Recommended Items

-

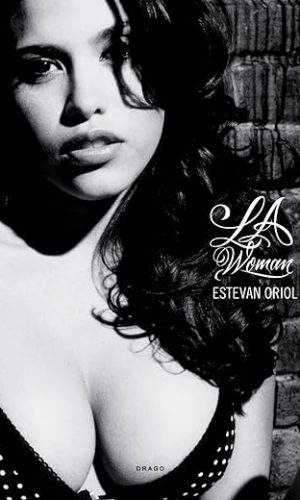

LA Woman

Estevan Oriol is hailed as the eye of the new wave Latino aesthetic. Coming up from the streets and the Hip Hop scene, his rough and ready images of his neighborhood homies caught the attention of major media and music players. Oriol has since been commissioned by Nike and Cadillac, as well as directing music videos for Eminem, Linkin Park, D12 and Xzibit. He began taking pictures of his neighborhood and low-rider culture and soon discovered his incredible talent for capturing raw street life. He is now one of the most sought after photographers in the urban community.Read more

£543.90LA Woman

£543.90 -

Nancy Drew Complete Set 1-56 (Nancy Drew Mystery Stories)

Nancy Drew Hardcover Set 1-56 HardcoverRead more

£539.81 -

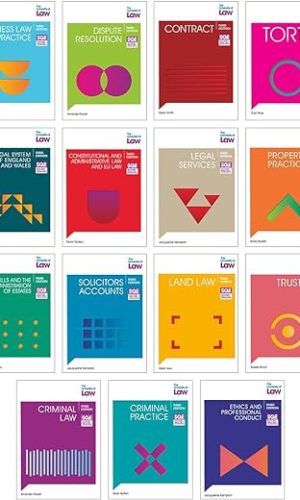

SQE Bundle FLK 1 & 2: 3e (SQE1)

The Law & Professional Practice (FLK1 & FLK2) bundle contains all 15 study manuals that have been specially collated to focus on the Law area of the Solicitors Regulation Authority (SRA) syllabus for the Solicitors Qualifying Examination (SQE1) in a concise and tightly focused manner.

Published and updated regularly, these user-friendly study manuals are designed to help you successfully prepare for the SQE1 exams. They provide solid knowledge and understanding of fundamental legal principles and rules, while bringing the law and practice to life with example scenarios based on realistic client problems.

Each title is complemented by worked examples and sample assessment questions that enable you to test your knowledge and understanding through single best answer questions that have been modelled on the SRA’s sample assessment questions.

For students at The University of Law, the study manuals are used alongside other learning resources and the University’s assessment bank to prepare students not only for the SQE1 exams, but also for a future life in professional legal practice.

The legal principles and rules contained within this study manual are stated as at 1 April 2023 (titles with tax elements to 30 April 2023)

Titles included in this bundle:

- Business Law and Practice

- Dispute Resolution

- Contract

- Tort

- Legal System of England and Wales

- Constitutional and Administrative Law and EU Law

- Legal Services

- Property Practice

- Wills and the Administration of Estates

- Solicitors Accounts

- Land Law

- Trusts

- Criminal Law

- Criminal Practice

- Ethics and Professional Conduct

Read more

£407.80£455.90SQE Bundle FLK 1 & 2: 3e (SQE1)

£407.80£455.90 -

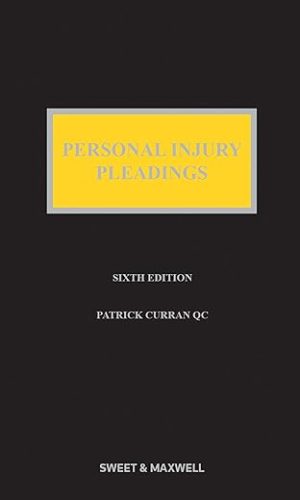

Personal Injury Pleadings

Personal Injury Pleadings is the authoritative stand-alone source to assist the professional draftsman settling claimants and defendants statements of case. The sixth edition deals with contemporary challenges in litigation as diverse and demanding as the requirements for pleadings in fundamentally dishonest QOCS cases; relief from sanctions applications; cases involving foreign travel; the consequences of BREXIT in Personal Injury litigation; post-ERRA pleadings requirements as to breach of statutory duty; and much more. It provides informed, accurate, in-depth model pleadings, covering the whole gamut of personal injury work, drawn from many years practical experience of real cases. Comprehensive subject coverage is combined with up-to-date informed analysis of recent case law, legislation and subordinate legislation, changes in the Civil Procedure Rules, costs issues, and the minutiae of troublesome practical problems such as the special difficulties involved in fatal accident and late-onset terminal disease claims.Read more

£248.00Personal Injury Pleadings

£248.00 -

Tolley’s Health & Safety at Work Handbook 2022

This essential title provides an authoritative reference source covering key aspects of health and safety law and practice. Adopting a user-friendly A-Z format, the handbook presents clear narrative on the latest legislative changes, how to comply with current law and practice, and how they affect the role of the health and safety manager. Leading experts in health and safety offer insight and guidance on a range of subjects, from accident reporting, welfare facilities, mental ill-health, an aging workforce, absenteeism, travel safety and personal safety. This essential handbook also provides an authoritative reference source covering key aspects of health and safety law and practice, as well as related environmental and employment information. Updated annually, this title fully equips busy practitioners with everything to deal with day-to-day issues quickly.Read more

