PowerPoint slides, and more examples and solutions.Read more

£48.50£52.20Introduction to Accounting

£48.50£52.20 -

The Accounting Controls Guidebook: Fifth Edition

Controls are an essential ingredient of the modern business, since they can reduce error rates, minimize fraud, and ensure that procedures are completed in a consistent manner. The Accounting Controls Guidebook reveals the controls you need for every accounting system, from billings to financial reporting, in addition to such operational areas as order processing, shipping, and receiving. Controls are separately stated for manual and computerized accounting systems. The book also addresses types of controls, control principles, the proper balance of control systems, and how to construct a system of controls. In short, this is the essential desk reference for the accountant who wants to install and maintain a well-constructed system of controls.Read more

£23.10£24.50The Accounting Controls Guidebook: Fifth Edition

£23.10£24.50 -

Construction Accounting: Fourth Edition

Construction Accounting addresses every aspect of the accounting for a construction business. The intent is to not only explain accounting concepts, but also provide examples and show how an accounting system can be constructed and operated. The book pays particular attention to unique aspects of construction accounting that are not encountered in other industries, including the job cost ledger, change orders, back charges, percentage of completion calculations, and the treatment of anticipated losses on contracts. In short, Construction Accounting is the go-to source for information about the accounting for a construction firm.Read more

£24.50 -

Just for Fun Accounting Activity Book: Level 3 (Accountancy Revision Workbooks)

This ‘just for fun’ accounting activity book has 35 puzzles, including word searches, number puzzles and crosswords. All puzzles are based around Level 3 accounting topics.Read more

£4.70