£237.50 -

Diagnostic Pathology: Kidney Diseases

This expert volume in the Diagnostic Pathology series is an excellent point-of-care resource for practitioners at all levels of experience and training. Covering the full range of common and rare nonneoplastic renal diseases, it incorporates the most recent scientific and technical knowledge in the field to provide a comprehensive overview of all key issues relevant to today’s practice. Richly illustrated and easy to use, Diagnostic Pathology: Kidney Diseases, fourth edition, is a visually stunning, one-stop resource for every practicing pathologist, nephrologist, resident, student, or fellow as an ideal day-to-day reference or as a reliable training resource.-

Provides a comprehensive source for key pathologies and clinical features of more than 265 kidney diseases

-

Features two dozen new chapters on a variety of timely topics, including COVID-19 nephropathies, xenografts, artificial intelligence (AI), digital pathology analysis, harmonized nephropathology terminology, newly identified types of amyloidosis, common artifacts and pitfalls on kidney biopsy, vaccination-associated renal disease, crystal nephropathies, and much more

-

Includes updates from the International Kidney and Monoclonal Gammopathy (IKMG) research group, the American College of Rheumatology/European League Against Rheumatism (ACR/EULAR) classification criteria for IgG4-related disease, Banff Foundation for Allograft Pathology, and others

-

Details updated genetic causes of nephrotic syndromes and antinephrin antibodies in podocytopathies-by the investigator who discovered it

-

Discusses the newly identified variant IgG nephropathy and novel membranous autoantigens

-

Contains chapters on techniques, including immunofluorescence on paraffin sections, C4d staining, and polyomavirus detection in tissue

-

Contains more than 4,300 print and online images, including high-resolution photographs and histologic images, full-color medical illustrations, radiologic images, and more

-

Employs consistently templated chapters, bulleted content, key facts, a variety of tables, annotated images, pertinent references, and an extensive index for quick, expert reference at the point of care

-

Shares the expertise of internationally recognized authors who provide fresh perspectives on multiple topics, with a particular emphasis on practical information that directly assists in making and supporting a diagnosis

-

Includes an eBook version that enables you to access all text, figures, and references, with the ability to search, customize your content, make notes and highlights, and have content read aloud

Read more

£220.70£237.50Diagnostic Pathology: Kidney Diseases

£220.70£237.50 -

-

Handbook of Conspiracy Theory and Contemporary Religion: 17 (Brill Handbooks on Contemporary Religion)

The Handbook of Conspiracy Theories and Contemporary Religion is the first collection to offer a comprehensive overview of conspiracy theories and their relationship with religion(s), taking a global and interdisciplinary perspective.Read more

£195.40

-

Accounts Book Self Employed: Simple Bookkeeping Accounts For Sole Trader Or Small Business To Keep Track Of Your Business Income And Expenses. Accounts Book A4 Size With 120 PAGE

Accounts Book Self Employed Ledger ” Compliant with accounting obligations “

Keep track of your :

⁕ Checkbook Registers

⁕ Bank transactions

⁕ Personal Checking Account Ledger

⁕ Account Payment Record Tracking

⁕ Management Finance Budget ExpenseFeatures:

- Size 8.5” x 11” inch

- Paper High-quality white paper

- Pages 120 pages

- Cover Soft and matte

⁕ Quick and easy to add entries.

⁕ Great for gel pen, ink or pencilsRead more

£4.70 -

3 Column Ledger Book: Simple Numbered Ledger for Accounting and Bookkeeping

Master Your Finances with Our 3 Column Ledger Book.Whether you are a small business or someone managing personal finances, this ledger will be your accounting companion, helping you towards streamlined financial success.

Our accounting ledger can help with

- Identify Trends: Easily spot areas for financial improvement and growth with the help of the ledger’s structured format.

- Tax and Reporting Made Easy: Simplify audits and tax filings with well-documented financial data.

- Boost Financial Literacy: Gain a deeper understanding of your finances, empowering you to make informed decisions.

- Cost-Effective Solution: Manage your finances efficiently, even on a tight budget.

Your financial future deserves the best, and our 3 Column Ledger Book is here to deliver it.

Features:

- Optimal Size: Measuring a convenient 8.5″ x 11″, our ledger book offers ample space to capture every financial detail.

- Ample Pages: With 108 pages at your disposal, you’ll have the room you need for comprehensive record-keeping.

- Numbered Three Columns, Forty-One Rows: Our layout simplifies income and expense tracking, ensuring accuracy and efficiency.

- Quality Matters: The ledger book features crisp white paper and a durable matte cover for long-lasting use

Click Buy Now to get your copy and gain financial mastery, today.

Item Returns

If your book arrives damaged or hasn’t arrived, please go to your Returns & Orders. Choose the item in Your Orders. Click Return or Replace Items and complete the information.

Amazon manufacturers and distributes this product for us and will take reposibility for any damage or loss.

Of course we hope you receive it in perfect condition for your enjoyment.Read more

£4.70 -

3 Column Cash Book A4: Treble Cash Analysis Accounts Notebook, 100 Pages, A4 Size, White Paper | Book-Keeping Ledger for Personal and Small Business Transactions – Green Cover

3 Column Cash Book (Treble Cash Account Book) A4

Book keeping treble cash pad for keeping track of financial transactions – suitable for self employed, small business, office, personal use, accounting and bookkeeping students, cash record keeping and daily accounting, etc.- Dimension: 8.27″ x 11.69″ (A4)

- 100 Pages

- Ruling: 3 Column (Treble) Cash

- 90gsm white paper

- Matte finish cover

Read more

£4.30 -

ICAEW Accounting: Passcards

BPP Learning Media’s unique Passcards make the best use of your revision time. They summarise key topics to jog your memory and are packed with exam and assessment targeted guidance. Their innovative card format helps you revise at a glance. They are part of a market leading suite of materials BPP Learning Media has produced to help support students.Read more

£10.30ICAEW Accounting: Passcards

£10.30 -

Look at you becoming An Accountant And Shit Funny Accountant Notebook Graduation gift: Notebook/Journal Track Lessons, Homebook To Define Goals & … And To do list | 6″x9″, 120…

Funny Accountant Notebook University Graduation gift a 120 pages Notebook featuring Look at you becoming An Accountant And Shit a Matte-finish cover.

Perfect gift for parents, grandparents, kids, boys, girls, youth and teens as an Accountant journal gift.

- 120 pages

- 6″”x9″”

- White-color paper

- Matte Finish Cover for an elegant look and feel

Are you an Accountant ? Are you looking for a gift for your parents or relatives that works as an Accountant ? Then you need to buy this gift for your brother, sister, Auntie and celebrate their birthday. Great Accountant gift for graduation .

Are you looking for an Accountant Gift ? Accountant journal ? Accountant Notebook ?

Then click on our brand and check the hundreds more custom options and top designs in our shop!”Read more

£5.40 -

Cambridge International AS & A Level Accounting Coursebook with Digital Access (2 Years)

This series supports teachers and students of Cambridge International AS & A Level Accounting (9706) for examination from 2023. Empower your students to become confident learners and achieve success with our third edition of our Cambridge International AS & A Level Accounting series. Closely mapped to the new syllabus, our coursebook with digital access, workbook and digital teacher’s resource are the perfect addition to any classroom and come filled with real-world connections and exam support.Read more

£39.80 -

FIA Foundations of Financial Accounting FFA (ACCA F3): Workbook

Foundations in Accountancy (FIA) awards are entry-level, core-skill focused qualifications from ACCA. They provide flexible options for students and employers, and as an ACCA Approved Content Provider, BPP Learning Media s suite of study tools will provide you with all the accurate and up-to-date material you need for exam success.Read more

£34.40£36.10 -

Agricultural Accounting: Third Edition

Agricultural Accounting addresses every aspect of the accounting that one might encounter in a farm, ranch, or related business. The intent is to not only explain accounting concepts, but also to provide examples and show how an accounting system can be constructed and operated. The book pays particular attention to unique aspects of agricultural accounting that are not encountered in other industries, including special valuation rules for inventory, hedging transactions, dealing with cooperatives, and recording non-current farm assets. In short, this book is an essential desk reference for anyone engaged in agricultural operations.Read more

£21.50 -

CIMA BA2 Fundamentals of Management Accounting: Exam Practice Kit

The Exam Practice Kit is an essential revision tool. It allows students to test knowledge by putting theory into practice and refine exam technique.Read more

£19.00 -

Accounting Ledger Book: Simple Accounting Ledger Book for Small Business for Bookkeeping and Small Business Income & Expenses Account Tracker helps … Journal Book &…

Entrepreneurs have plenty on their to-do lists and keeping track of their finances may be difficult.

Daily small business expenses or maintenance costs on the facility, equipment, or building are sometimes overlooked for recording. Paying utility bills, rent, and invoices from vendors, as well as any other small business transactions, if not properly recorded, will reveal errors in your budgeting, cash flow statements, ledgers, and receivables.

Most people fail to keep record of minor financial transactions. Businesses must keep an accurate record of all financial transactions for an extended period of time. The financial information you record and store can be referred to in the future for legal, financial, organizational, or tax purposes.This Accounting Ledger Book is great for basic accounting and bookkeeping. It assists you in maintaining records of daily business and personal transactions which includes bank statements, invoices, receipts, tax forms, and other records.

This Accounting Ledger book saves time and stress.

Features

★120 Pages (60 Sheets helps to record 60 Account name)

★Note for Each Account Name helps to record other important information

★Contains No., Date, Description, Account, Amount Paid (Debit), Amount Receieved (Credit), Balance Column and Note

★Perfectly Size: 8.5 inches x 11 inches

★High-Quality Matte finish softcoverRead more

£4.70 -

9 Column Ledger: 9 Column Ledger Pad | 9 Column Accounting Ledger Book | 9 Column Ledger Book | 9 Column Ledger Notebook | Accounting Ledger Paper 9 … for Small Business |…

Simple Customizable 9 Column Ledger Book to monitor all monthly expenses. Perfect for Accounting, Small Business, Home Based Businesses, Professionals, Students and much more.

This Accounting Ledger Book 9 Column (Columnar Log Book) can be customized for any Business.BOOK DETAILS:

• Manage Financial Records

• Size: 8.5” X 8.5”

• 100 Pages

• 35 Lines with 9 Columns

• Track all Financial Transactions

• Premium Matte Cover

• Black and White Paper InteriorRead more

£6.30 -

Accounting Ledger: Simple Bookkeeping Record Book| Cash Book|Accounts Bookkeeping Journal for Small Business | Income and expense|100 pages Financial … | Compliant with…

Accounting Ledger/Account Journal

Control your finances with this simplistic cash accounting record. Ideal for businesses to keep records of debits and credits during the year.

This simple & basic bookkeeping layout helps you to write & keep track of all of your income expenses. Large 8.5″x11″ sheets provide an abundance of room to log under the titles of Date, Description, Debit, Credit, Balance. Simply record transactions as they occur before entering them into your accounting software.

Book features:

- 100 pages bookkeeping log

- Size: 8.5 inches x 11 inches

- Date, Description, Debit, Credit, Balance fields

- Premium matte cover design

- Printed on High-quality paper

- Made in USA / UK

Read more

£2.80 -

SAP S/4HANA Financial Accounting Certification Guide: Application Associate Exam

Preparing for your financial accounting exam? Make the grade with this SAP S/4HANA 1909 and 2020 certification study guide! From general ledger accounting to financial closing, this guide reviews the key technical and functional knowledge you need to get a high score on your SAP S/4HANA for Financial Accounting Associates exam. Explore test methodology, key concepts for each topic area, and practice questions and answers. Your path to financial accounting certification begins here! Highlights Include: 1) Exam C_TS4FI_1909 2) Exam C_TS4FI_2020 3) Deployment 4) General ledger accounting 5) Accounts payable (AP) 6) Accounts receivable (AR) 7) Asset accounting 8) Financial closing 9) Document parking 10) Validations and substitutions 11) Bank account managementRead more

£81.70 -

The Guide To Accounting Basics At Any Age: Unlock the World of Financial Management Excellence with Comprehensive Basics, Techniques, and Strategies

Embark on a transformative journey into the world of accounting with “The Guide To Accounting Basics At Any Age.” This comprehensive guide is tailored for beginners, equipping you with the essential knowledge and skills needed to navigate the intricate landscape of financial management with confidence.

Demystifying Accounting:

“Discover the fundamentals of accounting in a beginner-friendly manner, breaking down complex concepts into digestible insights.”

Building Financial Literacy:

“Develop a strong foundation in financial literacy as you delve into the core principles that govern the business world.”

From Ledger to Balance Sheet:

“Explore the step-by-step process of recording financial transactions, preparing financial statements, and understanding balance sheets.”

Tools of the Trade:

“Learn to navigate accounting software and tools, enabling you to streamline financial data management with ease.”

Key Financial Ratios:

“Uncover the power of financial analysis by mastering essential ratios that provide insights into a company’s performance and health.”

Effective Bookkeeping Practices:

“Gain practical skills in maintaining accurate financial records, ensuring that your financial management is always on point.”

Interpreting Financial Statements:

“Unlock the ability to interpret income statements, cash flow statements, and balance sheets to make informed business decisions.”

Budgeting and Forecasting:

“Develop the skills to create budgets, forecasts, and projections that drive strategic planning and financial success.”

Sound Financial Decision-Making:

“Equip yourself with the tools to make sound financial choices that positively impact your personal and professional life.”

A Comprehensive Guide:

“Benefit from clear explanations, real-world examples, and hands-on exercises that reinforce your understanding.”

Your Path to Financial Mastery:

“Empower yourself with the knowledge that is essential for financial management, career growth, and personal financial success.”

Step into Financial Excellence:

“Embrace the world of accounting with confidence and embark on a journey that opens doors to financial excellence. Get your copy of ‘The Guide To Accounting Basics At Any Age’ now.”

Read more

£9.10 -

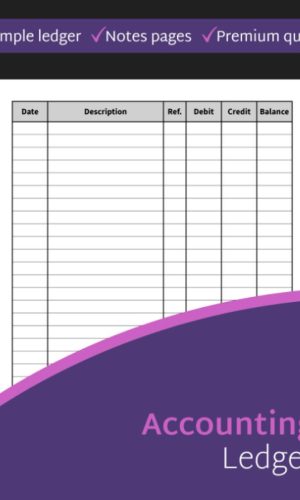

Accounting Ledger: Simple 6 column General Ledger, Debit & Credit Record Book, Basic Ledger For Small/Medium Businesses

Accounting Ledger

Stay on top of your business finances with this simple accounting ledger. Includes customized columns for tracking debit and credit transactions, and notes pages for writing additional information and references.

Columns:

- Date

- Description

- Reference

- Debit

- Credit

- Balance

Features:

- 9.7”x7.4” medium size

- 110 pages

- Premium quality

Grab your accounting ledger today!

Read more

£5.70 -

Financial Accounting for Decision Makers

Understand financial accounting principles and techniques, and develop the skills to make informed business decisions.

Financial Accounting for Decision Makers, 10th Edition by Peter Atrill & Eddie McLaney, is an accessible introduction to the subject, focusing on the ways in which financial statements and information improve the quality of decision-making.

Written by two highly regarded accounting authors, the text is ideal for those who study Financial Accounting modules in Undergraduate and MBA courses.

This latest edition has been thoroughly updated with examples, showing the pressure facing industries as a result of the Covid-19 pandemic. Maintaining its clear and friendly style throughout, the book regularly illustrates the outworking of financial accounting in real business issues, allowing you to experience the decision-facing environment.

The commentary from real company reports and survey data in the form of illustrative extracts further supports your understanding of the basic concepts surrounding the subject and challenges both your individual thinking and group discussion in class.

With its step-by-step approach, activities, and real-world examples, this textbook is an essential reading resource whether you are on an accounting degree or studying financial accounting modules within other disciplines.

Instructors personalise learning with MyLab® Accounting

By combining trusted author content with digital tools and a flexible platform, MyLab® personalises the learning experience and improves results for each student. MyLab Accounting for this edition includes over 1200 questions that you can assign to students.

If you would like to purchase both the physical text and MyLab Accounting, search for:

9781292409153 Financial Accounting for Decision Makers 10th edition with MyLab® Accounting

Package consists of:

- 9781292409184 Financial Accounting for Decision Makers 10th edition

- 9781292409122 Financial Accounting for Decision Makers 10th edition MyLab® Accounting

- 9781292409139 Financial Accounting for Decision Makers 10th edition Pearson eText

MyLab® Accounting is not included. Students, if MyLab Accounting is a recommended/mandatory component of the course, please ask your instructor for the correct ISBN. MyLab Accounting should only be purchased when required by an instructor. Instructors, contact your Pearson representative for more information.

Read more

£50.30£52.20Financial Accounting for Decision Makers

£50.30£52.20 -

Derivatives and Hedge Accounting_2nd Edition

This book is a revised edition of the very well-received “Derivatives and Hedge Accounting” published in 2016.This revision is necessitated by the fact that IAS 39 Financial Instruments: Recognition and Measurements (except its hedge accounting provisions) has been superseded by IFRS 9 Financial Instruments effective 1 January 2018, and also due to the IBOR Reform.

As in the first edition, this book discusses and illustrates the nature, valuation and accounting for derivative instruments in Chapter 1 as a prelude to hedge accounting. Hedge accounting under IAS 39 is discussed and illustrated in Chapter 2, and hedge accounting under IFRS 9 in Chapter 3.

The book is written by four authors with many years of teaching, research and practical experience. It is hoped that accounting practitioners and students will continue to benefit from this revised edition.

Read more

£32.80 -

ACCA Management Accounting (MA) Study Text – 2023-24 (ACCA – 2023-24)

Fully covering the syllabus but without excessive detail, this book is written in clear English and uses an attractive, simple layout. With a large bank of practice questions and comprehensive solutions to help you with learning each topic, this book is an essential tool for passing your ACCA exam.

This book covers everything you would expect from an exam-focused text:

- The nature and purpose of cost and management accounting

- Cost classification

- Cost behaviour and cost estimation

- Presenting information

- Accounting for materials

- Accounting for labour

- Accounting for overheads

- Accounting for costs: ledger entries

- Marginal costing and absorption costing

- Job costing, batch costing and service costing

- Process costing

- Alternative costing systems

- Budgeting

- Statistical techniques

- Capital budgeting and discounted cash flows

- Standard costing and variance analysis

- Performance measurement

Read more

£28.50 -

ICAEW Law: Passcards

BPP Learning Media’s unique Passcards make the best use of your revision time. They summarise key topics to jog your memory and are packed with exam and assessment targeted guidance. Their innovative card format helps you revise at a glance. They are part of a market leading suite of materials BPP Learning Media has produced to help support students.Read more

£10.30ICAEW Law: Passcards

£10.30 -

Financial Accounting and Reporting for Non-Accounting Students: How to Interpret Financial Statements and Appraise Company Performance

This textbook introduces the essential principles of financial accounting to non-accounting students, written for an international audience with global case studies and a suite of learning features.

Using terminology which is compliant with International Financial Reporting Standards (IFRS), Financial Accounting and Reporting for Non-Accounting Studentscovers topics such as the statement of financial position, profit and loss statements, non-current assets, inventory valuation and the statement of cashflows. It also provides a roadmap for performance appraisal and presents the subjective nature of financial accounting and the impact of bias in financial reporting.

Real-world case studies from Huawei, Ryanair and Greggs illustrate the principles discussed in the book and a fictional performance appraisal case study demonstrates how financial metrics can be applied to analyse the effects of new entrants on an incumbent’s operating performance. With over 300 multiple-choice questions, 44 extended problems and more than 90 questions to enable deep learning in the fundamental aspects of this core business subject, Financial Accounting and Reporting for Non-Accountings Studentsis a key textbook for undergraduate and postgraduate students taking modules on financial accounting and reporting or introductory modules in accounting.

Read more

£35.10 -

Accounting for AQA A-level Part 2 – Text

Comments – New Store StockBecause we have over 2 million items for sale, we have to use stock images, not actual images of the items for sale. Unless explicitly mentioned in this listing, the purchase of this specific item is made with the understanding that the image is a stock image and not the actual item for sale. For example, some of our stock images include stickers, labels, price tags, hyper stickers, obi’s, promotional messages, and or writing on the sleeve or disk label. When possible we will add details of the items we are selling to help buyers know what is included in the item for sale. The details are provided automatically from our central master database and can sometimes be wrong. Books are released in many editions and variations, such as standard edition, re-issue, not for sale, promotional, special edition, limited edition, and many other editions and versions. The Book you receive could be any of these editions or variations. If you are looking for a specific edition or version please contact us to verify what we are selling. Christmas Gift Ideas This is a great gift idea. Hours of Service We have many warehouses, some of the warehouses process orders seven days a week, but the Administration Support Staff are located at a head office location, outside of the warehouses, and typically work only Monday to Friday. Contact Us Please contact us to check and verify the details of the item before purchasing if there is a specific image, edition, or variation you are looking for. If we have resources available we will share images. Location ID 245ziHaveit SKU ID 149863875Unique Reference Number 1999072284Read more

£19.00 -

Accounting Ledger Book: Tropical Leaves Cover Simple Accounting Ledger for Bookkeeping, 6 Column Account Record Journal / Notebook, Financial Accounting for Women – Size 8.5″ x 11″

This Accounting ledger book is a great and versatile tool for tracking finances and transactions. It can be used for personal finance tracking to small or home based business tracking. This book includes Account No., Date, Description, Reference, Debit, Credit and Balance. There are 110 pages and the size of the book is 8.5″ x 11″. Premium Matte Finish.Read more

£5.20 -

ICAEW Financial Accounting and Reporting IFRS: Passcards

BPP Learning Media’s unique Passcards make the best use of your revision time. They summarise key topics to jog your memory and are packed with exam and assessment targeted guidance. Their innovative card format helps you revise at a glance. They are part of a market leading suite of materials BPP Learning Media has produced to help support students.Read more

£10.30 -

Incoming And Outgoing Book: income and expense logbook For Easy Accounting – 101 Pges.

Start now to keep track of incoming and outgoing expenses for your small business or personal finances.Book Content:

-DATE

-REFERENCE

-INCOMING

-OUTGOING

-BALANCERead more

£4.60 -

Funny Notebook For Accountants & Professionals: Welcome To The Accounting Department, Where Everyone Counts

Funny Notebook for Accountants and Professionals – a great gift idea for colleagues, friends or family, or just for personal use.Grab your copy now!

Details of this magnificent notebook include:

- Lined paper

- 100 pages

- 6″ x 9″ Dimensions: Not too big, not too small

- Multi-purpose use

- Matte finish

Want another?! Check out our author profile for more books – Panda Royce Publications.

Read more

£5.00 -

BUSINESS ACCOUNTING RECONCILIATION

The Bank Account Reconciliation is the last set of transactions to be reconciled against the bank statement. This is the last check – matching recorded transactions with the figures shown on the bank statement.

If the transactions recorded for the sale of products or services or transactions recorded for the payment to suppliers are incorrect due to manipulation of data for a personal benefit or by human error – the bank reconciliation will be incorrect as well. It will not pick up the incorrect transactions entered during raising of invoices or payment of bills. This is only a sample but it extends to payroll, inventory, etc.

This process needs the attention of the decision-makers, business owners to maintain the integrity of the business accounting reconciliation, thus minimizing the risk of errors, cooking the books and/or fraud.Read more

£15.60 -

MBA Fundamentals Accounting and Finance

How do you make sense of the accounting report or balance sheet you’ve just been handed How do these reports help you to understand the company’s performance How do you use the numbers you have been given to make good business decisions in the short- and long-term MBA Fundamentals in Accounting and Finance offers real-world accounting and finance basics that can be applied today. In the business world, we are frequently called on to review and analyze financial data. This convenient and straightforward guide offers everything you need to know about the numbers to ensure your business’s growth. Understand the functions of accounting Learn how to read financial statements, balance sheets, income statements, and more Analyze profit and cash flow Improve your forecasting and strategic-planning skills MBA Fundamentals helps you to master core business basics.Here are the chapters:

Chapter 1: Financial Accounting Basics

Chapter 2: The Accounting Process and Cycle

Chapter 3: The Balance Sheet

Chapter 4: The Income Statement and Retained Earnings

Chapter 5: The Statement of Cash Flows

Chapter 6: Working Capital

Chapter 7: Property, Plant, and Equipment, and Intangible Assets

Chapter 8: Liabilities

Chapter 9: Managerial and Cost Accounting

Chapter 10: Cost Behavior

Chapter 11: Pricing

Chapter 12: Financial Statement Analysis

Chapter 13: Preparing Pro Forma Financial Statements and Financial Forecasting

Chapter 14: Budgeting and Responsibility Accounting

Chapter 15: Time Value of Money: The Math of Finance

Chapter 16: Bond and Stock Valuation

Chapter 17: Cost of Capital

Chapter 18: Capital Budgeting Cash Flows

Chapter 19: Capital Budgeting TechniquesAbout the Author

Michael P. Griffin is a graduate of Providence College (B.S. 1980) and Bryant University (M.B.A. 1982). For over 35 years, Griffin, an Associate Teaching Professor, has taught accounting and finance, full-time in the Charlton College of Business at the University of Massachusetts Dartmouth.Michael worked for a number of employers including Sears Roebuck and Company, Rhode Island Hospital Trust, Fleet National Bank, E.F. Hutton and Company, and the Federal Home Loan Bank of Boston. He is a Certified Public Accountant (CPA) and holds the designations of Certified Management Accountant (CMA), and Certified Financial Manager (CFM); both are awarded by the Institute of Management Accountants. He also holds the Chartered Financial Consultant (ChFC®) designation from the American College.

Griffin is the author of many business books and has developed several software packages both for commercial and academic use. He has been an editorial consultant to a number of publishers, including KMT Software, TemplateZone, McGraw-Hill, Irwin, Harvard Business Publications, John Wiley, LearningExpress(EBSCO), Addison Wesley, and Prentice Hall and has been a consultant for software content development for dozens of projects in the area of accounting, business finance, and personal financial planning.

Read more

£19.10 -

Incoming And Outgoing Book: income and expense logbook For Easy Accounting – 101 Pges.

Start now to keep track of incoming and outgoing expenses for your small business or personal finances.Book Content:

-DATE

-REFERENCE

-INCOMING

-OUTGOING

-BALANCERead more

£4.50 -

Accounting Ledger: Simple Ledger Book For Small Businesses And Self Employed, income and expenses log book a4.

Accounting Ledger.

Keep track of your business income and expenses in one place with this logbook and keep an eye on your professional earnings.Include sections for:

– No.

– Date

– Description

– Income

– Expenses

– TotalBook details:

– 110 pages

– Durable matte paperback cover

– Size 8,5 x 11 inchesGET YOUR COPY TODAY!

Read more

£3.80 -

Accounting for Real Estate Transactions: A Guide For Public Accountants and Corporate Financial Professionals (Wiley Corporate F&A Book 4)

Accounting for Real Estate Transactions, Second Edition is an up-to-date, comprehensive reference guide, specifically written to help professionals understand and apply the accounting rules relating to real estate transactions. This book provides financial professionals with a powerful tool to evaluate the accounting consequences of specific deals, enabling them to structure transactions with the accounting consequences in mind, and to account for them in accordance with US GAAP. Accountants and auditors are provided with major concepts, clear and concise explanations of real estate accounting rules, detailed applications of US GAAP, flowcharts, and exhaustive cross-references of the authoritative literature.Read more

£111.70 -

Accounting Ledger Book: Perfect for Bookkeeping, Recording Transactions, Balance Checkbook, Income and Expenses Tracker, Purple Cover

The accounting ledger book is a great tracker for finances and transactions.

It can be used for personal, small businesses, or home-based businesses.

Our Objectif is to cover all the important info you need to track with a load of space and a well-organized Template of up to 28 Transactions per Page

Details:

- Size: 8.5″x11″

- Print length: 110 Pages

- Cover Type: Premium Soft Matte

- Cover Color: Purple

- Cover Design: Simple, Minimalist, Trendy

- Paper Type: Premium White Paper

- Ink Color: Black and White

Features:

This Book Includes:

- Accounting information introduction page (Start Date, Book NO, Department Info, and more!)

- Simple Accounting Ledger pages: (Year, Month, and Sheet No Sections, Date, Account, Description, Debit, Credit, and Balance)

For more Sizes and Designs Check Our Author Page, or Contact us on knowledgesparkpublishing@gmail.com

Get Yours Now!!

We are waiting for your feedback

Read more

£2.90 -

An Easy Introduction to Financial Accounting: A Self-Study Guide

This book is a self-study guide written for someone who wishes to teach themselves basic financial accounting. It is based on a course by the same author that has been successfully completed by thousands of students worldwide. It explains concepts in simple language with illustrative examples, provides review questions and quizzes after each chapter and section, and contains two full-length practice exams at the end of the book. This book compares and contrasts US GAAP and IFRS for every topic covered in the book.Read more

£85.90 -

Management accounting techniques: Question book (Accountancy Revision Workbooks)

This question book contains 50 questions, with answers, to help with revision for management accounting.Read more

£3.80 -

Accounting Ledger book – 8 Column: Simple Leather Cover | Ledger Paper Pad, Columnar Notebook | For bookeeping, money management, accountant to record … (100 pages)…

Get this ledger, the perfect financial planning tool to help you manage your expenses and budget.

8 column ledger will help you work more efficiently, smarter and better at the office, home or school.

A simple tool to keep accurate, permanent bookkeeping records.Book Details:

– Size 8.5×11 inches

– 100 pages contain

– Premium Matte Soft Cover

– White pagesThanks for looking for this accounting ledger book.

Read more

£4.70 -

Financial accounting and reporting

Financial accounting and reporting, discusses how accountants act as processors and purveyors of information for decision making and the needs of those who use accounting information. It also looks at the role performed by accountants and notes the need to be aware of relevant regulatory and conceptual frameworks.

After reading this ebook, you should be able to: define bookkeeping and accounting; explain the general purposes and functions of accounting; explain the differences between management and financial accounting; describe the main elements of financial accounting information – assets, liabilities, revenue and expenses; and identify the main financial statements and their purposes.

Read more

£1.50 -

Accounting Ledger Book: Simple Accounting Log Book for Bookkeeping, Recording Small Business Income and Expenses, Tracking Finances and Transactions

This accounting ledger book is the perfect log book for recording and tracking transactions and finances, and is suitable for small and large business use, home-based business use, and personal use. Simple and effective book for basic bookkeeping.

Book features:

- 110 pages for recording transactions

- Size: 8.5 inches x 11 inches

- Record date, description, account, debit, credit and balance

- Ample row space to record extra information

- An index page helps locate information quickly

- A notes page for recording related information

- Attractive high quality matte finish cover

Read more

£5.30 -

Accounting: A Comprehensive Guide for Beginners Who Want to Learn About Basic Accounting Principles, Small Business Taxes, and Bookkeeping Requirements (Start a Business)

Discover accounting made easy!Are you looking for an accounting book that can teach you how to run your small business?

Are you tired of having to continually visit an accountant or consultant for essential advice on how to manage your financial records?

Do you want a book that not only gives you the basic knowledge of accounting fundamentals but also provides valuable ways to manage your business and finances like a pro?

If you said yes to any of these questions, then this book is for you.

In this book, you will:

- Master the conceptual knowledge about accounting and bookkeeping

- Discover the differences between accounting and bookkeeping

- Discover which accounting methods suit your small business

- Get the top 10 tools for digital accounting

- Learn step-by-step instructions on setting up your Chart of Accounts

- Understand the differences in transactions, ledgers, and journal entries

- Learn how to process payroll

- Get an entire chapter on financial statements and how to analyze them

- Master how to close your books easily and quickly

- Get advice on small business budgeting

- Uncover the 3 small business accounting pitfalls you should avoid at all costs

- And so much more!

This easy-to-understand guide will provide you with clear concepts and methods to help you think like an accountant and teach you how to implement them into your small business.

So, what are you waiting for? Click the “add to cart” button now to get your copy of this book!

Read more

£2.00 -

AAT Level 3 Financial Accounting: Preparing Financial Statements: Study Text and Exam Practice Kit (Q2022) (AAT level 3 Q2022)

AAT Level 3 Financial Accounting: Preparing Financial Statements

Study Text and Exam Practice Kit (Q2022)This Study Text and Exam Practice Kit is produced by our expert team of AAT tutors. Our team have extensive experience teaching AAT and writing high quality study materials that enable you to focus and pass your exam. Our Study Text and Exam Practice Kits cover all aspects of the syllabus in a user friendly way and build on your understanding by including real style exam questions for you to practice.

We also sell FIVE AAT mock practice assessments for this subject. They are produced by our expert team of AAT tutors, giving real AAT exam style and standard questions that ensure the very best for exam success. All exam style questions have solutions fully explained and revision summaries are also included to revise the syllabus.

Our AAT tutors work extensively to produce study material that is first class and absolutely focused on passing your exam. We hope very much that you enjoy this product and wish you the very best for exam success! For feedback please contact our team aatlivelearning@gmail.com or safina@acornlive.com

Read more

£18.00 -

The Essentials of Finance and Accounting for Nonfinancial Managers

They say that numbers don’t lie, but what if you can’t even read them? Discover how great managers use financial data to guide decisions.

Financial analysis reports, budgeting reports, forecasting and measuring reports–sometimes they all run together, don’t they? The Essentials of Finance and Accounting for Nonfinancial Managers is here to help.

This new edition of a business classic demystifies finance and accounting and gives managers the tools they need to make better decisions.

Complete with fresh insights, case studies, and street-level exercises to help non-numbers people master the numbers game, this guide reveals how to:

- Understand the fundamentals of financial analysis, budgeting, and forecasting

- Interpret balance sheets, income/cash flow statements, and annual reports

- Sift through conflicting data to find the most relevant figures

- Locate key information about competitors and suppliers

- Analyze variances and calculate break-even points and other vital measures

The numbers are too important to allow others to translate for you. The Essentials of Finance and Accounting for Nonfinancial Managers shows you how to read them yourself.

Imagine the impact on future decisions when you grasp not only what the numbers mean but can use that insight to drive your business forward.

Read more

£9.50 -

Financial accounting: Preparing financial statements Q2022: Two practice exams (Accountancy Revision Workbooks)

This book contains two practice exams which have been written to resemble the AAT exam and includes answers and mark scheme.Read more

£5.90